How to Accelerate Your Journey to Financial Independence

Photo by AbsolutVision on Unsplash.

Reading time: 7 minutes

Disclaimer: I am not a financial adviser, and this content is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

Mastering Financial Decisions: A 3-Step Framework to Honor Your Time, Freedom, and Values

The Power of a Thoughtful Spending Framework: How to Make Smarter Financial Choices

The goal of the personal finance posts in this blog is to increase financial literacy and to set you on the path towards financial independence. The core concept of achieving financial independence and early retirement is to save as much as you can and invest it, so you can eventually live off passive income streams from your investments, gaining financial freedom from traditional employment. For most, this occurs at the traditional retirement age, where a person exiting the workforce is able to live off a combination of pensions, savings, and investments. However, for others that plan ahead this can be achieved much sooner.

As discussed in our previous post, the idea of achieving financial independence is not to stash your hard-earned money away for the sake of it, but to gain financial flexibility to pursue what truly matters to you, like passion projects or quality time with loved ones.

In this post we will outline a straightforward 3-step decision-making framework to make smart spending choices and avoid financial regrets–should I buy this or not? The main purpose is to illustrate explicitly the connection between your spending habits and the time and effort invested in earning that money.

Three Key Steps for Financial Independence: Honor Your Past, Future, and Values

1) How much time does this purchase cost? Honor your past.

2) How much freedom does this purchase cost? Honor your future.

3) Is this purchase aligned with what I care about? Honor your values.

1) Evaluate the True Cost of Your Time: Honor Your Past

Suppose a brand new pair of shoes has caught your eye and you are debating whether you should buy them or not. Our proposed framework suggests to convert the value of the item under consideration to the amount of time you need to work to generate it. Even a rough approximation of this exercise will provide you with valuable information.

First, we need to calculate the actual number of hours you dedicate each day to earning your salary. For many, a starting point will be 8 hours per day. However, consider also other amounts of time that may be indirectly supporting your work day, for example the daily commute. Considering a half an hour commute each way would already bring the total to 9 hours per day. Similarly, if your lunch is not included and you actually spend an additional hour of the day in town, then this total would be 10 hours.

Next, multiply this number of hours by the number of days you work per month on average. To account roughly for vacation, let’s use 19 days, which brings the total of working hours per month to 171 hours (9 hours * 19 days). We now consider our net (after tax) salary. For this example we will consider a monthly net salary of €2,000. This means we net around €11.7 for every hour of effort at (or indirectly supporting) our job (2,000/171).

The next time you find yourself tempted by an impulsive purchase–say a pair of €100 shoes that caught your eye (but that you may not actually need), ask yourself the following: would I be happy to sit down and work at my desk for nearly a full working day (100/11.7=8.5 hours) to cover this expense? For some it actually helps to go a step further and visualize going through their daily work routine: arriving at work and engaging in a bit of small talk with colleagues before settling down at your desk; joining a Zoom call with your client or partners; opening the latest excel sheet you are working on, etc. You get the idea, just go quickly through your daily routine at work.

If you are truly passionate about your career, chances are you will be happy with the tradeoff, and buying the pair of shoes (that you don’t need) is not an unreasonable decision. For many others though who either dislike their job or just honor their work effort, this excercise may be an eye opener. Even if they like their work, spending 9-10 hours a day at it may not be their first choice.

For most, this 2 minute calculation will be enough to have a solid benchmark to use in this first step to answer “How much of your time does it cost?”. For those who are interested in more details and further reading, we highly recommend Vicky Robin’s book classic linked below.

Be careful with unnecessary spending. Honor your past.

Photo by Ben White on Unsplash.

2) Assess the Impact on Your Freedom: Honor Your Future

In a second step, we consider how a seemingly small expense, like those extra shoes, can impact your path to financial independence and early retirement goals. Lets suppose you and your partner take home a combined net €4,000 per month. Following up on the example and assumptions from our previous post, it takes 16.2 years for this couple to reach financial independence. This projection assumed a 37.5% savings rate, i.e., that the couple spends €2,500 on average and saves and invests the rest.

What happens though when the couple overspends this monthly average by an additional €200 euros per month? What impact does this have on their financial independence timeline? According to the calculator, it pushes financial independence back by 1.4 years! This means that if you consistently overspend €200 each month on items that you don’t need you will have to work for nearly a year and a half more to sustain that lifestyle in the future. Are those shoes you don’t need really worth it? The opposite is also true: consider deferred spending not as deprivation, but as investing in your future freedom and financial security–the option to retire earlier or achieve a better work-life balance during your career.

To be clear: it is not the one time purchase (in this case, the two extra pairs of shoes) that has this strong effect on your financial independence timeline, but rather the consistent overspending €200 each month on items that you don’t necessarily need. If working an extra day to afford those unnecessary expenses feels discouraging, then don’t push back your freedom by a year and a half also!

The reason why it has such a large impact on your financial independence timeline is that you are not only able to save and invest less each month, but that the amount of money you need to save to accommodate a marginally higher lifestyle is also larger. It is a non-linear relationship and humans are notoriously bad at intuitively understanding this type of relationships.

Be careful with unnecessary spending. Honor your future.

Photo by Mohamed Nohassi on Unsplash.

3) Align Your Spending with Your Principles: Honor Your Values

In the third and final step, we recommend a qualitative check to complement the two previous questions. We do not intend to be prescriptive here and prefer to leave this relatively open, since everyone will naturally have their own set of values, i.e., principles that matter to them. What are yours? Are they aligned with how you are spending your time and money?

Ultimately, you must ask yourself: what do I care about? Are you concerned with biodiversity, environmental conservation, and climate change? Or perhaps you are driven by social issues, focused on generating impact in your community? Inequality? Animal welfare? Perhaps some aspect related to freedom? Ask yourself whether your spending behavior is aligned with what you care about and try, at least, to minimize any obvious conflict. The simple reason for being mindful of these questions is that aligning your spending with your core values can bring greater peace of mind and overall financial well-being. It is difficult to achieve a fulfilling life and financial contentment without peace of mind.

What could a practical example look like? Besides some of the items listed above, I strive to embrace a minimalist lifestyle in some areas of my life. Freeing my apartment of clutter feels really good to me and allows me to have more headspace and positive energy to focus on my day to day. I prefer to keep it that way, so I also consider this third step before I purchase something.

I know how much time I need to work to earn €100 each month (step 1) and I know how many more years I will have to work if I consistently inflate my lifestyle by €100 each month (step 2). A third question I would then ask myself is: will this purchase add unnecessary clutter to my life? Or, is there any way I can avoid or reduce the environmental impact of this purchase?

These questions will be different for each reader, but the bottom line is the same: be careful with your spending–honor your values.

Photo by Joshua Kirshner on Unsplash.

Summary of The Three-Step Framework:

1) How much time does this purchase cost? Honor your past.

2) How much freedom does this purchase cost? Honor your future.

3) Is this purchase aligned with what I care about? Honor your values.

Enjoyed this post? Don’t miss our insights on the importance of reaching your first $100K invested or flexible spending strategies suitable for financial independence and early retirement that outperform the 4% rule.

Check out other recent articles

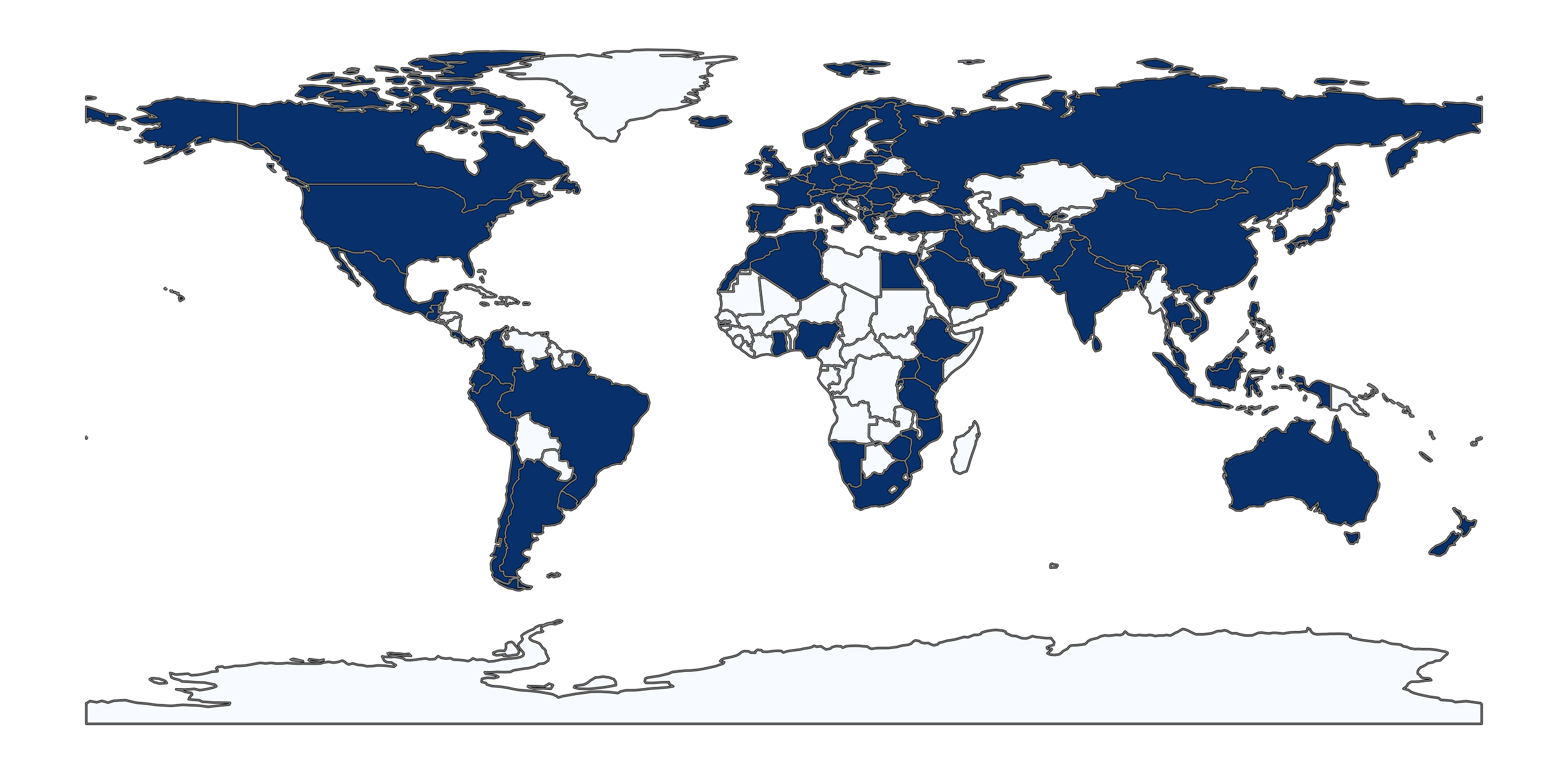

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: