How much do you need to save to retire early at age 45

Early retirement while you’re still young and healthy is the dream—but how much do you need to save and invest to get there? Photo by Priscilla Du Preez on Unsplash.

Reading time: 7 minutes

Retiring at 45 sounds extreme—but for some people, it’s mathematically achievable.

Quick answer:

To retire at 45 you need two things: a target portfolio and a timeline to reach it. A common starting point is the 4% rule of thumb, which suggests a Financial Independence number of about 25× your annual expenses. For example, spending $40,000 per year in retirement implies roughly $1 million invested.

But the real question isn’t just the number—it’s how quickly you can reach it. That depends primarily on your savings rate and current progress, which Table 1 below makes clear.

What you’ll get from this guide 🌿

✔ Quick FI estimate: 25× expenses (baseline) + how to think about being more conservative

✔ The retire-by-45 table: years to FI by savings rate and % of FIRE number already saved

✔ Worked examples: “I’m 30—what savings rate do I need to hit 45?”

✔ High-ROI levers if the table says “not yet”: savings-rate boosters, flexibility, geographic arbitrage

✔ Reality checks early retirees ignore: account access/bridge years + healthcare planning (brief, not overwhelming)

TL;DR — Retire at 45 🧮

🧠 Rule of thumb: Financial Independence (FI) number ≈ 25× annual expenses (4% baseline).

🗺️ Use Table 1: find your % of FI saved + your savings rate → estimate your years to early retirement.

🎯 If you’re not on track to 45: you only have three levers—spend less, earn more, or delay

🚀 Best first move: automate investing (“pay yourself first”) and raise savings rate by fixing big recurring costs.

🧯 Early retirement gap: plan for healthcare and income access before traditional retirement age.

Just want the answer fast? Jump straight to the retire-by-45 savings table below. The section directly above it explains how to interpret the table.

What Savings Rate You Need at Every Age (and Current Net Worth) to Retire by 45

If you’re trying to retire at 45, you need two numbers:

Your target portfolio (usually ~25× annual expenses), and

The savings rate that gets you there on time.

In this article, I’ll give you a simple rule-of-thumb for the dollar target, then a table that shows how many years to Financial Independence (FI) you have left based on your current portfolio size and savings rate. You’ll see instantly whether retiring by 45 is realistic—and what would need to change to make it happen.

Why Savings Rate is the #1 Lever for Early Retirement

While many people tend to fixate on getting higher investment returns from their portfolio, the data says that these efforts are typically unsuccessful for the vast majority of retail investors. Not only are they unsuccessful, but the statistics show that overall they are much more likely to end up underperforming the market—understood here as a simple, low-cost index fund.

Instead, the biggest driver of whether retiring at 45 is realistic is your savings rate. Your savings rate determines two key sides of the early retirement equation—how much money you invest and “put to work” each month and how much you ultimately need to retire.

If you can live off, say, 50-70% of your net income, you’re not only investing more each month, but your target FIRE (Financial Independence, Retire Early) number—based on your annual expenses—is smaller. Your savings rate is the fastest, most reliable lever to pull. It’s one of the few things over which you have most agency.

Focusing on your savings rate is a far more robust strategy to get to early retirement that focusing your energy on chasing returns. The vast majority of active retail investors underperform a simple index fund. Photo by Austin Distel on Unsplash.

This explains why some people earning $60,000 can potentially retire much earlier than someone earning $120,000. A disciplined saver with modest expenses can easily outpace—in relation to their Financial Independence number and timeline—a much higher earner who lets lifestyle creep take over. This is a principle widely understood in the FI community, however, it’s largely ignored by nearly everyone else.

Of course, there are other possible paths to early retirement—entrepreneurship is one of them. It does have the potential for very outsized returns, but at the same time it carries a lot more risk, effort, and it’s simply not for everyone.

In contrast, for the majority who prefer stability, steady investing over a 10-20 year period with a high savings rate will always beat chasing the next “big thing” in crypto or stock picking. In the end, early retirement is largely a game of compounding and consistency, not gambling or taking outsized risks.

Of course, savings rate isn’t everything. Unexpected life events, health challenges, or major career shifts can change any projected timeline. But among the variables we can control, savings rate remains the most reliable lever for bringing retirement closer to the present.

For readers unfamiliar with the nuts and bolts of the savings rate, we’ve covered how to calculate and track your savings rate in detail in a previous post, which can help you establish your baseline before you use the numbers in this article. Although the savings rate is the most important one, there are a few other important levers to be aware of for early retirement—for instance, your spending in retirement, your safe withdrawal rate, or your current biological age and life expectancy.

Photo depicts four young men (possibly) talking complete nonsense about moving forward a product society doesn’t really need. Entrepreneurship is certainly one path to accumulate wealth and reach early retirement. But it’s not easy, it has its risks, and, of course, it’s not for everyone. In contrast, slow and steady investing will more reliably do the trick over time. Photo by Austin Distel on Unsplash.

The Recipe: Simple, Not Easy

The math for early retirement is simple, but not easy: save aggressively, invest wisely, and wait. The real challenge in most cases isn’t the math—the problem is usually behavioral: it’s sticking with a plan over the long term while resisting distractions. In some sense, it reminds me of a fitness program you want to implement to be healthy: the exercises themselves are simple, but showing up week after week is the hard part.

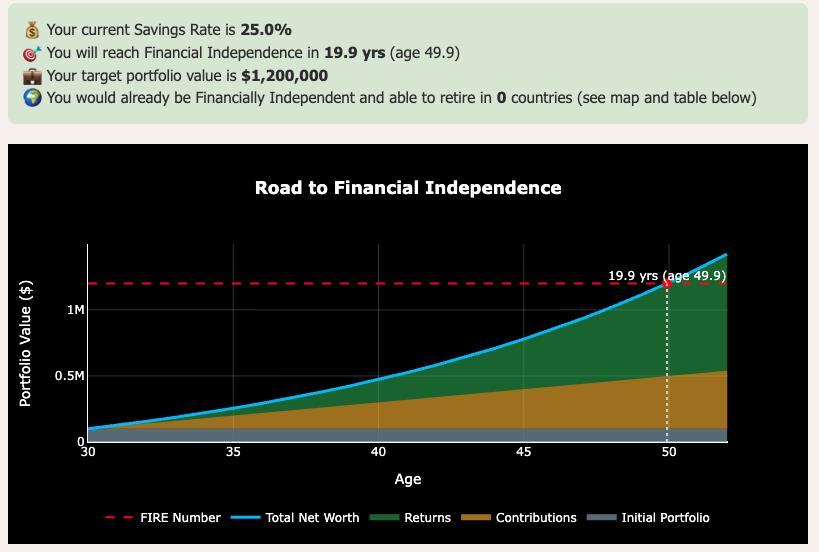

From my own experience, the biggest shift happens when you make your own early retirement timeline visible (see example in Figure 1). Seeing how savings decisions translate directly into years of life reclaimed makes it far easier to be consistent and disciplined with saving and investing.

Generally, discipline beats complexity every time. I know friends and coworkers who spend years tinkering with complex investment strategies and stock picking, confident this is what moves the needle. Unfortunately, their savings rate was too low for any of it to make a meaningful difference—even if they were lucky with their investments.

It’s far better to focus our energy on trying to earn more, keep a steady investment routine, and optimize our spending—so that it is fully aligned with what brings us true value and joy.

The remainder of this post is designed to give you a clear, visual map of how long it could take you to reach Financial Independence depending on your current age, portfolio size as a % of your FIRE target, and savings rate you can maintain going forward.

Most importantly, it allows you to answer the specific question: “If I want to retire by 45 or 50, what combination of current portfolio and savings rate will get me there?”.

Figure 1: Screenshot of our Financial Independence Calculator (free, email unlock). Enter your current portfolio value, annual net salary and expenses, and estimate your timeline to early retirement in seconds.

Savings rate and current progress: how many years until you can retire at 45?

The core message of today’s question—“How much do I need to save, given my age and current net worth, to retire early at age 45?”—is represented by Table 1 below. It presents how many years you are from FI at different savings rates, depending on your starting position. We will also explain how to estimate how much you’d need to save to retire by other ages, say 50 or 55.

For the sake of simplicity, we’ve considered using the 4% rule (of thumb) as the baseline. In other words, the FIRE number is calculated as the annual expenses multiplied by 25—this is your retirement portfolio target. We’ll also assume an investment portfolio composed of largely low-cost index funds with a real return on investments of 7%. We use our Financial Independence Calculator (free, email unlock) to generate the results.

How to read the table:

Choose your current % of FIRE number saved (left column)

Find a savings rate you could realistically sustain (top row)

The intersection shows your years remaining until Financial Independence

Compare that number with your target retirement age (45 or whatever you prefer)

Again, the amount you’ve managed to save and invest doesn’t matter in absolute terms—it matters related to your lifestyle and current annual expenses. This means the table works for any portfolio target—it doesn’t matter whether your goal is $750,000 or $3M.

Caveats and important assumptions behind the table: This model assumes a long-term diversified portfolio and a consistent savings rate. Remember that real life tends to be messier. The biggest risks for someone targeting retirement at 45 are poor market returns early in retirement (also known as sequence-of-returns risk), healthcare costs before traditional retirement age, and tax or access limits on retirement accounts. Treat the table as a planning baseline, then stress-test it with more conservative assumptions or flexible spending.

Table 1: Years to Financial Independence (FI) using our Financial Independence Calculator. Rows depict different percentages of retirement target saved already (FIRE number), while columns present different Savings Rates (SR). Example: a person who’s saved up 20% of their retirement portfolio target—e.g., $200,000 out of $1M—and has a 30% savings rate will take 15.1 years to reach Financial Independence.

| % of FIRE number saved | Years to FI @SR=10% | Years to FI @SR=20% | Years to FI @SR=30% | Years to FI @SR=40% | Years to FI @SR=50% | Years to FI @SR=60% |

|---|---|---|---|---|---|---|

| 0 | 41.5 | 30.7 | 23.8 | 18.9 | 14.9 | 11.4 |

| 10 | 27.6 | 22.9 | 18.8 | 15.5 | 12.6 | 9.8 |

| 20 | 20.6 | 17.8 | 15.1 | 12.7 | 10.5 | 8.3 |

| 30 | 15.8 | 14 | 12.1 | 10.4 | 8.7 | 7 |

| 40 | 12.3 | 11 | 9.7 | 8.4 | 7.1 | 5.8 |

| 50 | 9.4 | 8.5 | 7.5 | 6.6 | 5.7 | 4.6 |

| 60 | 7 | 6.4 | 5.7 | 5 | 4.3 | 3.6 |

| 70 | 4.9 | 4.5 | 4.1 | 3.6 | 3.1 | 2.6 |

| 80 | 3.1 | 2.8 | 2.6 | 2.3 | 2 | 1.7 |

| 90 | 1.4 | 1.3 | 1.2 | 1.1 | 1 | 0.8 |

Reading the table is straightforward: choose your current % of FIRE number saved on the left (0-90%), pick the savings rate you could realistically sustain going forward (columns, 10-60%), and the intersection cell gives you the years remaining to reach FI. From there, you can check whether that timeline matches your target retirement age.

You might notice that the table focuses on percent of your FIRE number saved, rather than a specific dollar amount like $1 million. If you’re wondering whether $1M is enough to retire early in your own situation, I’ve explored that question in depth in a separate guide—including spending levels, withdrawal strategies, and location trade-offs.

Let’s go back to the table with an example: if you’re 30-years-old with 10% of your FIRE target saved and you want to retire by 45, you have a 15-year window. Looking at the table, you’d need a savings rate of just over 40% to get there. A savings rate of under 40% wouldn’t align with your desired timeline.

What if you’re 30 with already 50% of your portfolio saved and would like to retire by age 40 instead? According to the table, with such a large portfolio you could reach FI with only a 10% savings rate. Increasing it to 50% would only get you there 4 years faster.

The table makes it easy to assess whether your current saving habits are aligned with your goal—or whether you need to reduce your expenses or increase your savings rate to get there. In other words, it shows how close (or how far) age 45 really is based on today’s saving habits. For many readers, this may be the moment early retirement shifts from fantasy to a concrete timeline.

As mentioned, we consider this table—which uses the 4% rule (of thumb)—as the “baseline case”. Further below, we explore how variable spending strategies like Guardrails and Variable Percentage Withdrawal—which require more flexibility in retirement spending—could shorten these timelines further.

Interested in retiring early abroad? Portugal ranked as one of the top 5 locations for early retirement in Europe. Photo by Emanuel Haas on Unsplash.

What the table really shows about retiring in your mid-40s

The first most obvious takeaway from Table 1 is that starting earlier is the ultimate superpower. A 20-year-old with no net worth to her name—0% of her FIRE target saved—and a 30% savings rate can reach Financial Independence in little over two decades (23.8 years)—in her early 40s. Starting early lets time do most of the heavy lifting.

Compare this with someone starting at age 45 in a similar position. They would need a very aggressive savings rate of 50% to have a chance at retiring by 60. Again, time, more than any other factor, determines how gentle or extreme your savings journey will be to meet your retirement goals.

The second lesson is that your current portfolio size massively changes the game. If you’re already at 50-60% of your FIRE target, the timeline to FI can accelerate very quickly. At that stage, where you may be making more from your portfolio annually than from your salary, you may start to wonder whether implementing such a high savings rate is worth it or whether it’s better to “coast” to the finish line with a lower savings rate.

This is actually the exact principle behind Coast FIRE. Once you’ve built a substantial base, you can ease up on your savings, free up cash for travel or other lifestyle sources of joy, and still hit FI relatively quickly.

The idea of Coast FIRE is that, once you’ve reached a sizeable portfolio, you can ride it out into retirement—you don’t need aggressive savings rates anymore. Photo by Colin Watts on Unsplash.

Third, the table reveals an important but counterintuitive insight—there are diminishing returns to pushing your savings rate higher and higher beyond a certain point once you’re closer to your FI number. If you’re sitting at 80-90% of your target, dramatically increasing your savings rate might only shave off a couple of months—is it really worth the effort?

Our own journey has taken advantage of this effect. After saving and investing aggressively for many years early on, the table now shows that the difference between a 40% and 60% savings rate for us would not make a large difference in terms of FI date. With a growing family, that extra effort doesn’t feel worth it anymore—we’d rather enjoy more flexibility now while our portfolio compounds in the background.

Fourth, the table makes the power of savings rate impossible to ignore. For those in the early stages, the jump from a 10 or 20% savings rate to 40 or 50% can be transformative—it can literally cut your timeline in half.

Finally, the table provides also a clear “it’s too late” inflection point. If you’re starting out with little savings in your 30s or 40s, the years-to-FI at low savings rates could be longer than the time you have left to reach the traditional retirement age.

While this reality check can be sobering—you can also choose to see it as empowering, because it makes the trade-offs crystal clear. You either increase your savings rate, push back your retirement timeline, or find other levers to explore.

For several years we implemented aggressive savings rates (50-60%) in pursuit of Financial Independence. With kids entering the picture, we’ve taken the foot off the gas a bit. Photo by Jessica Rockowitz on Unsplash.

If the baseline case feels too rigid or the savings rate you’d need to implement is higher than you’d like, there are a few ways to “tweak” the math without taking on excessive risk.

How Flexible Withdrawal Strategies Can Help You Retire Sooner

Not everyone will want—for different reasons—to follow the rigid 4 % rule (of thumb). Other variable spending strategies like Guardrails or Variable Percentage Withdrawal (VPW) can provide you with a quicker FI timeline in exchange for more flexibility in retirement spending.

This means that you adjust your withdrawals in retirement based on how market conditions change. In good years, you can take more, while you tighten your spending temporarily during weaker years. We’ve covered in detail the numerous advantages and disadvantages of these approaches in the posts linked in the previous paragraph.

These strategies often mean you can retire with less than the classic 25x annual expenses indicated by the 4% rule. For example, if your FIRE target drops from $1M to $800,000 by using Guardrails (and a 5% SWR), your position in the table improves slightly—your percentage of FIRE saved jumps without contributing a single extra dollar. For late starters, while it may not dramatically alter your plan, this shift could still bring your retirement forward by several years.

We’ve explored these variable spending strategies in detail in separate articles, but the takeaway is clear: don’t underestimate flexibility in retirement spending—it can accelerate your timeline without introducing excessive risk, especially if you’re willing and able to adjust your withdrawals to changing market realities.

Interested in retiring early abroad? Mexico ranked as one of the top retirement locations in Latin America. Photo by Spencer Watson on Unsplash.

Geographic Arbitrage: Retire Earlier by Lowering Your Cost of Living

Another important lever with even greater potential is geographic arbitrage—in this case, reducing your retirement expenses by relocating to a lower-cost area, either temporarily or permanently. Given that your FIRE number is tied directly to your expenses, cutting them by 30-50% can cut your target portfolio by the same amount.

The effect on your position in the table can be dramatic. Let’s imagine your current FI number is $1M, based on a $40,000 annual spending in the US. If you decide to move to a South East Asian country where the cost of living is 25-50% of the one found in the US, you could very easily sustain a similar lifestyle with, say, $25,000 (63% of your previous budget). This moves your target portfolio from $1M to $625,000.

We’ve covered in previous posts popular retirement destinations abroad, with rankings for Latin America, Europe, and Asia. Note as well that this same strategy doesn’t have to involve moving overseas—many people choose to move to lower-cost-of-living cities or towns within their own country.

Relocating isn’t the only lever—you can also boost your savings rate from the income or spending side without moving.

Interested in retiring abroad in Asia? Malaysia ranked as one of the top 3 early retirement destinations in Asia. Pangkor Island, Malaysia. Photo by Anh Thu Le Nguyen on Unsplash.

Strategies to Increase Your Savings Rate

If, after running your numbers, you realize your savings rate won’t get you to FI on your preferred timeline, the next step is finding a way to raise it.

Personally, I’ve found the most effective way to do this is to implement a “pay yourself first” budget, where you prioritize your savings to take place as soon as your money in your account.

In other words, after your salary has come in, your very first monthly “expense” should be the investment contributions to your retirement accounts. This is an excellent way to “lock in” your desired savings rate, and “force” yourself to live on the remaining budget for the rest of the month.

Another approach—which can be used in a complementary way—is to leverage the 1% Savings Method. The goal here is to increase your savings rate by a single percentage point each month. This gradual approach means giving yourself time to adjust without really feeling the pain of a sudden change in lifestyle.

A third approach—as mentioned above—is to engineer some form of geographic arbitrage, but in this case, while you’re still earning. Is it possible to move to a lower-cost location without cutting your income? Or does it actually make sense to shift jobs and take a lower-paying job in a comparatively more favourable cost-of-living location? As we saw above, what matters in the end is your savings rate, not how big your paycheck is.

Your path to Financial Independence and early retirement starts with your savings rate—are you willing to take the necessary action? Photo by Ante Hamersmit on Unsplash.

Next steps: adjusting your timeline toward age 45

Your savings rate is more than a number. It’s a reflection of how you’ve chosen to design your life—both now and later. The table provided in this post isn’t about judgement or depravation—but designed to provide clarity and help you reach your goals

Once we see our personal timeline explicitly, we can decide whether it makes sense to accelerate it, slow it down, or change it altogether (e.g., pursue Coast FIRE or Barista FIRE instead)

If you’re early on in the journey, even modest increases in savings rate can have a huge impact. But if you’re already close-ish to hitting your retirement target, you may realize that the small gains achieved from higher contributions may not be worth the trade-off—you may prefer to let your existing portfolio compound in the background and go for a lower savings rate that allows you to enjoy life more now.

There are other strategies available, e.g., earning more, moving to a lower-cost area, or adopting a more favourable withdrawal strategy.

Either way, the earlier you start, the less extreme your savings rate needs to be, and the closer you are to your FI target the more you can afford to spend now without compromising your future. The table provides you with the ability to see these trade-offs instantly—and to design a path that fits both your goals now and later.

It’s worth remembering that there is no single “correct” retirement age or savings rate. The goal isn’t to hit 45 at all costs, but to understand the trade-offs clearly enough to design a life that fits your priorities.

If you found this article helpful, here are some natural next steps:

👉 Estimate your personal retirement timeline with the FI Calculator (free, email unlock).

👉 New to Financial Independence? Start with the Start Here guide.

👉 Want more tools like this? Subscribe to the newsletter (one-click unsubscribe anytime).

💬 What does your savings rate look like today and what would you be willing to sacrifice to retire in your mid-40s? Let us know in the comments below!

🌿 Thanks for reading The Good Life Journey. I share weekly insights on personal finance, financial independence (FIRE), and long-term investing — with work, health, and philosophy explored through the FI lens.

Disclaimer: I’m not a financial adviser, and this is not financial advice. The posts on this website are for informational purposes only; please consult a qualified adviser for personalized advice.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

The exact amount depends on your current age, savings rate, and how much of your FIRE target you’ve already saved. Use the table in this article to match your age and savings rate to your years-to-FI. For example, a 30-year-old with 10% of their FIRE number saved would need a savings rate just over 40% to retire at 45.

-

Possibly—but it depends on your spending, location, withdrawal strategy, and flexibility. Using the 4% rule, a $1 million portfolio supports roughly $40,000 per year, which may be enough for some lifestyles but not others. Because this question depends heavily on personal circumstances, I explore it in detail in a separate guide on whether $1 million is enough to retire early, including real-world examples and trade-offs.

-

There’s no universal dollar amount—it depends on your annual expenses. A common benchmark is to have your FIRE number (25x annual expenses) fully saved by your desired retirement age. If you’re willing to use variable spending withdrawal strategies like Guardrails or VPW you may need less.

-

Yes—but it requires high savings rates early, disciplined investing, and avoiding lifestyle creep. The earlier you start, the lower your required savings rate.

-

For aggressive early retirement goals like 45, a savings rate of 40–50% is often necessary unless you already have a significant portfolio.

-

Savings rate impacts both how quickly you accumulate wealth and how much wealth you need. Higher rates shorten the time to FI dramatically, especially when starting early.

-

Yes. Geographic arbitrage can slash expenses by 30–50%, reducing your FIRE number and years to FI. This strategy works domestically too by moving to lower-cost areas.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: