What Is Considered Upper Class? It’s More Than Just Income

What is really considered upper class? Photo by cottonbro studio o Pexels.

Reading time: 8 minutes

Quick answer — What is considered upper class?

Most definitions combine three factors: income, net worth, and social/cultural capital. A common rule of thumb is income around ~3× the median (often top 5–10%), and net worth in the multimillion range (often ~$2–5M+ in the US), but thresholds vary by country and age. In practice, many high earners are still “upper-middle” if they’re dependent on a job, while people with Financial Independence can be “upper” in autonomy even without flashy consumption.

This article uses two lenses: (1) classic benchmarks (income/net worth), and (2) a modern test: autonomy vs appearance.

I explore ideas like this regularly—money as freedom, not just status—in a short newsletter (unsubscribe anytime).

What you’ll get in this article

✔ The classic income + net worth thresholds economists use

✔ Why high income can still mean financial fragility

✔ How “upper class” differs from “upper-middle class”

✔ A practical framework that considers autonomy versus appearance

✔ A modern definition grounded in Financial Independence

TL;DR — What Is Considered Upper Class?

💵 Income: Often ~3× the median household income (US ≈ $250K+ households, depending on source)

📈 Net worth: Often $2–5M+ in assets (U.S. ballpark; varies by age and region)

📍 Social tier: High-prestige roles and strong cultural capital

🧘 Modern view: True upper class = autonomy + financial resilience

🚫 Key insight: High income ≠ upper class if you’re dependent on work

🛡️ Today: Financial independence and time freedom matter more than consumption-based status

What Is Considered Upper Class in 2026? A Modern Financial Perspective

In this article, we go beyond income brackets to reveal what truly defines upper-class status today—combining income, net worth, lifestyle, upbringing, and Financial Independence (FI). If you’ve ever wondered whether class is about money or freedom, this breakdown shows where it really stands.

If you’re here for a quick benchmark, the next section summarizes the standard income, net worth, and social-position definitions. Then we’ll zoom out to the modern view: autonomy and financial resilience.

Rethinking What It Means to Be Upper Class Today

Many assume being upper class is all about having a high income. The typical mental shortcut is to equate class with income—six figure salaries, luxury houses, and perhaps accompanied by a fancy degree or two. But if you dig a bit deeper it can get complicated quickly.

Can you be upper class if you earn $300K but follow a lavish lifestyle and live mostly paycheck to paycheck, without any meaningful savings? What if you’re a high-net-worth 40-year-old who’s reached the FI crossover point, needs no job income, and intentionally flies under the radar—living a life of “stealth wealth” that few would recognize as affluent?

Before going any deeper, though, it’s worth briefly acknowledging the part of the conversation that usually dominates public thinking. In other words, what is the classic definition of “upper class”? Most people don’t use the word philosophically—they use it as shorthand for a certain income range, neighborhood, or social tier. And because of that, terms like “upper class,” “upper-middle class,” “top 5%,” “high net worth”, and “financially independent” tend to get blurred together.

So for clarity—not because income is the full story—we can quickly outline what some institutions typically mean when they measure the upper class today.

Does upper class mean travelling first class? It’s not that simple; some people practicing “stealth wealth” may be more financially independent (perhaps even retired in their mid-40s) than high-salary individuals with low net worths relative to their income. Photo by Benjamin Nelson on Unsplash.

What Economists Usually Mean by “Upper Class”

In most modern definitions, the “upper class” simply refers to households whose resources, options, and influence place them well above the median citizen. That often translates into three overlapping pillars:

• Income:

Households earning around three times the median income—roughly $250,000+ in the US—are often labeled “upper class” in statistical reports.

• Net worth:

A household with several million dollars in assets (commonly $2–5M+ in the US) often ends up in the same category, even if its income is modest or there is no income. A shortcut could be to multiply the median salary in your country by 25—this comes from the 4% rule (of thumb) to determine Financial Independence.

• Social position:

Some prestigious roles—surgeons, partners at firms, elite academics, diplomats—are often treated culturally as “upper class”, regardless of actual finances.

But these benchmarks are only the surface layer. They tell us who has money or status—not who has time-freedom. And, in my view, this is where the entire traditional framework starts to fall apart. This model breaks down when it treats income, wealth, and class as the same thing. A high salary doesn’t automatically mean stability, freedom, or lasting security.

Once you see how narrow these benchmarks are, the deeper question naturally follows: What if “upper class” has less to do with income—and far more to do with autonomy?

When you look closely, many modern careers quietly trade autonomy for status. Long hours, high pressure, and constant availability are normalized—often justified by income or prestige—but they leave little room for control over time, health, or attention. This tension sits at the heart of how we misunderstand class today.

Given that many continue to embrace the cycle of work and consumption—deep down, to gain the respect and admiration of others—it begs the question: is class about external status—or about internal freedom? If you earn $300K a year but are chronically stressed, time-poor, and dependent on your job… are you really upper class or just look like it?

True wealth—and true upper class in a modern sense—isn’t about visible status. It’s about Financial Independence, time autonomy, and the ability to live life on your own terms. When you no longer rely on work to sustain your lifestyle, you’ve crossed the line into a deeper, more durable form of wealth

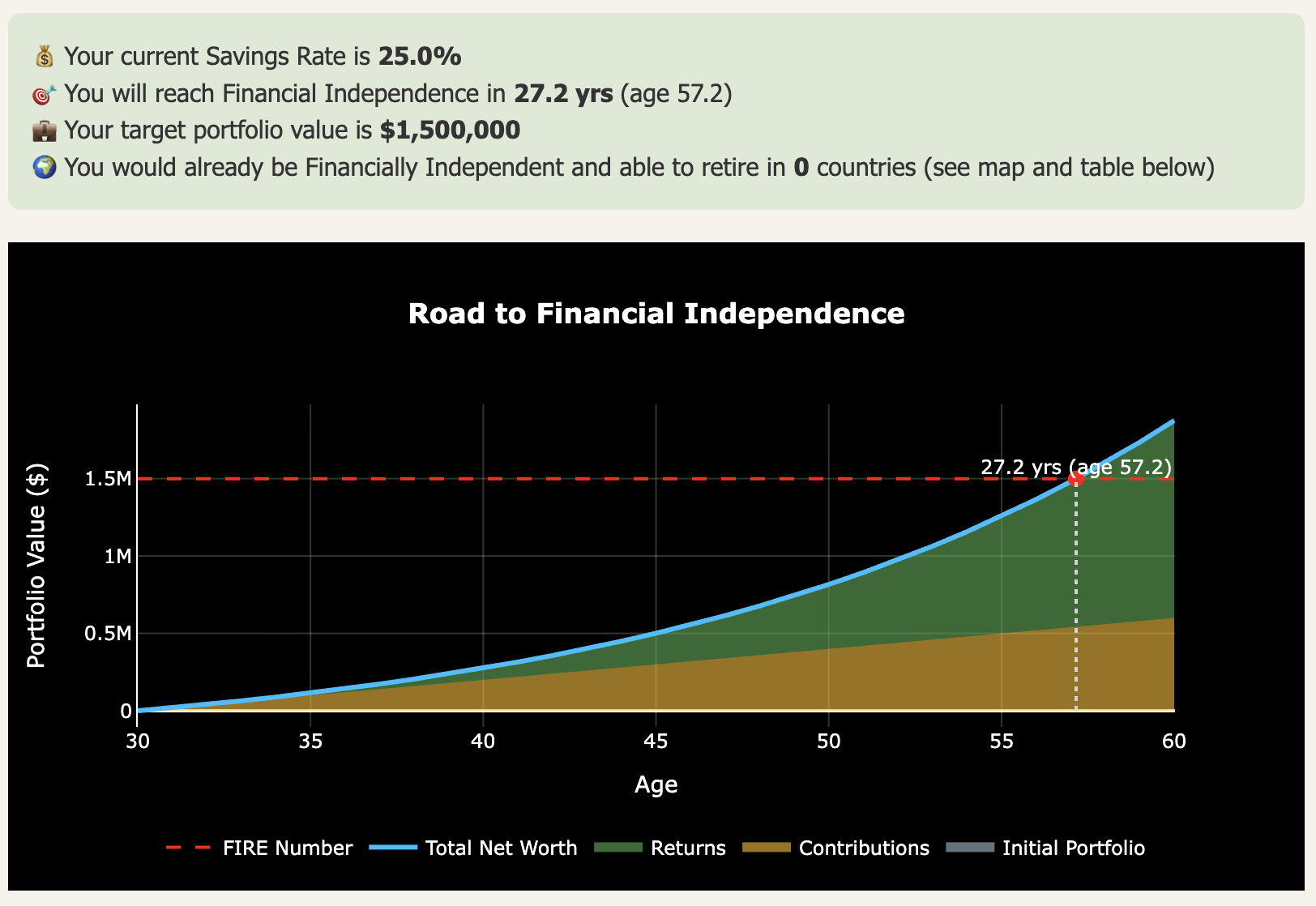

👉 Quick self-check: if autonomy is the goal, it helps to know your Financial Independence timeline (calculator linked below).

Why High Income Doesn’t Guarantee Upper Class Status

Defining “upper class” by income alone can be misleading. A six-figure salary can create the appearance of wealth, but it doesn’t guarantee financial stability—especially if spending rises in step with income. In many cases, this disconnect comes down to lifestyle creep quietly matching each income rise.

Without savings, investments, or even a well-structured emergency fund, high earners risk living paycheck to paycheck, making them financially fragile despite a seemingly wealthy façade. Class status, in this sense, looks more like a rental agreement with their employer. Without job security, their perceived upper-class status can quickly vanish.

It’s clear that income alone can’t define class: high earners can be fragile, and modest earners can be financially secure. That’s why net worth—not salary—is clearly a better indicator of true financial resilience.

Law firm employees and partners—are they upper class due to high salary or is more needed? Photo by August de Richelieu on Pexels.

Is Net Worth a More Accurate Indicator of Class?

Net worth—assets minus liabilities—is already a better indicator of financial resilience. While it may not match traditional views of the upper class, someone with a $2M portfolio and no debt has greater financial security and independence than someone earning $250K, but either head-deep in student loans or just unwilling to translate that high income into savings and investments through a healthy savings rate.

But we should consider that net worth correlates strongly with age. As workers progress through their careers, buy property and pay off debt, their net worth naturally grows, usually peaking in retirement. Defining class only by net worth risks reducing it to a retirement milestone—detached from the freedom or identity it’s supposed to signal. That doesn’t seem quite right either—there must be other ingredients we are sill missing.

Even net worth can’t capture the full picture. Upper class also has cultural and social layers that money alone can’t buy.

How Education, Upbringing, and Identity Shape Class

What about a fancy degree—like Ivy League or Oxford credentials? A high-quality education certainly provides cultural capital. It can give you the ability to navigate elite institutions, influence networks, and adopt refined tastes. Yes, but it doesn’t guarantee financial success either.

A high-earning plumber without formal education, but with business acumen, reputation, and financial discipline can end up with a higher net worth, live a spendier lifestyle, and end up retiring much earlier than a fancy degree holder that ends up in a modestly paid position. Critics might say that elite education still opens doors. While that can be true, credentials alone without financial discipline rarely translate into long-term security or autonomy.

There may be some exceptions when it comes to very advanced degrees or elite professions. Some roles—like surgeons, tenured professors, federal judges, politicians, senior diplomats—tend to carry an automatic upper-class perception, regardless of the actual finances involved.

These positions normally command deep societal respect and are associated with prestige, authority, and influence. They could be saddled in debt, yet still be regarded as upper class. This suggests that there are a few paths to class which aren’t necessarily tied to net worth or Financial Independence.

Upbringing is also considered by many as a marker of class. Inherited wealth and early exposure to financial education often create long-term advantages. Kids from upper class families often gain fluency in social codes, unwritten rules, and have access to resources like travel or job opportunities.

Even without high income or net worth, this upbringing can open doors and lead to influence. In contrast, those with late-life wealth, resulting from decades of financial discipline, but no cultural capital—either upbringing or education—may struggle to navigate upper class spheres of influence.

Lifestyle Choices vs Real Wealth Signals

The perception is that living in an upscale neighborhood, owning designer brands, or taking frequent vacations often visually signals upper-class status. It is one of the multiple reasons humans work so hard: at the end of the day, we want to command respect by others. At the heart of it lies a deep desire to be loved, yet usually a poor understanding of how to achieve this ultimate form of respect.

So, off we go into the 40-year career grind we dislike in order to conform and gain respect from others—to live in the right neighborhoods, wear the right clothes, drive the right car, and generally consume the right products. But, of course, at the end of the day these signals can be very superficial. Some people lease luxury cars or wear designer brands while accumulating debt, highlighting the gap between image and financial health.

These spending patterns are textbook lifestyle creep, often locking people into fragile financial positions, especially when big-ticket decisions like housing compound the effect over decades. We explore these status games in depth elsewhere—and what you should focus on instead.

Can you really be considered “upper class” based only on consumption? To make sense of these blurred boundaries, we need a clearer distinction between people who only look affluent and those who have meaningful financial autonomy.

A spendy lifestyle does not always equal financial stability. Photo by Virginia Marinova on Unsplash.

Upper Class vs Upper-Middle Class: Why the Distinction Matters

Many people who think of themselves as “upper class” are often really describing the upper-middle class—a group with high earnings, strong credentials, and comfortable lifestyles, but who still rely heavily on employment income.

In contrast, the traditional upper class has historically been defined by something different: enduring resources, cultural capital, and the ability to live life without strict financial dependence on work. Here’s a simple way to see the difference in today’s world:

Upper-middle class: high salaries, impressive degrees, professional roles, good neighborhoods

Upper class: lasting wealth, autonomy over time, and financial systems that sustainably outlive the need for income

This distinction matters because many high earners assume they’ve “made it” financially, only to realize that their chosen lifestyle keeps them tethered to a demanding job they dislike. It explains why someone earning $200K can feel stretched, while someone with modest income but strong net worth can feel secure.

This sets the stage for the deeper question: if income and lifestyle aren’t reliable indicators of class, what is?

Financial Independence and Autonomy as True Class Markers

At its core, Financial Independence often reframes the very idea of class—from something externally validated to something internally lived. Instead of measuring success though visible signs of consumption—as discussed in previous sections—financially independent individuals prioritize control over their time, health, and life decisions.

Pursuing Financial Independence means designing a lifestyle that reduces reliance on traditional jobs and builds lasting wealth, aiming to reclaim autonomy from the conventional 9-to-5 grind, and to potentially retire decades earlier than most. For them, the ability to say “no” to toxic workplaces, pointless meetings, or obligatory social climbing is the ultimate flex. It’s not about how prestigious your job title sounds, it’s whether you could safely walk away from it tomorrow without your whole life falling apart.

This shift towards more freedom over appearance is especially clear in the FIRE (Financial Independence, Retire Early) movement. Many FIRE minded folk choose to live modestly, invest aggressively, and often adopt a form of stealth wealth. They may not appear upper class by conventional markers—no luxury cars or designer vacations—but they have true financial freedom.

They possess something more important than material wealth: independence from the need to earn. They also avoid Sunday scaries and stay calm during recessions, thanks in part to their financial resilience mindset. Skeptics sometimes point out that FIRE lifestyles can appear restrictive or minimalist. But the restriction is intentional: it prioritizes autonomy over display, a tradeoff many find deeply worthwhile.

Who do you think enjoys a higher quality life—a 40-year-old with a $1.5M portfolio, spending $55K per year without needing to work, and plenty of free time for leisure and exploration of interests, or a high-paid executive working in corporate America, who is chained to their inbox and doesn’t spend time with their kids? In practice, autonomy changes your daily life far more than a higher salary does.

The degree of Financial Independence should be an ingredient determining social class, arguably even more so than absolute net worth or income. It’s the difference between owning your freedom and renting your lifestyle.

Doctors enjoy high incomes but also have the reputation for being terrible savers. It’s almost impossible to reach Financial Independence if you’re unable to implement basic savings habits. Photo by Accuray on Unsplash.

Visualizing Class: The Autonomy vs Appearance framework

As we’ve seen, it’s clear that traditional ideas of class—based on income, degrees, or lifestyle—don’t tell the full story. High earners can still be financially fragile if they lack savings and stability. You may look wealthy but feel trapped and dependent. You can even truly be financially independent but not appear “upper class” to others, just because you are not flashy or because you chose to embrace stealth wealth.

How can we make better sense of this? One way to is to examine class through two separate dimensions:

Autonomy: How much freedom and control do you have over your time, finances, and life choices?

Appearance: How much you look upper class in the eyes of others—defined by your lifestyle, job title, neighborhood, clothing, and other social status cues?

Below we plot these two dimensions in a grid—Autonomy (Free to Tethered) on one axis and Appearance (Flexing to Low-Key) on the other. The resulting 4 quadrants capture four distinct life situations that challenges conventional assumptions about class.

| Flexing (High Appearance) |

Low-Key (Low Appearance) |

|

|---|---|---|

| Free (High Autonomy) |

🗡️ Elite Independents Financially free & socially visible |

🛡️ Stealth Wealth Financially free, not flashy |

| Tethered (Low Autonomy) |

💼 Status Trapped Flashy but financially fragile |

🔧 Time-Strapped Invisible & financially limited |

Let’s review the different possibilities. These are covered in a continuum of class, from highest to lowest.

🗡️ High Autonomy & High Appearance—Elite Independents

These individuals represent the vast minority of society—those who are both financially free and display high appearances. A key characteristic of the upper class is Financial Independence, where investments and assets can fully sustain a chosen lifestyle without the need to work. Examples of individuals falling in this category could be very successful business owners, heirs, or individuals that have achieved some version of fat FIRE. They don’t need to work and chose to live a visibly “upper class” lifestyle. This is probably what most people imagine when they hear the term “upper class”.

🛡️ High Autonomy, Low Appearance—Stealth Wealth

These individuals have also achieved Financial Independence, but choose not to signal it by means of outward consumption. In eyes of others, they live in good—but not fancy—neighborhoods, don’t drive fancy cars, and avoid luxury branding. They do so because they prioritize time freedom and security over perceived status. In this group you can think of most early FIRE retirees or the stereotypical saver and investor described in The Millionaire Nextdoor. They may also be small business owners who quietly built wealth over time. Their autonomy is very high, but their wealth in invisible to the status-obsessed. For them, success isn’t about being seen—it’s about being free. They tend to choose internal peace over prestige.

💼 Low Autonomy, High Appearance—Status Trapped

Next enter the Status-Trapped. This group looks wealthy, but only on the surface. They may live in upscale neighborhoods, wear nice clothes, or hold prestigious jobs, but they are still highly dependent on their salaries to maintain that projected image. Think lawyers, doctors, or executives, who, despite their high income, don’t have a good grasp on their finances and are very far from achieving Financial Independence. They have high appearances, but enjoy low levels of freedom—often working long hours under stress, unable to take extended breaks from work without risking their financial stability.

🔧 Low Autonomy, Low Appearance—Time-Strapped

Finally, we have individuals who lack both financial security and visible markers of status. Unfortunately, this is the majority—many work hard yet live paycheck to paycheck, lacking upward mobility and financial opportunities. This includes service workers, freelancers, or graduates stuck in underpaid roles without financial mobility. They aren’t signaling wealth—because they can’t—and don’t have the financial freedom to reclaim time. They are time-strapped.

Of course, many individuals won’t fall squarely into one of these quadrants. We’ve used this simplified approach so that everything fits neatly into four categories, but remember that you can also find yourself halfway from one category to another.

This simple framework reveals something important—that class is not always what it seems. Some people appear rich, but are completely trapped and lack freedom. Others seem ordinary, but are financially free. Modern upper class status is less about visible wealth and more about autonomy over time, choices, and lifestyle design.

A not-so-flashy lifestyle could still be someone practicing stealth wealth, with a high degree of Financial Independence. Photo by Rana Sawalha on Unsplash.

How FIRE Investors Are Redefining What It Means to Be Upper Class

Most FIRE folk reject traditional class assumptions that are built on external validation. In my view, one thing this group gets right is that they value freedom and health over status. They understand the relationship existing between social signaling and the need to be dependent from a job. In other words, they understand the tradeoff between freedom and status.

Going back to our previous example, a 40-year-old with a $1.5M portfolio and an annual $55K spend might not look “upper class” at first glance. But that person likely has more day-to-day freedom than someone earning $300K in a job they dislike (and perhaps not saving very much relative to their salary). FIRE folk redefine class around life satisfaction and freedom rather than external validation.

This challenges the more traditional, status-signaling model. If your version of “making it” in life means owning your time, living intentionally, and spending freely only on what really matters to you—then Financial Independence isn’t just a means to opt out of the rat race. Ironically, by stepping away from traditional class games entirely, you may end up attaining a deeper, quieter form of status: one rooted not in how others see you, but in the freedom you’ve actually earned.

If we tried to offer a more accurate definition of “upper class” today, it might sound something like this: those who have enough financial and personal autonomy to live life on their own terms, with options rather than obligations shaping their days.

It doesn’t mean the biggest house or the highest income, but the deepest reservoir of freedom. In an economy that rewards endless display, this quieter, more durable version of class is easy to overlook—but far more meaningful.

How far away are YOU from reaching Financial Independence? Use our FI Calculator—free for email subscribers—to figure out whether you’re on track to retire early.

Final Thoughts: Why Freedom Is the Ultimate Status Symbol

In the end, status is rented, but freedom is owned. Many of the traditional signals of being upper class—cars, clothes, credentials—are temporary, expensive, and often misleading. Real wealth—and real class—might lie in your ability to walk your own path—one that is more inward-looking versus externally validating.

In the end, it shouldn’t be about being upper class at all—it’s about whether you’ve bought time freedom and peace of mind. The ability to live on your own terms may not show up in status symbols, but is far more meaningful and lasting.

So forget chasing the traditional markers of success. True wealth isn’t about what you own—it’s about what you no longer have to do. Instead of chasing someone else’s definition of success, why not define it for yourself? Pursuing time autonomy and mental peace instead of status symbols may be the truest form of success today—one where you no longer need to prove anything to anyone.

Redirecting your energy toward healthier status games—like freedom and health—can make that shift far more sustainable.

💬 What’s your definition of “making it”? Is it income, status, or the freedom to live life on your own terms? Share your thoughts below.

If you want to translate this into action:

👉 Use the FI Calculator to estimate your autonomy timeline (free via newsletter)

👉 New to FI? Our Start Here guide is the best place for beginners

👉 Get the newsletter: tools + notes on money, work, and freedom (unsubscribe anytime)

🌿 Thanks for reading The Good Life Journey. I share weekly insights on personal finance, financial independence (FIRE), and long-term investing—with work, health, and philosophy explored through the FI lens.

Disclaimers: I’m not a financial adviser, and this is not financial advice. The posts on this website are for informational purposes only; please consult a qualified adviser for personalized advice.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

Upper class is typically defined by income—often households earning around $250,000 or more per year. However, this definition misses the bigger picture: real “upper class” today is about more than just earnings. It also includes financial independence, autonomy, and how resilient someone is without a paycheck.

-

Yes—very easily. A high salary alone doesn’t make someone upper class. If you're spending everything you earn, relying on each paycheck, or maintaining an expensive lifestyle without savings or investments, you’re financially fragile despite appearing successful.

In this sense, many high earners fall into a “status-trapped” category: they look upper class on the outside, but lack the freedom, stability, and autonomy that define true upper-class living.

-

Net worth—your assets minus liabilities—is a better long-term indicator of financial health and freedom. Income is temporary and job-dependent; it stops the moment you stop working. Net worth reflects accumulated security and the ability to live without relying on work, which gets much closer to what people intuitively mean when they think of a stable “upper-class” life.

-

In many ways, yes. Financial independence allows you to live life on your terms, without needing to work to cover your basic expenses—which is arguably the most meaningful form of class, even if it doesn’t always look flashy from the outside. Someone modest but free may be living a more “upper class” life than someone wealthy-looking but trapped.

-

Stealth wealth is when someone is financially independent or very secure but chooses to live modestly by choice. They may not show many outward signs of affluence, but they often enjoy more peace of mind and control over their time than those chasing visible status. In the framework of this article, they score high on autonomy and low on appearance—quietly living a version of upper class, without the performance.

-

Traditional class is about external validation—income, degrees, neighborhoods, job titles. Financial freedom is internal: it’s about time, autonomy, and living life intentionally. Someone with modest habits and no job can be far “richer” in lived experience than someone with a high salary and no time. Social class impresses others; financial freedom changes your day-to-day reality.

-

Yes—and this is a very common trap. Expensive clothes, luxury cars, upscale travel, or prestigious jobs can project success, but without savings or investments, it’s just a façade. Real wealth is quiet, often invisible, and based on financial choices—not consumption. You can look upper class to others while being one missed paycheck away from trouble.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: