Do REITs Have a Role in a FIRE Portfolio?

For some investors, there is certainly an emotionally compelling side to owning REITs—the appeal to harvest global rents from housing, offices, and other public spaces is high. But how do they work in your portfolio? Dubai, United Arab Emirates. Photo by Emma Harrisova on Unsplash.

Reading time: 7 minutes

REITs in a FIRE Portfolio: Tax Strategies, Diversification Benefits and Key Risks

Why read this: Many FIRE (Financial Independence, Retire Early) seekers wonder if Real Estate Investment Trusts (REITs) deserve a place in their portfolios beside index funds and bonds. In this article I break down what REITs are, how US and European tax rules differ, REITs’ long-term performance, and the real pros and cons for someone pursuing or already living in Financial Independence. By the end you’ll know when REITs can help—and when they might hurt—a FIRE portfolio.

What Are REITs and How Do They Work?

Real Estate Investment Trusts or REITs are companies whose core business is to own or finance income-producing real estate. By law they distribute the majority of their profits to their shareholders. For instance, in the US, a REIT must pay out at least 90% of its income each year in the form of dividends to investors. This is a requirement to maintain its REIT status and their associated corporate tax privileges.

Other countries have adopted similar rules. For example, the UK and Germany’s REITs also require a 90% distribution of rental profits. Although the details vary by country, the bottom line is the same—these are investment vehicles designed primarily to channel rental income to investors, not retain profits for growth.

There are numerous types of REITs, but they are usually grouped into three main types. Equity REITs own and manage properties such as apartment blocks, office towers, logistics warehouses, or shopping centres—collecting rent as their main source of income.

In contrast, mortgage REITs provide real-estate financing and earn from interest paid on mortgages. As you’d expect, their earnings are much more sensitive to movements in interest rates. Finally, you have hybrid REITs that combine both approaches. Diversified equity REITs are the most common entry points for long-term investors looking for exposure to the property market.

REITs are listed on stock exchanges and trade like ordinary shares. That means they can be bought or sold in seconds, enabling an investor to easily rebalance the desired real-estate exposure of their portfolio—a major difference from direct property ownership.

But it also means that their market value—like stocks—varies daily, far more than slow appraisal changes of physical buildings. Daily pricing enables liquidity but also higher volatility. Remember that—as with stocks—prices instantly reflect market sentiment, economic newsm and shifts in interest rates.

Just like stocks, REITs are listed in public stock exchanges, making them very easy to access, buy, and sell. Photo by Austin Distel on Unsplash.

REIT Tax Treatment: Key Differences Between US and Europe

The large cash distributions that make REITs attractive also create some tax complications. For example, US investors holding REITs in a regular taxable account will find that most REIT dividends are classified as “non-qualified” and hence taxed as ordinary income at the investor’s marginal rate, not the lower long-term capital gains or qualified-dividend rates.

For US investors, the straightforward way to avoid this annual tax drag is to hold REITs in tax-advantaged accounts like an IRA or a 401(k), where dividends can be reinvested without immediate tax.

European investors face a different landscape. In Germany, a direct holding of a US-listed REIT in a brokerage account would trigger the US 15% withholding tax and then the German flat “Abgeltungsteuer” of 26.375 % on those dividends each year. Obviously, paying a hefty tax bill yearly on the annual distributions before they can be reinvested represents an important brake for FIRE-minded folks. For investors pursuing Financial Independence in Europe, it’s essential to understand these REIT tax implications

A popular alternative is using Irish-domiciled accumulating (global) REIT ETFs—exchange-traded funds that bundle many REITs into a single, stock-like investment—so the US still withholds 15% of US-generated REIT income, but the Irish fund reinvests the remaining amount for you. In practice, as a German investor you wouldn’t be taxed on those distributions annually—only when you decide to sell your REIT ETF would you be taxed according to Germany’s flat CGT.

In practice, the German investor wouldn’t be able to reclaim the 15% US withholding tax, but they’d also avoid facing the yearly income taxation—a major advantage. For most long-term FIRE investors, this structure is much more efficient than holding a US REIT directly.

For a US investor with access to tax-advantaged accounts, the domestic REIT market is attractive because high-cash payouts can compound tax-deferred. For a German investor, a European-domiciled accumulating REIT ETF achieves a similar goal: the 15% withholding is a modest performance drag, but it’s generally outweighed by the benefit of deferring taxation until sale. And let’s not forget the benefit of also being able to access the US real estate market in the first place.

In either case, the lesson is the same—if you want the yields of this investment vehicle to compound, REITs belong in either a tax-sheltered account or at least in some tax-efficient structure.

With the tax picture in mind, the next question is whether REITs genuinely improve portfolio diversification.

New York skyline, US. Photo by Jonathan Roger on Unsplash.

REITs and Portfolio Diversification: Promise vs. Reality

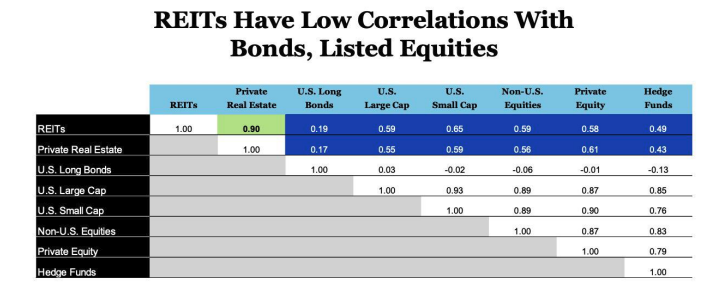

Many long-term investors—and especially those pursuing FIRE—look to REITs as a way to diversify their portfolio beyond stocks and bonds. According to Nareit’s 2023 research, the 20-year correlation of US equity REITs with the S&P 500 has typically ranged between 0.5 and 0.7 (see Figure below). For context, that’s substantially lower than the correlation between large-cap and small-cap stocks.

Figure 1. REITs had a 0.59 and 0.65 correlation with US large-cap and small-cap, respectively. Source Nareit (2023).

This means that in principle one could expect REITs to modestly reduce portfolio volatility. Over long horizons, their drivers—rental income and property values—are different to corporate earnings, so the returns are not perfectly aligned.

It’s also worth noting that broad equity indices only give you a small slice of listed real estate. Real estate companies—including REITs—represent roughly 2% of both the S&P 500 and the MSCI World index, while the real share of real estate in the economy is substantially larger. Why is this?

The reason is a large share of the global property market is privately held—think pension funds, insurance companies, or private equity vehicles—so public indexes under-represent real estate’s weight in the real economy. For investors who specifically want meaningful real-estate exposure, a dedicated REIT allocation is a way to achieve it.

But before jumping on REITs after hearing this, keep in mind that during major market crises the correlation pattern can change. In 2008 and again in March 2020 correlations between REITs with the broad equity market spiked towards 1 as investors panic-sold all risk assets. In other words, during those events, REITs fell just as sharply—or even more so—than the S&P 500.

While REITs can smoothen “normal” market bumps, they do not have government bond-like behaviour in extreme events and it will not protect a portfolio in an equity crash. For FIRE investors seeking to align their portfolio allocation to their individual risk tolerance, keep in mind that REITs can complement equities but not replace the role of bonds in strong market downturns.

On the flip side, numerous sources suggest that higher correlations during stock market downturns often represent a short-term market phenomenon that reflects panicky sentiment. However, it’s not necessarily a reflection of the long-term fundamentals of the underlying real estate. In other words, during strong market downturns, it’s possible to find very profitable buying opportunities in the REITs sector.

While adding a REIT portion to portfolios has historically preserved equity-like long-term returns while slightly lowering overall volatility, incorporating REITs is not a free lunch. If you’re on the accumulating phase of FIRE and you wish to reach Financial Independence faster, REITs will likely not slow down expected returns the way a large bond allocation would. However, they will not deliver the same safety bonds provide either.

The best way to think about it may be to consider REITs as a different flavour of equity rather than a low-risk stabilizer.

* Further Reading – Article continues below *

Advantages of Adding REITs to a FIRE Portfolio

Let’s summarise some of the potential advantages of owning REITs in a long-term FIRE portfolio.

Let’s summarize some of the potential advantages of owning REITs. First, they provide broad real-estate exposure without the headaches of being a landlord. You can indirectly own hundreds of office buildings, apartment complexes, or other types of real-estate worldwide with a single trade.

For investors who want exposure to the economic characteristics of property—think steady rental cash flows or inflation-linked assets—without fixing leaky roofs and toilets, REITs can be a very compelling argument.

Second, the asset class itself has delivered attractive long-term results. According to FTSE Nareit data, US equity REITs have produced about 12.6 % average annual total return since 1972, slightly higher than the S&P 500 over the same period. That figure though captures multiple real-estate and interest-rate cycles—booms, busts and everything in between.

Consider that over the most recent five-year period the same index delivered around 17% in total—compared to over 100% of the S&P 500 over the same time frame. What does this mean for someone pursuing FIRE?

For someone racing to Financial Independence in, say, the next 5 years, that timing risk makes a large REIT allocation a gamble: returns could be extraordinary, but they could also lag badly just when you need growth most. In contrast, if your goal is to preserve and grow wealth over decades after reaching FI, perhaps the long-term historical evidence could argue for giving REITs a modest place in your portfolio.

In other words, REITs are unlikely to be a reliable short-cut to reach FIRE quicker, but for investors planning to stay Financially Independent for the long haul, a carefully sized REIT allocation may be a sensible way to diversify and strengthen a long-term portfolio.

Finally, a third key advantage is that REITs are liquid and easy to trade—this is only an advantage if you’re not an emotional investor. Unlike physical property, which is costly and slow to buy and sell, publicly-listed REIT shares can be rebalanced in your portfolio in seconds and can fit seamlessly into an index-fund or ETF portfolio.

Victoria Peak, Hong Kong. Photo by John O'Nolan on Unsplash.

Risks and Drawbacks of REITs for FIRE Investors

As mentioned earlier, some features that make REITs attractive for diversification also create risks for investors seeking financial independence.

First, the tax drag. Those generous dividends are great for cash flow but, unless you hold REITs inside a tax-sheltered account (or some form of accumulating ETF as discussed above), you’ll face large tax burdens each year. Ordinary-income rates apply in the US, or the combination of US withholding and German CGT for a direct German investor.

Second, REITs are very sensitive to interest rates. Their business model depends on borrowing and their yields compete directly with bonds. When central banks increase rates—like in 2022—cap rates and financing costs rise, and REIT valuations can fall very quickly—faster than the broader equity market.

Third, publicly traded REITs behave more like stocks than like the properties they own. Their share prices respond instantly to economic data and interest-rate expectations, not just to gradual changes in property values. Because many REITs borrow to finance acquisitions, that leverage can amplify market moves—so prices can swing well beyond what the underlying real estate justifies.

For FIRE investors these risks don’t automatically disqualify REITs, but they do mean you should size any allocation in your portfolio and be clear-eyed as to what role you want them to play in your portfolio.

Shanghai, China. Photo by Ralf Leineweber on Unsplash.

When REITs Do—and Don’t—Belong in a FIRE Plan

REITs make most sense for investors who desire further diversification with real-estate exposure without having to deal with the issues of direct ownership and for those who can hold them in a tax-efficient wrapper that avoids annual taxation of their dividends. Under these settings, and understanding the long-term nature of their returns and their higher volatility, income stream from REITs can compound without yearly taxation and provide a diversified advantage.

They are less appealing for investors confined to fully taxable accounts, especially in high income-tax brackets, where annual dividend taxation can represent a substantial drag on returns.

Investors looking to protect their portfolio’s from strong market downturns should look elsewhere—while REITs are moderately uncorrelated to equities, in market crashes they tend to increase their correlation. They cannot substitute for the stabilising role that high-quality bonds play in a portfolio—especially post-FIRE.

If you’ve ever felt the same housing-FOMO I wrote about here, for some investors, REITs may offer a way to gain real-estate exposure while continuing to rent.

For a FIRE portfolio, REITs could occupy a middle ground: they can modestly reduce volatility versus a 100% equity allocation without materially lowering long-term expected returns—unlike a heavy bond allocation, which dampens both volatility and growth. That makes them a potentially valuable—but not essential—complement for those pursuing Financial Independence, provided you’re clear-eyed about the tax and interest-rate risks.

💬 What has been your experience with REITs and what role do they play in your portfolio? Please let us know in the comments below!

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey.

Disclaimer: I’m not a financial adviser, and this is not financial advice. The posts on this website are for informational purposes only; please consult a qualified adviser for personalized advice.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

REITs can add real-estate exposure and modestly reduce volatility compared to a 100% equity portfolio. They behave like another flavour of equity, not like bonds, so they complement but do not replace fixed income.

-

REITs can be more volatile because they use leverage and react strongly to interest-rate changes. In market crashes their correlation with equities can spike, so they are not a safe-haven asset.

-

No. While they sometimes move differently from stocks in normal markets, in deep downturns REITs often fall alongside equities. Bonds remain the main tool for portfolio stability.

-

It depends on where you live. US investors often hold REITs in IRAs or 401(k)s to defer taxes. In Germany an Irish-domiciled accumulating REIT ETF can defer German tax until sale, which is usually more efficient than holding US REITs directly.

-

Yes, but very little—real-estate companies make up only about 2 % of the S&P 500 and MSCI World. Most of the world’s property market is privately held.

-

From 1972–2024 US equity REITs delivered about 12.6% annualised returns, slightly higher than the S&P 500’s roughly 11%. Shorter periods can differ very strongly. In the last 5 years, the S&P 500 has been about 5 times stronger in terms of returns.

-

Their high dividends can provide income, but the payouts are taxed as ordinary income unless held in a tax-efficient account.

-

REITs finance property with debt and their yields compete with bonds. Rising rates lift required cap rates, lowering property valuations and often REIT share prices.

-

Broad real-estate diversification without being a landlord, historically competitive long-term returns and liquidity—shares can be bought or sold in seconds.

-

High tax drag on dividends if held in taxable accounts, high sensitivity to interest rates, and stock-market volatility that can exceed substantially the swings in actual property values.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: