Bonds in Your FIRE Portfolio: The True Cost in Cubicle Years

“Sleeping better” at night with a higher bond allocation also means delaying your timeline to retirement. In today’s article we quantify this trade-off. Photo by LYCS Architecture on Unsplash.

Reading time: 9 minutes

Bond Allocation for Financial Independence (FIRE): Role, Returns & Timeline Trade-offs

In today’s post, we’ll answer a question many aspiring early retiree ask: what role should bonds play on the road to Financial Independence (FI)? Today, we’ll learn how stocks and bonds have performed historically, how today’s bond yields compare, and—most importantly—what the trade-off looks like in terms of extra years in the cubicle. Increasing the share of bonds in your portfolio reduces expected returns and—inevitably—lengthens your career. By the end, you’ll see why “sleeping well” at night with more bonds isn’t free—it’s priced in time.

What Role Do Bonds Play on the Road to Financial Independence?

When you’re building towards Financial Independence (FI)—also known as the accumulation phase of FI—the split between stocks and bonds can be one of the most important decisions you’ll make. Stocks are always understood as the growth engine—what gets you to FI faster, while bonds have the role of stabilizer—it makes the ride less bumpy.

So there’s an obvious trade-off at play. Every percentage point shifted into bonds lowers your expected long-term return, and over a certain period that difference can compound into years more at work. Many people add bonds early on in their FI journey because they were told it was the “responsible” thing to do.

The reality is that it comes down to your risk tolerance, but it doesn’t make the trade-off any less real: “better sleep” and less volatility today means more time in the office tomorrow—there’s no way around it. Perhaps you’d rather avoid the stomach-churning volatility of the stock market, but how well can you stomach working years more in a career most find unfulfilling?

There is no free lunch in the design of your stocks-to-bonds allocation. If you lean conservatively with your investments, you’re also choosing a longer career and delaying stepping away from your job. That’s not an inherently bad decision—for some, sleeping soundly during downturns over a, say, 15 year period is worth the extra cubicle years. But the point is that this should be a conscious decision, not an accidental one.

This leads to the question every aspiring early retiree has to address—what should be your bond allocation for financial independence? Ultimately, it may depend on what you find harder to stomach: what do you fear more—temporary 30-40% drops in your net worth on paper, or 3-5 extra years tied to your job? Again, there is not a universal answer here, but making the trade-off explicit and running some numbers will make the consequences of each choice clearer. That’s exactly what we’re going to do in today’s article.

In a meeting with your corporate family. Which pain do you prefer avoiding—stock market volatility or longer years in the office? There’s no free lunch. Photo by Rodeo Project Management Software on Unsplash.

Role of Bonds in a FIRE Portfolio (Accumulation, FI Start, and Beyond)

Let’s zoom out a second and remember the different roles bonds can play depending on where you are. The role of bonds isn’t static, but changes throughout the different phases of the Financial Independence journey. Firstly, on the road to FI, bonds act as a stabilizer: they reduce your portfolio’s volatility, but also drag down its performance.

In these initial stages, your portfolio is still relatively small compared to future contributions, which makes stock market drawdowns less problematic. If the market strongly underperforms, you’re just buying at a strong discount—you’ll be very happy over the long-term. But every dollar you put into bonds is a dollar not added to your stocks growth engine—in other words, the price of stability is paid in lost growth.

Secondly, once you reach FI, bonds suddenly have a different appeal. Their main function immediately post-FI is to protect you from sequence of return risk (SORR)—one of the main aspects early retirees need to consider. The danger of a market crash or several consecutive poor return years when you’re starting to withdraw from your nest egg can be catastrophic for the portfolio’s long-term longevity.

Many early retirees use a bond tent—which we discussed in a dedicated post—to protect their portfolios from SORR and avoid running out of money in their later years. Having bonds to tap instead of selling stocks at depressed prices can substantially improve the survivability of your plan. So, for this second phase, bonds can play an insurance role.

Finally, post-FI and after those initial years, bonds can become about optionality and comfort. Once they’ve passed the earlier years of SORR, some retirees choose to move back into higher stock allocations to encourage portfolio growth. Others, prefer to keep a moderate share of bonds to dampen volatility—just like in the first phase. Some also view bonds as “dry powder”—you can sell them and buy on-sale stocks during market downturns.

This highlights that the role of bonds in your FIRE portfolio shifts over time—stabilizer while accumulating, insurance at FI, and optionality later.

Now that we’ve mapped out bonds’ shifting role through the FI journey, let’s anchor the discussion in hard data: what history and today’s markets actually tell us about stock versus bond returns.

As discussed in previous posts, a bond tent can protect you from Sequence of Return Risk (SORR)—arguably the most important challenge FIRE portfolios face after Financial Independence. Photo by Pars Sahin on Unsplash.

Bond vs. Stock Returns: History and Today’s FIRE Outlook

A reasonable starting point for any stock vs bond decision is understanding what history and current yields tell us about real portfolio returns. The exact numbers will always depend on what period you consider. For instance, US equities (e.g., S&P 500) delivered 6.7% in real terms, i.e., above inflation, since 1957. Zooming out further to the 1928-2024 period, it delivered 8.5% . For the purposes of today’s exercise, let’s consider 7%—a commonly used benchmark.

A more internationally diversified index focused on global equities (e.g., MSCI World) provided around 5.2% real over the last 125 years. Historically, there has been a meaningful gap between US equity and global returns—but it doesn’t mean it will hold going forward. Current valuations, large-scale geopolitical changes, and other factors also matter.

On the bond side, US long-term government bonds have delivered about 1.9% real per year since 1900, compared to ~1.7% for a global basket (Dimson–Marsh–Staunton dataset). Looking forward, in 2025, the US 10-year Treasury yields ~4.5% nominal against ~2.3% inflation expectations—implying a ~2.2% real return.

International bonds, as proxied by global bond ETFs like BNDX, currently yield closer to 3% nominal, translating to ~0–1% real. While today’s global bond yields look lower than US Treasuries, over the long run history suggests global and US bonds converge to a similar baseline of ~2% real returns.

So the story is pretty consistent: equities, whether US or global, are the long-term growth engine, while bonds historically have delivered modest real returns in the ~2% range. This brings us back to the original trade-off: every extra percent you lean into bonds may mean fewer sleepless nights today—but it also compounds into extra years in the cubicle, which in some cases can also be associated with stress, poor health, and disrupted sleep.

Table 1: Illustrative real return ranges (per year) for different stock/bond allocations. Equity returns use historical US (7.0%) and global (5.2%) averages as ranges; bonds assumed at 2.2% (US bonds). Higher stock allocations mean more volatility but faster paths to FI.

| Allocation | 100/0 | 90/10 | 80/20 | 70/30 | 60/40 | 50/50 | 40/60 | 30/70 | 20/80 | 10/90 | 0/100 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Expected Real Return (%/yr) | 5.2 – 7.0% | 4.9 – 6.5% | 4.6 – 6.0% | 4.3 – 5.6% | 4.0 – 5.1% | 3.7 – 4.6% | 3.4 – 4.1% | 3.1 – 3.6% | 2.8 – 3.2% | 2.5 – 2.7% | 2.2% |

We’ll now use this data to quantify what that trade-off actually looks like in practice—how does it affect your timeline to reaching Financial Independence?

* Further Reading – Article continues below *

The Downside of a High-Bond Allocation: Cubicle Years Added

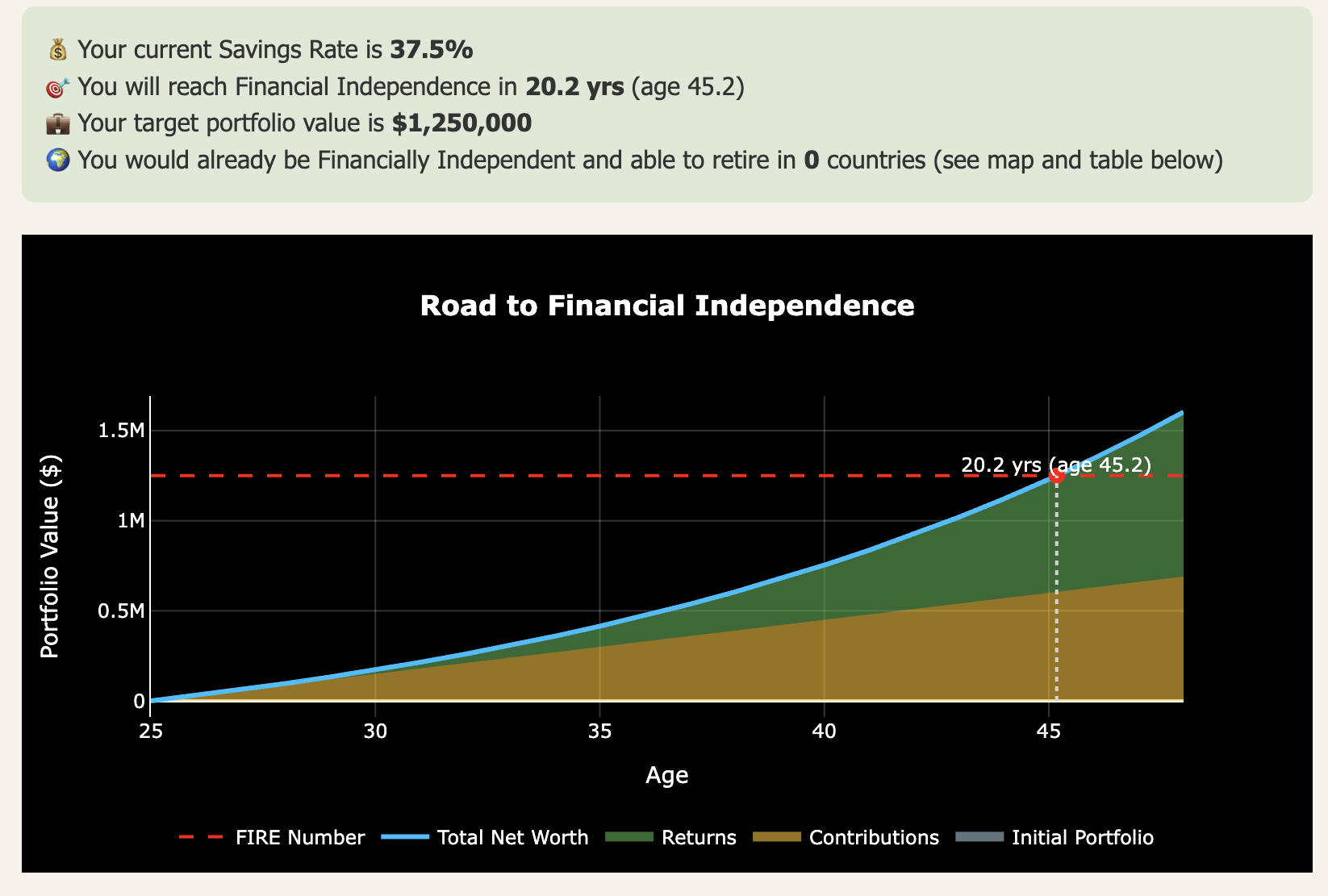

Again, there is no free lunch. Let’s consider an example using our Financial Independence Calculator below (free for our email newsletter subscribers): a 25 year-old couple starting out their career and implementing consistently a 37.5% household savings rate (for example, spending $50,000 annually on an after-tax $80,000 salary). Assuming a 7% real return on their 100% stocks portfolio, they would reach Financial Independence in 20.2 years at age 45.2 (Figure 1).

Figure 1: Timeline to Financial Independence using our free FI Calculator (free for our email newsletter subscribers). Assuming a 37.5% savings rate and starting out from scratch ($0 net worth), a 25-year-old couple would reach FI in 20.2 years with a 100% stocks portfolio.

That’s a great timeline. Without implementing an incredibly aggressive savings rate, they’d still get to early retirement roughly two decades ahead of most. But what would the picture look like with a stronger bond allocation—a more conservative portfolio?

We summarize the answer to this question in Table 2 below. As observed, implementing a 80/20 stocks-to-bonds portfolio delays your path to Financial Independence by 1.1-1.3 years; a 60/40 portfolio delays FI by 2.3-2.7 years; while a very conservative 40/60 delays it by 3.7-4.6 years. These numbers assume a fairly high savings rate (37.5%)—different savings rates produce very different results as illustrated further below.

Is this a big delay for smoother volatility? Each person will respond to this trade-off differently. Suppose you are working in a very stressful environment, say a consultant working 50-60-hour workweeks. For her, “sleeping better at night” with a smoother portfolio ride may not compensate the extra stress and health impact, or generally the lower quality of life from grinding another two and half years in her corporate role.

The key message is that stock allocation depends on risk tolerance, yes, but also on what your individual working circumstances look like.

Someone who loves their job may see this very differently. If you are among the one in five global workers that feel engaged in their job—perhaps even receive a sense of fulfillment from it—then you may feel perfectly comfortable trading 2-3 years of work for a smoother stock market ride.

Table 2: Estimated impact of stock–bond allocation on long-term real returns and years to Financial Independence (FI), assuming a 37.5% savings rate. Expected return Ranges reflect historical differences between US (S&P 500) and global (MSCI World) equity returns. For lower savings rates the impact on extra years increases for a given portfolio allocation.

| Allocation (Stocks/Bonds) |

Expected Real Return (%/yr) |

FI Timeline (yrs) |

Extra Years vs 100% Stocks |

|---|---|---|---|

| 100 / 0 | 5.2 – 7.0% | 20.2 – 22.7 | – |

| 90 / 10 | 4.9 – 6.5% | 20.8 – 23.2 | +0.5 – 0.6 |

| 80 / 20 | 4.6 – 6.0% | 21.5 – 23.8 | +1.1 – 1.3 |

| 70 / 30 | 4.3 – 5.6% | 22.1 – 24.4 | +1.7 – 1.9 |

| 60 / 40 | 4.0 – 5.1% | 22.9 – 25.0 | +2.3 – 2.7 |

| 50 / 50 | 3.7 – 4.6% | 23.8 – 25.7 | +3.0 – 3.6 |

| 40 / 60 | 3.4 – 4.1% | 24.8 – 26.4 | +3.7 – 4.6 |

| 30 / 70 | 3.1 – 3.6% | 25.9 – 27.2 | +4.5 – 5.7 |

| 20 / 80 | 2.8 – 3.2% | 26.9 – 28.0 | +5.3 – 6.7 |

| 10 / 90 | 2.5 – 2.7% | 28.3 – 28.9 | +6.2 – 8.1 |

| 0 / 100 | 2.2% | 29.9 | +9.7 |

One important note on savings rates: the downside of a high-bond allocation depends heavily on your savings rate—because your savings rate ultimately sets the length of your retirement timeline. The table above assumes a 37.5% savings rate. But consider that at higher rates (say, 50%+), the drag from bonds is weaker, because most of the progress toward FI is driven by your contributions rather than market returns.

In contrast, at more typical savings rates (15–20%), lower expected returns weigh much more heavily—because compounding has more years to magnify the difference. To illustrate, at a 15% savings rate, the same 60/40 portfolio takes roughly 7–13 years longer to reach FI than a 100% stock portfolio. That’s the difference between leaving work in your early 50s vs your mid-60s.

If those extra cubicle years sound painful, the next question is: can you build the resilience to handle volatility without leaning too heavily on bonds?

Is it possible to build resilience in the face of market volatility or do you prefer working a longer career? The response will be different for each individual. Photo by Alonso Reyes on Unsplash.

How to Handle Volatility Without Adding Too Many Bonds

If the only reason you’re adding bonds is because you can’t handle stock market volatility, but you’re also unhappy about working 36 months longer—or 10 years longer if your savings rate is low—than needed in a job you dislike, it’s worth asking whether there is a way to strengthen your resilience. After all, selling long-term growth for short-term comfort can cost you years of freedom.

Here are a few ideas and strategies that can help you manage the bumps everyone experiences when investing in the stock market:

Educate yourself about volatility. Periodic stock market downturns and crashes feel less frightening when you understand that they are a feature, not a bug. Reading personal finance classics like The Psychology of Money, The Little Book on Common Sense Investing, or studying historical drawdowns helps you internalize that markets have always been bumpy, but also that—assuming you are well diversified—they have always recovered. Experiencing a 30% drop as something “normal” helps reframe panic into patience.

Don’t just read—immerse yourself. In my view, it’s not enough to skim a blog post or glance at a chart of past returns. Building resilience means actually picking up the investing books and diving in. The more time you spend studying how markets behaved in the past—including its brutal downturns—the more likely you are to stay calm when volatility inevitably knocks on the door. I see reading not just about knowledge, but even more about rehearsing emotional discipline.

Build behavioral guardrails. Draft your own Investment Policy Statement (IPS) that spells out exactly your allocation, how often you rebalance, and under what conditions you make changes in your strategy. Share it with your spouse or someone close that can keep you accountable if you start to deviate from the plan.

Another simple guardrail is to limit how often you check your portfolio—it doesn’t help emotionally to check on a daily or weekly basis. The less you check, the less emotional you’ll feel throughout the bumpy ride.

Flip the script emotionally. Dollar-cost averaging (DCA) into low cost, internationally diversified index funds makes you a systematic buyer in both good and bad times. When the market tanks, don’t think of your net worth, think about the opportunity for buying substantially more shares for the same amount.

Some people also like to keep a small “dry powder” cash buffer and get excited about downturns. Strictly speaking, holding cash is sub-optimal mathematically, but here we’re considering the emotional side of investing. If this is what it takes to keep you from panic-selling a stock-heavy allocation during a downturn, it may still be a cheap trade-off. Just ensure your cash buffer remains only a modest share of the portfolio.

At the end of the day, the better you can stomach volatility, the fewer cubicle years you’ll need to “pay” in bonds. And that resilience is a muscle you can train to some extent.

Read, study, and research. Committing to becoming knowledgeable on how the stock market functions is one important guardrail for those who prefer equity-heavy portfolios that face higher volatility. Photo by Iewek Gnos on Unsplash.

Final Thoughts: Bond Allocation Trade-offs for FIRE

Ultimately, for most the stock-bond trade-off boils down to this: choose your pain. Market volatility is uncomfortable—but temporary. In contrast, cubicle years can mean missing out on years of health, freedom, and fulfillment.

For some, a smoother ride is worth the trade. If you’re truly happy in your job and don’t mind the extra years, leaning more into bonds on the accumulation phase of FI might be a solid call.

But I know many friends who are absolutely miserable in their careers. For many pursuing FI, the dream isn’t to have a slightly calmer portfolio graph, it’s to step away from a stressful work situation to spend more time with their interests and loved ones. In these cases, maximizing the equity engine could make sense—assuming they have strategies in place to handle the higher volatility.

Personally, I have a high risk tolerance and I’ve chosen a 100% stock allocation during my FI accumulation phase to maximize growth. But as I approach FI, I plan to shift into a small bond tent to mitigate SORR.

There is, of course, no universal answer, but hopefully today’s quantified exercise gives you food for thought. The right allocation depends on your savings rate, your tolerance for risk, and—perhaps most importantly—your tolerance for your job.

And here’s the key insight: your savings rate is the first-order driver of your FI timeline. Asset allocation matters—but mostly at the low margins. At higher savings rates (40–50%+), bonds add only a small delay. At lower savings rates (15–20%), the extra cubicle years climb dramatically when you add bonds—sometimes stretching timelines by an entire decade.

The key, in my mind, is making it a conscious decision, not just implementing something because that is the “norm” or others told you that it’s reasonable. “Better sleep” is not free—it’s priced in years of work, and “reasonable” means different things to different people.

So ask yourself: would you rather stomach the volatility of markets—or the slow grind of extra cubicle years? Your answer will define not just your portfolio, but your timeline to freedom.

If you’re ready to run the numbers yourself, try our free FI Calculator and experiment with different stock–bond allocations (using the returns indicated in Table 1 above). you may be surprised to find out how much (or how little) the trade-off matters for your specific savings rate.

💬 How do you handle the trade-off between market volatility and extra cubicle years? Are you mostly stocks, a balanced mix, or leaning heavily on bonds for peace of mind? What strategies help you stay the course during downturns—education, automation, reframing, or something else? Please share in the comments below!

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey. Subscribe below to follow our journey.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

Disclaimer: I’m not a financial adviser, and this is not financial advice. The posts on this website are for informational purposes only; please consult a qualified adviser for personalized advice.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

There’s no universal answer—it depends on your savings rate and tolerance for risk. At higher savings rates (40–50%), bonds delay FI by only a few years. But at lower rates (15–20%), high bond allocations can delay FI by a decade or more.

-

Bonds reduce volatility and provide stability. During accumulation they act as ballast, at the start of FI they protect against sequence-of-return risk, and later they offer comfort and optionality.

-

The main downside is lower long-term returns, which extend your FI timeline. At low savings rates, this can mean working 7–13 years longer compared to a stock-heavy portfolio.

-

No, bonds are not strictly necessary. Many non-emotional FIRE investors run 100% stock portfolios during accumulation phase. Bonds become more useful in the years right before and after FI, when sequence-of-return risk is highest.

-

Historically, US and global bonds have delivered similar ~2% real returns. Today, US Treasuries yield slightly more than global bonds, but the long-term difference is modest.

-

Bonds make the journey smoother but longer. They reduce the emotional stress of downturns but add cubicle years, especially for those saving less aggressively.

-

It depends strongly on your savings rate. At a 37.5% savings rate, 60/40 delays Financial Independence by about 2–3 years. At a 15% savings rate, the delay can stretch to 7–13 years. That could be the difference between leaving work in your early 50s vs your mid-60s.

-

Bonds provide a buffer against market crashes when you’re withdrawing. They allow you to avoid selling stocks at depressed prices, reducing sequence-of-return risk—the most important challenge faced by early retirees.

-

Education (reading finance classics), building guardrails (Investment Policy Statement), and reframing downturns as buying opportunities help investors stick with stock-heavy portfolios.

-

Yes—your savings rate is the biggest driver of FI timelines. Allocation matters, especially at the margins, but savings rate sets the runway. At high savings rates, bonds matter less; at low rates, their cost is huge.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: