Renting vs Buying a Home: Impact on Financial Independence

Photo by Vincentiu Solomon on Unsplash.

Reading time: 8 minutes

Disclaimer: I am not a financial adviser, and this content is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

Check out and subscribe to our YouTube channel here.

Financial Independence and the Decision to Rent or Buy a Property

Pursuing Financial Independence to Buy your Freedom Back

This personal finance blog aims to increase your financial literacy and guide you on the path to achieving financial independence. Achieving financial independence involves saving diligently and investing wisely so you can eventually live off the income generated through your investments and reduce or eliminate the need for paid employment. For many, financial independence occurs at the traditional retirement age, where retirees live off a combination of pensions, savings, and investments. However, with strategic planning, financial independence can be achieved much sooner.

To be clear, in this blog we don’t advocate for early retirement as a form escapism. Instead, we focus on buying back our time to pursue meaningful societal contributions. When we stop working for money, we may be out of a job, but we will never be out of work. There are countless ways to meaningfully contribute to society outside the structures of paid employment. Similarly, as advocated by the ancient Greeks, enjoying a healthy amount of leisure is essential for a well-rounded life, one that allows for intellectual and cultural pursuits integral to personal and societal development.

Should You Rent or Buy a Home?

Today, we explore a controversial topic in personal finance—whether it makes sense to rent or buy a property. Specifically, we will evaluate several different scenarios that consider house renting and buying to determine the following financial outcomes: 1) the differences in net worth after a 30 year period for each scenario, given a set of assumptions, and 2) the potential implications of both paths for your pursuit of financial independence. Does buying a house slow down, accelerate, or have no effect on your timeline to achieving financial independence?

The renting vs buying a home debate is complex, involving financial and lifestyle considerations, where presenting a few individual scenarios that are relevant to some people may not be applicable to others. However, my hope is that going through this process you may be in a better position to evaluate the different factors at play that are relevant to your personal situation. At the end of the article, I will provide a link to the excel template that underlies all the numbers and graphs presented so you can tailor the calculations to your situation.

The debate on renting versus buying a home is often emotional and complex. I get it; there are a lot of personal, non-financial factors involved in this decision: for some, this is a lifestyle choice—some may choose simply to have a larger space for their growing family or prefer to have more control over their living situation. In some countries, the need and/or pressure to conform to societal expectations and achieve status through home ownership can also play a role. Over time, you may face questions from family and friends about why you haven’t bought a home yet. In some cases, these are difficult conversations to have, because the person you are talking to may have already settled on a specific path long ago. Nobody wants to hear that their decision wasn’t correct or realize that they probably didn’t think it through. In other words, they may already be heavily invested in their decision—both emotionally and financially.

Renting vs Buying a Home: Impact on Financial Independence Explained

Assumptions for Comparing Renting vs Buying a Home

Table 1 summarizes the two scenarios under analysis. In both Renting and Buying Scenarios, the household income is $7,450 monthly after tax, with an initial $140,000 in savings. In the Renting Scenario, the household rents a comfortable apartment for $2000 per month, which is adjusted upward 2% per year to account for inflation. In this scenario, we invest the initial $140,000 in an internationally diversified, low cost index fund, which we assume is held for the long term with an average 7% return on investment. Given the objective of pursuing early financial independence, the household in this scenario has an aggressive 40% savings rate and manages to invest $3,000 per month in their portfolio of index funds.

In the Buying Scenario, $140,000 is used for a 20% down payment on a $700,000 home in the outskirts of the city, taking on a mortgage for $560,000. The mortgage assumes a 3.6% interest rate, and, given a 30-year mortgage, a $2,569 fixed monthly payment over the entire period. In addition, we consider annual property taxes (1% of home value), maintenance costs (1% of house value), and insurance costs (0.35% of house value). All these items bring the “real” monthly costs of home ownership from $2,569 to $3,940. Since there is about $2,000 less to invest each month in this scenario, we only consider $1,000 monthly contributions to our favourite index fund. Finally, we consider an average 3% home appreciation rate over the 30 year period.

Table 1: Summary of assumptions used under the home Renting versus Buying Scenarios.

Renting vs Buying a Home: Detailed Financial Results

There are several interesting points to unpack here, so let’s go step by step. First, even though the value of the house was $700,000 and we took on a mortgage of $560,000 it is important to understand that we would end up paying a total of $925,000 over the 30 year period (Figure 1): $560,000 would go towards the principal payment plus another $365,000 as interest on the loan.

Figure 1: Annual mortgage payments disaggregated by principal and interest.

Now, let’s consider how the index fund investments did under both scenarios. The Renting Scenario considered an initial $140,000 plus $3,000 monthly contributions, while the Buying Scenario started at 0$ and added $1,000 monthly contributions. Both are adjusted annually for 2% inflation. As observed in Figure 2, in the Renting Scenario, you would end up, after 30 years, with a whopping $7.3M vs 2.0M in the Buying Scenario. Of course, such a large difference ($5.3M or $2.9M in today’s money) was to be expected, given the difference in contributions. But to make a fair comparison, we need to consider the equity in the house, which is an important part of the net worth in the Buying Scenario.

Figure 2. Index fund investments after a 30-year period under the Renting versus Buying Scenarios.

Factoring in home equity makes the Buying Scenario more competitive. However, as observed in Figure 3, the total net worth after 30 years of the Renting Scenario is still superior $7.3M versus $3.6M, a $3.7M difference ($2.0M in today’s money).

Figure 3. Total net worth after a 30-year period under the Renting versus Buying Scenarios.

Financial Independence: Renting Versus Buying Scenario

Let’s assume that after seeing this difference in final net worth you are still comfortable with buying the house. After all, this is also an emotional, lifestyle decision, and clearly both scenarios end up with a very high net worth.

The monthly costs of the household are $4,450 (household income of $7,450 minus the $3,000 invested each month). Using the 4% rule, achieving financial independence requires around $1.3M in income-generating assets to be considered financially independent ($4,450 x 12 % 0.04). In the Renting Scenario, you would reach this net worth after roughly 15 years. In contrast, in the Buying Scenario you would reach it after 22 years, but with one critical caveat: a large part of your net worth is tied to your home equity, i.e., it is not an income-generating asset. If you consider only the index funds of the Buying Scenario, unfortunately you wouldn’t reach the $1.3M (in today’s money) mark even after 30 years.

Photo by Flo Pappert on Unsplash.

Buying Makes Financial Sense for the Unsophisticated Investor.

It’s important to note that the high savings rate (40%) considered translates into investing an aggressive $3,000 per month in the renting scenario. The more aggressive your savings rate, the larger the difference will be in net worth between the Renting Scenario and the Buying Scenario. The difference in net worth between both scenarios would reduce to zero if the Renting Scenario only invested $500 per month versus $0 per month in the Buying Scenario. Even though the house appreciates at a lower rate (3%) than the index funds (7%), in this particular case you are investing overall larger amounts of money into home equity. Simply put, investing more money at a 3% return can outperform minimal investments at 7%. This illustrates an important conclusion: for those who are not willing to invest aggressively in the stock market and for those who are not willing to buy and hold their stock investments over the long term, buying a property makes perfect sense. After all, paying a mortgage does force disciplined savings for many.

Discussion of Assumptions Used and Disclosures

We consider here a conservative 20% down payment, although in many countries a smaller percentage may be possible, e.g., 10%. Decreasing the down payment would further hurt the Buying Scenario in relation to the net worth results presented above.

There are numerous assumptions in Table 2 which may not apply to everyone or for all locations. For example, rent may increase at higher rate than 2% per year in some locations. This 2% per year is actually locked in in my apartment rental contract, so it is not an unrealistic assumption. Similarly, an average house appreciation of 3% seems reasonable as a benchmark, but this varies very strongly over time and location. On the other hand, please consider whether it is realistic for real estate markets that have experienced unbelievable growth over the last decade/s to continue to do so 30 years into the future.

I don’t live in the US. A lot of the assumptions included in this excercise are tailored to the specific circumstances of where I live, which may not apply to you. House prices, interest rates, and other assumptions disclosed in Table 1 can vary substantially from country to country. Feel free to download the excel template and adjust the assumptions to your specific situation.

Disclosure: this post is for educational purposes only, intended to help readers think through the numerous factors involved in making this decision. Buying a house can be wonderful, but for many there are important tradeoffs to consider, especially related to your ability to reach financial independence.

Enjoyed this post? Don’t miss our insights on reaching your first $100K investment milestone and mastering the 4% rule to achieve financial independence.

Check out our Financial Independence Tools (Works for PC only)

Tool: Best Countries for Retirement: Where to Retire Abroad?

Tool: Identify Countries Where Relocating Can Help You Achieve Financial Independence Faster

Tool: Identify Cities Where Relocating Can Help You Achieve Financial Independence Faster

What to read next?

“Best Countries to Retire in Europe in 2025: Top 5 Affordable and Expat-Friendly Destinations”

“Find Your Perfect Retirement Destination: A Data-Driven Relocation Tool for 2025”

“Relocation Tool for FI: Compare Salaries & Cost of Living Globally”

“Best and Worst Cities in the US and Canada for Financial Independence in 2025”

“Top 11 Countries Globally to Accelerate Financial Independence (and Retire Early)”

“Best Countries in Europe to Achieve Financial Independence (FI)”

“How to Retire Early in Germany: Key Insights into Financial Independence (FIRE)”

“Variable Percentage Withdrawal (VPW): A Flexible Retirement Strategy to Maximize Your Portfolio”

“FIRE with Kids: How to Achieve Financial Independence While Raising a Family”

“Green Living, Wealth Building: The Financial Rewards of a Sustainable Lifestyle”

“How Wars Affect Stock Market Returns: Lessons from History and Current Conflicts”

“Cut Years to Financial Independence with Geographic Arbitrage”

“Capital Gains Taxes and Financial Independence in Retirement Locations”

“Top Countries for Geographic Arbitrage and Early Retirement in 2025”

“Flexible Early Retirement: A Smarter Alternative to the 4% Rule”

“Renting vs Buying a Home: Impact on Financial Independence”

“The Crossover Point: Key to Financial Independence Explained”

“Common Sense Investing: 14 Tips from Jack Bogle for Financial Success”

“18 Key Money Lessons from The Psychology of Money by Morgan Housel”

“The 4% Rule for Retirement: Guide to Safe Withdrawal Strategies”

“Reaching Your First $100K: The Key to Financial Success and Growth”

“10 Financial Habits You Need to Master by Age 30 for Financial Success”

“7 Effective Budgeting Strategies to Reach Financial Freedom”

“How Living Car-Free Can Help You Retire Early and Save Millions”

“Global Savings Rates: What OECD Data Reveals About Financial Independence”

“How to Achieve Financial Independence: Beginner's Guide to Early Retirement”

Check out as well some of our life philosophy posts.

“From Burnout to Freedom: Why I Quit My Job Before Financial Independence”

“The ‘Second Mountain’ : How Relational Living Leads to a Fulfilling Life”

“Green Living, Wealth Building: Financial Rewards of a Sustainable Lifestyle”

“9 Key Work and Money Lessons from ‘Your Money or Your Life’”

“Seneca’s Timeless Wisdom: 9 Life Lessons for Purposeful Living”

“Unlock Happiness: 12 Life Lessons from Naval Ravikant's Almanack”

“8 Longevity Lessons from Netflix’s Blue Zones for a Longer Life”

“30 Powerful Life Lessons from My 30s for Success, Health, and Happiness”

“10 Powerful Lessons from Stoicism and Buddhism to Achieve Inner Peace”

“Dalai Lama’s 50 Lessons for Happiness and Living a Joyful Life”

“20 Rewilding Lessons from Isabella Tree: Insights to Restore Our Planet”

“8 Surprising Lessons on Work and Time from Dr. James Suzman’s Research”

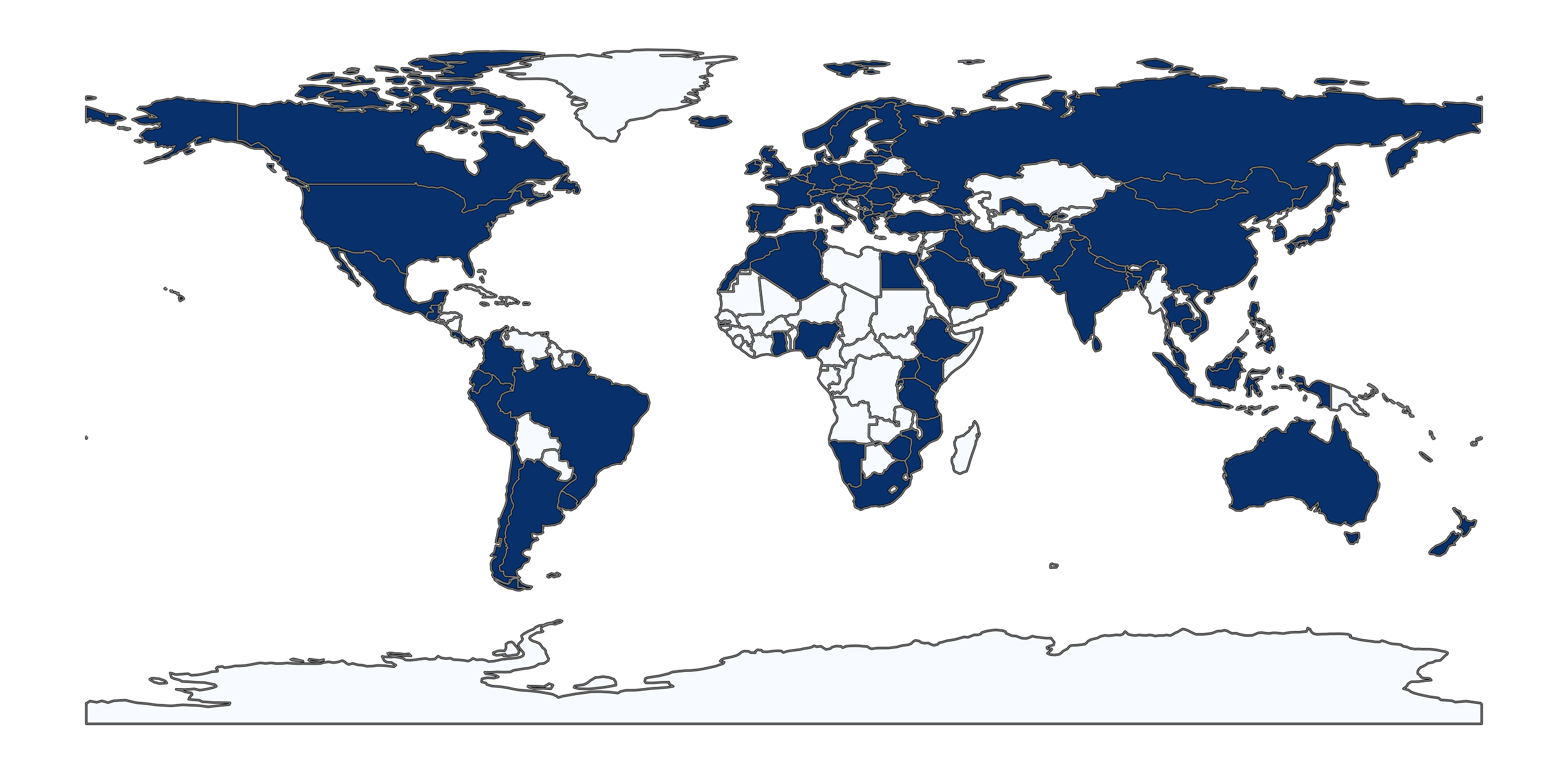

Join readers from more than 100 countries, subscribe below!

Check out and subscribe to our YouTube channel here.

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: