Flexible Early Retirement: A Smarter Alternative to the 4% Rule

Photo by Jakob Owens on Unsplash.

Reading time: 7 minutes

Disclaimer: I am not a financial adviser, and this content is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

Check out and subscribe to our YouTube channel here.

Introduction

In a previous post we covered all you need to know about the famous "4% rule”. Before continuing in this post, I recommend to start there in order to fully understand its limitations and how today’s post attempts to circumvent them. In a nutshell, the 4% rule is an approach widely used in the personal finance space that allows you to benchmark (roughly) how much money you need to have accumulated in order to be able to safely retire or to consider yourself financially independent. This approach is typically considered in the context of traditional retirement with a 30 year retirement horizon. However, it is also widely used as a starting point for early retirees facing 40, 50, or more years of retirement.

Let’s provide an example of how the 4% rule works in practice and summarize briefly its main advantages and disadvantages. Again, we provide a lot more detail and background on this rule in our previous post. After this summary, we will focus on a flexible spending rule that may complement the 4% rule nicely by addressing some of its main flaws.

How Does the 4% Rule Work in Practice?

According to the 4% rule, for a 30 year period, you could expect to “safely” retire with a portfolio of 50% stocks / 50% bonds and sustainably withdraw 4% each year (adjusted for inflation) without too much fear or running out of money. In fact, in the vast majority of cases, following this rule is very conservative and will leave you with a much larger portfolio than the one you retired with, even after taking care of your expenses during the retirement period.

Here is a simple example. Let’s suppose you are 65 and ready to retire. You have $1M dollars invested in your portfolio, a combination of stocks (low cost index funds) and bonds (50%-50%). Following the 4% rule, your portfolio withdrawals in retirement to cover expenses would take place as follows:

Year 1: you withdraw $40,000 (4% of $1M)

Year 2: you withdraw $41,200 (adjusting for a 3% inflation that took place during year 1).

Year 3: you withdraw $42,024 (adjusting for a 2% inflation that took place during year 2)

Rinse and repeat for the following years of retirement.

Advantages of Using the 4% Rule

The “4% rule” can become your guiding star. The “4% rule” can be incredibly powerful at the start of your wealth accumulation phase. At the beginning of your investing journey, it can serve as a compass when trying to respond to the question of how much money you really need to be financially independent or to be able to retire. According to the rule, it amounts to 25 times your annual expenses. For example, if you envision needing $40,000 in retirement, you would aim at first to accumulating, roughly, a $1,000,000 portfolio ($40,000 x 25).

The “4% rule” allows you to draw a timeline to retirement. You not only have a guiding financial independence number to work towards, but it is also fairly easy to estimate how long it takes to achieve it, under a series of assumptions. We use several financial independence calculators in this blog to understand how different factors affect our timeline to financial freedom.

The “4% rule” can be a very powerful framework to analyze lifestyle choices. It can help you understand how changes in expenses affect your timeline to reaching financial independence. You can therefore evaluate differences in lifestyle no only in absolute dollar terms, but also in terms of time–you can literally understand what a certain expense or lifestyle choice means in relation to the length of you working career.

Disadvantages of Using the 4% Rule

Always be careful with applying too rigidly any rule in personal finance. The very creator of the 4% rule, Bill Bengen, suggests this should be thought of more as a rule of thumb, not a rule of nature. In general, it is not a good idea to blindly withdraw money from your portfolio following any approach that is too rigid. In practice, it is a better to allow for some flexibility in any strategy you decide to follow.

The 4% rule was not conceived for early retirees. As mentioned earlier, it is important to note that the study the 4% rule is based on was targeting traditional retirees with a 30-year retirement horizon. Anyone wishing to retire early should view this rule with extra caution; not only will their “retirement” be potentially longer because they leave the workforce earlier, but their life expectancy will also likely surpass that of previous retiree cohorts.

The 4% rule calls for an aggressive asset allocation that not everyone can stomach. Everybody’s investing risk tolerance is different. Asset allocations of stocks/bonds ranging from 75-25 to 50-50 are perceived as aggressive by many. It is important to remember that having a large share of your wealth in a volatile asset class like stocks calls for a perfect behavior from the investor: the investor must be very disciplined and avoid selling when markets periodically take a tumble.

The original study underlying the 4% rule used US data only. Subsequent studies have examined how the 4% rule would have performed historically outside the US. Surprisingly, although it worked in the US, Canada, and Australia, it was unsuccessful in 18 other countries of the dataset. You shouldn’t be investing only in your home country in the first place (research if needed the pitfalls of “home country bias”), but if you are, then the 4% rule calls, at the very least, for even extra care.

How Can we Improve the 4% Rule in Practice?

The main disadvantages of the 4% rule can be overcome by adopting a mindset of flexibility. It is important to pay attention to what the market is doing and adapt your spending accordingly. You don’t have to do this on a 1:1, ratio i.e., if the market goes down 20%, you don’t need to reduce your spending by 20%, or vice versa. But you do need a buffer for both cases. Better withdrawal “rules” than the 4% rule should consider variable spending strategies.

Building a Guardrail Withdrawal Strategy (GWS)

This variable spending strategy is suggested by financial advisor Michael Kitces. In practice, this means withdrawing within a “safety lane” that is limited by 2 guardrails that allow you to modify your withdrawal rates if the market is either underperforming or overperforming beyond a given threshold. A useful analogy is to think of this strategy as using bumper rails in the bowling alley (see picture below). No matter how poorly you through the ball, the bumper rails correct its trajectory and allow it to reach its final destination at the end of the lane. Next, we will see an example of how to apply this strategy in practice.

Figure 1. As an analogy, think of the Guardrail Withdrawal Strategy (GWS) as the bumper rails found in bowling alleys. Guardrails make it really hard to miss the mark! Photo from: murreybowling.com

Applying the Guardrail Withdrawal Strategy in Practice

According to the GWS, we start by spending 5% of our portfolio in the first year of retirement, and adjust by inflation in subsequent years. If you find the market has performed strongly over the initial years and you find yourself withdrawing 4% or less of your current portfolio, then you know you have “hit” the lower guardrail. You are spending too little and can therefore give yourself a 10% raise. If you were planning to withdraw $50,000 for that year, you could take $55,000 instead.

Analogously, if the market is steadily underperforming over the first years of retirement and you find that your annual withdrawal is now 6% or more of your current portfolio, it is time to be a bit more conservative. You can reduce your withdrawal by 10%: if you were planning to withdraw $50,000, you should aim for taking $45,000 instead.

Advantages of Using the Guardrail Withdrawal Strategy

Applying the GWS, you are guaranteed to not run out of money during retirement. However, this approach does mean you need some built-in flexibility in your portfolio on retirement. If you can’t afford to take a 10% cut in your spending, then this variable spending strategy will not work for you.

Following the GWS will ensure you fully enjoy the benefits of your portfolio. Everyone likes to focus on the few cases were the 4% rule doesn’t not work, but forgets to mention that in the vast majority of analyzed scenarios you end up with a portfolio that is several folds larger than it was when you retired. Following this this variable spending strategy ensures you enjoy the fruits of your labor.

Applying the GWS means you may be able to actually retire sooner. By using a 5% initial withdrawal rate, you could potentially retire with a smaller nest egg and therefore shorten your working career. Under the 4% rule, you needed $1M to retire, assuming an annual spend of $40,000. Using an initial 5% withdrawal rate instead means you could potentially pull the trigger sooner, with a smaller $800,000 portfolio ($40,000/0.05). As mentioned earlier, this works only if you have the ability to be flexible–if you are unlucky, a few years from now you may have to rely on $36,000 (following the 10% cut).

Enjoyed this post? Don’t miss our insights on the Variable Percentage Withdrawal (VPW), a popular portfolio withdrawal strategy from the Bogleheads community, or our post on the importance of reaching the crossover point for financial independence.

Check out and subscribe to our YouTube channel here.

Check out our Financial Independence Tools (Works for PC only)

Tool: Best Countries for Retirement: Where to Retire Abroad?

Tool: Identify Countries Where Relocating Can Help You Achieve Financial Independence Faster

Tool: Identify Cities Where Relocating Can Help You Achieve Financial Independence Faster

What to read next?

“Best Countries to Retire in Europe in 2025: Top 5 Affordable and Expat-Friendly Destinations”

“Find Your Perfect Retirement Destination: A Data-Driven Relocation Tool for 2025”

“Relocation Tool for FI: Compare Salaries & Cost of Living Globally”

“Best and Worst Cities in the US and Canada for Financial Independence in 2025”

“Top 11 Countries Globally to Accelerate Financial Independence (and Retire Early)”

“Best Countries in Europe to Achieve Financial Independence (FI)”

“How to Retire Early in Germany: Key Insights into Financial Independence (FIRE)”

“Variable Percentage Withdrawal (VPW): A Flexible Retirement Strategy to Maximize Your Portfolio”

“FIRE with Kids: How to Achieve Financial Independence While Raising a Family”

“Green Living, Wealth Building: The Financial Rewards of a Sustainable Lifestyle”

“How Wars Affect Stock Market Returns: Lessons from History and Current Conflicts”

“Cut Years to Financial Independence with Geographic Arbitrage”

“Capital Gains Taxes and Financial Independence in Retirement Locations”

“Top Countries for Geographic Arbitrage and Early Retirement in 2025”

“Flexible Early Retirement: A Smarter Alternative to the 4% Rule”

“Renting vs Buying a Home: Impact on Financial Independence”

“The Crossover Point: Key to Financial Independence Explained”

“Common Sense Investing: 14 Tips from Jack Bogle for Financial Success”

“18 Key Money Lessons from The Psychology of Money by Morgan Housel”

“The 4% Rule for Retirement: Guide to Safe Withdrawal Strategies”

“Reaching Your First $100K: The Key to Financial Success and Growth”

“10 Financial Habits You Need to Master by Age 30 for Financial Success”

“7 Effective Budgeting Strategies to Reach Financial Freedom”

“How Living Car-Free Can Help You Retire Early and Save Millions”

“Global Savings Rates: What OECD Data Reveals About Financial Independence”

“How to Achieve Financial Independence: Beginner's Guide to Early Retirement”

Check out as well some of our life philosophy posts.

“From Burnout to Freedom: Why I Quit My Job Before Financial Independence”

“The ‘Second Mountain’ : How Relational Living Leads to a Fulfilling Life”

“Green Living, Wealth Building: Financial Rewards of a Sustainable Lifestyle”

“9 Key Work and Money Lessons from ‘Your Money or Your Life’”

“Seneca’s Timeless Wisdom: 9 Life Lessons for Purposeful Living”

“Unlock Happiness: 12 Life Lessons from Naval Ravikant's Almanack”

“8 Longevity Lessons from Netflix’s Blue Zones for a Longer Life”

“30 Powerful Life Lessons from My 30s for Success, Health, and Happiness”

“10 Powerful Lessons from Stoicism and Buddhism to Achieve Inner Peace”

“Dalai Lama’s 50 Lessons for Happiness and Living a Joyful Life”

“20 Rewilding Lessons from Isabella Tree: Insights to Restore Our Planet”

“8 Surprising Lessons on Work and Time from Dr. James Suzman’s Research”

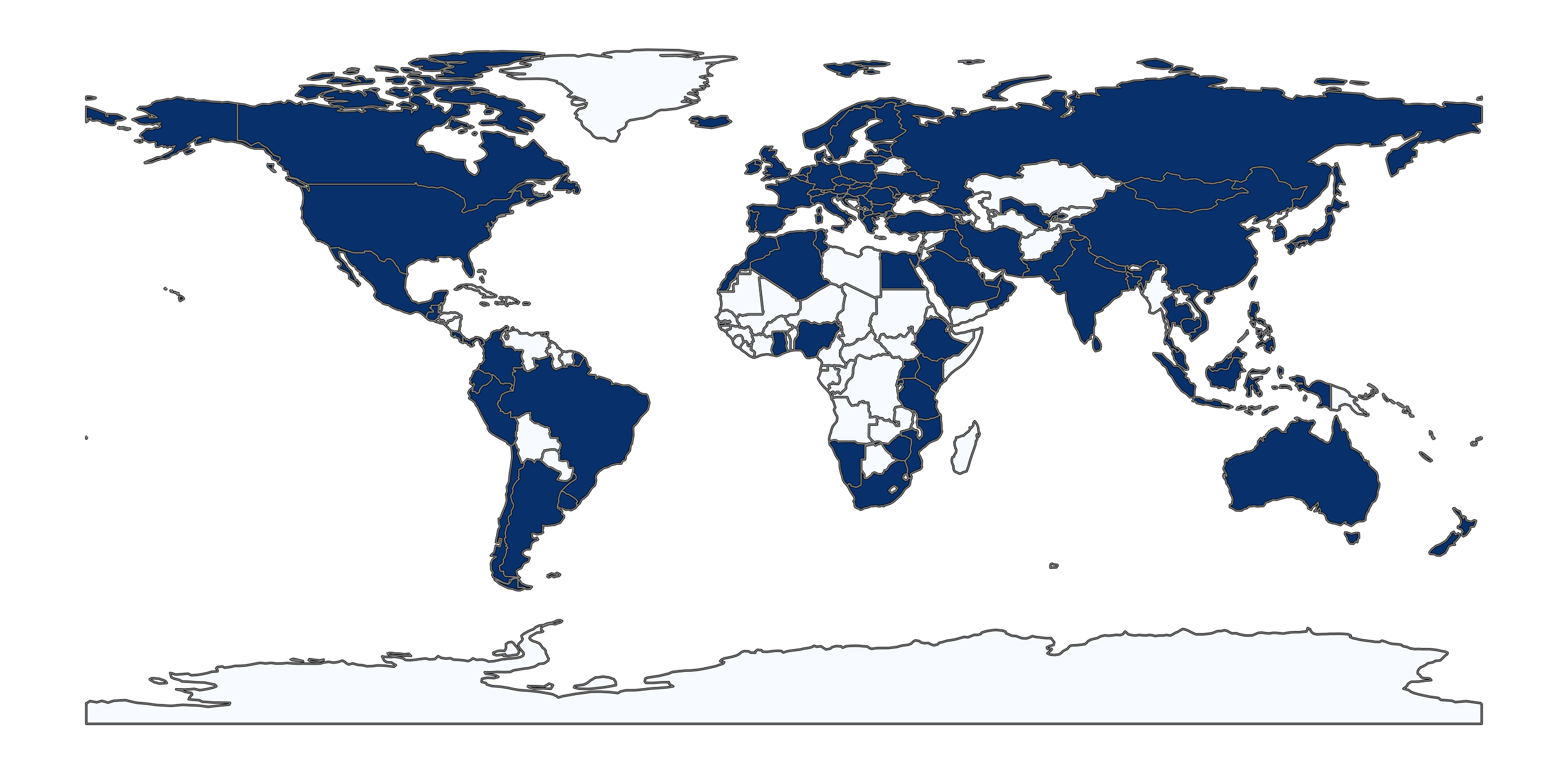

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: