How Living Car-Free Can Help You Retire Early and Save Millions

Photo by Dan Russo on Unsplash.

Reading time: 5 minutes

Disclaimer: I am not a financial adviser, and this content is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

Disclaimer 2: Not everyone can give up their car, especially those living in remote rural areas lacking public infrastructure or individuals whose professions need private transportation. This post primarily addresses urban and suburban residents who have access to viable alternatives.

Check out and subscribe to our YouTube channel here.

Introduction

There are many strategies to help you secure enough funds for a comfortable retirement. Today, we examine a simple but impactful strategy: living car-free to boost your retirement savings.

We answer two key questions about the financial benefits of giving up your car: First, what financial impact would dropping you car have on your retirement savings upon concluding your career? Second, what financial impact would giving up you car have on your journey towards achieving financial independence, particularly if you aspire to retire at a non-conventional, earlier age? To answer these questions, we will consider the hidden costs of car ownership, how they impact your savings, and examine how it relates to our disposable income.

How Living Car-Free Can Help You Retire Early and Save Millions

The Hidden Costs of Car Ownership: How Ditching Your Vehicle Can Save You Up to €1,000 Monthly

According to Gössling et al. (2022) study “The lifetime cost of driving a car”, monthly car ownership costs range from €554 to over €1,000, making a significant dent in your savings potential. The lower and upper estimates of their range were based on an Opel Corsa 1.2 and a Mercedes GLC 200, respectively. The table below, extracted from their paper, outlines over 20 cost items associated with owning a car, many of which are overlooked when budgeting by would-be drivers… or by drivers for that matter. These cost estimates should be interpreted as averages–actual costs naturally vary depending on where you are driving in Europe.

Table 3 from Gössling et al. (2022): total private costs of car ownership across three different models.

Financial independence calculator from https://engaging-data.com/fire-calculator/.

Next, we will consider an average household budget to gauge the potential impact of giving up a car. While we focus on a German example, readers can easily adapt this approach to their own countries.

According to Germany’s official statistics, households spent €2,846 per month in 2022 (or €34,152 per year). Despite their reputation for thriftiness, Germans, on average, have a low savings rate: they save just 10.8% of their income, a number that could dramatically increase by going car-free. In a previous post, we extensively discussed the important role of optimizing the savings rate, the single most important factor for achieving financial independence.

On average, it would require approximately 32.9 years to attain financial independence. Considering the key data points above–household spending and savings rate–we can input them into a financial independence calculator. Indeed, it would take nearly 33 years to have saved and invested €913,566, the ballpark amount you would theoretically need to have invested to sustain yourself without relying on employment. This estimation factors in a conservative 1% income growth over one's career and a 6% real return from the stock market, as illustrated in the figure below.

In light of these numbers, it is no wonder that a significant portion of individuals work lengthy careers and heavily rely on public pension schemes–they simply are not saving enough, their savings rates are too low.

In Germany, most public transportation users in Germany now rely on the €49 ticket, an affordable alternative to costly car ownership, in place since May 2023. While it doesn’t cover all long-distance trains, it definitely serves as a comprehensive option for commuting purposes, making it a fitting benchmark for our analysis.

What financial impact would dropping you car have on your retirement savings upon concluding your career? Let’s assume that you are reading this at the start of your career: you are 25 years old and looking at a conventional 40-year-long career. Assuming a long-term 6% return from the stock market, living car-free and investing the savings could generate over €1 million by retirement (by age 65). This substantial sum supplements the pension benefits accrued over the 40-year period. Saving and investing €505 euros is assuming the conservative lower end of the car-ownership spectrum (Opel Corsa, €554.7 per month), minus the €49 public transport ticket.

Achieve Financial Independence Faster by Living Car-Free: Cut 9 Years Off Your Working Career

What if you don’t want to work such a long career? What financial impact would giving up you car have on your journey towards achieving financial independence, particularly if you aspire to retire at a non-conventional, earlier age? By going car-free and allocating €505.7 monthly (representing the conservative end of car ownership costs), our annual spending in the example reduces from €34,152 to €28,084. As a results, the timeline to reaching financial independence would go down from 32.9 years to 24.1 years, potentially trimming your working career by 9 years.

Financial independence calculator from https://engaging-data.com/fire-calculator/.

Why does this change wield such a significant impact? It's not just about saving an extra €500 a month by living car-free; it's about needing less money to maintain a more frugal lifestyle, and therefore requiring less invested money invested to sustain that lifestyle upon early retirement. It is a double win.

Besides the financial aspect, there are numerous other reasons to contemplate reducing our reliance on cars or abandoning them entirely. If the notion of potentially becoming a millionaire through this single behavioral shift isn't convincing enough, perhaps consider some of the other benefits of switching to biking, using public transport, or walking: addressing environmental concerns (such as climate change and pollution), fostering physical activity, reducing time spend in traffic (reducing stress and enhancing wellbeing), potential for increased productivity during commutes, enhanced safety, and supporting more liveable urban settings.

Enjoyed this post? Don’t miss our insights on reaching your first $100K investment milestone and mastering the 4% rule to achieve financial independence.

Photo by Carlos Pernalete on Pexels.

Check out and subscribe to our YouTube channel here.

Check out and subscribe to our YouTube channel here.

Check out our Financial Independence Tools (Works for PC only)

Tool: Identify Countries Where Relocating Can Help You Achieve Financial Independence Faster

Tool: Identify Cities Where Relocating Can Help You Achieve Financial Independence Faster

Tool: Best Countries for Retirement: Where to Retire Abroad?

What to read next?

“Best Countries to Retire in Europe in 2025: Top 5 Affordable and Expat-Friendly Destinations”

“Find Your Perfect Retirement Destination: A Data-Driven Relocation Tool for 2025”

“Relocation Tool for FI: Compare Salaries & Cost of Living Globally”

“Best and Worst Cities in the US and Canada for Financial Independence in 2025”

“Top 11 Countries Globally to Accelerate Financial Independence (and Retire Early)”

“Best Countries in Europe to Achieve Financial Independence (FI)”

“How to Retire Early in Germany: Key Insights into Financial Independence (FIRE)”

“Variable Percentage Withdrawal (VPW): A Flexible Retirement Strategy to Maximize Your Portfolio”

“FIRE with Kids: How to Achieve Financial Independence While Raising a Family”

“Green Living, Wealth Building: The Financial Rewards of a Sustainable Lifestyle”

“How Wars Affect Stock Market Returns: Lessons from History and Current Conflicts”

“Cut Years to Financial Independence with Geographic Arbitrage”

“Capital Gains Taxes and Financial Independence in Retirement Locations”

“Top Countries for Geographic Arbitrage and Early Retirement in 2025”

“Flexible Early Retirement: A Smarter Alternative to the 4% Rule”

“Renting vs Buying a Home: Impact on Financial Independence”

“The Crossover Point: Key to Financial Independence Explained”

“Common Sense Investing: 14 Tips from Jack Bogle for Financial Success”

“18 Key Money Lessons from The Psychology of Money by Morgan Housel”

“The 4% Rule for Retirement: Guide to Safe Withdrawal Strategies”

“Reaching Your First $100K: The Key to Financial Success and Growth”

“10 Financial Habits You Need to Master by Age 30 for Financial Success”

“7 Effective Budgeting Strategies to Reach Financial Freedom”

“How Living Car-Free Can Help You Retire Early and Save Millions”

“Global Savings Rates: What OECD Data Reveals About Financial Independence”

“How to Achieve Financial Independence: Beginner's Guide to Early Retirement”

Check out as well some of our life philosophy posts.

“From Burnout to Freedom: Why I Quit My Job Before Financial Independence”

“The ‘Second Mountain’ : How Relational Living Leads to a Fulfilling Life”

“Green Living, Wealth Building: Financial Rewards of a Sustainable Lifestyle”

“9 Key Work and Money Lessons from ‘Your Money or Your Life’”

“Seneca’s Timeless Wisdom: 9 Life Lessons for Purposeful Living”

“Unlock Happiness: 12 Life Lessons from Naval Ravikant's Almanack”

“8 Longevity Lessons from Netflix’s Blue Zones for a Longer Life”

“30 Powerful Life Lessons from My 30s for Success, Health, and Happiness”

“10 Powerful Lessons from Stoicism and Buddhism to Achieve Inner Peace”

“Dalai Lama’s 50 Lessons for Happiness and Living a Joyful Life”

“20 Rewilding Lessons from Isabella Tree: Insights to Restore Our Planet”

“8 Surprising Lessons on Work and Time from Dr. James Suzman’s Research”

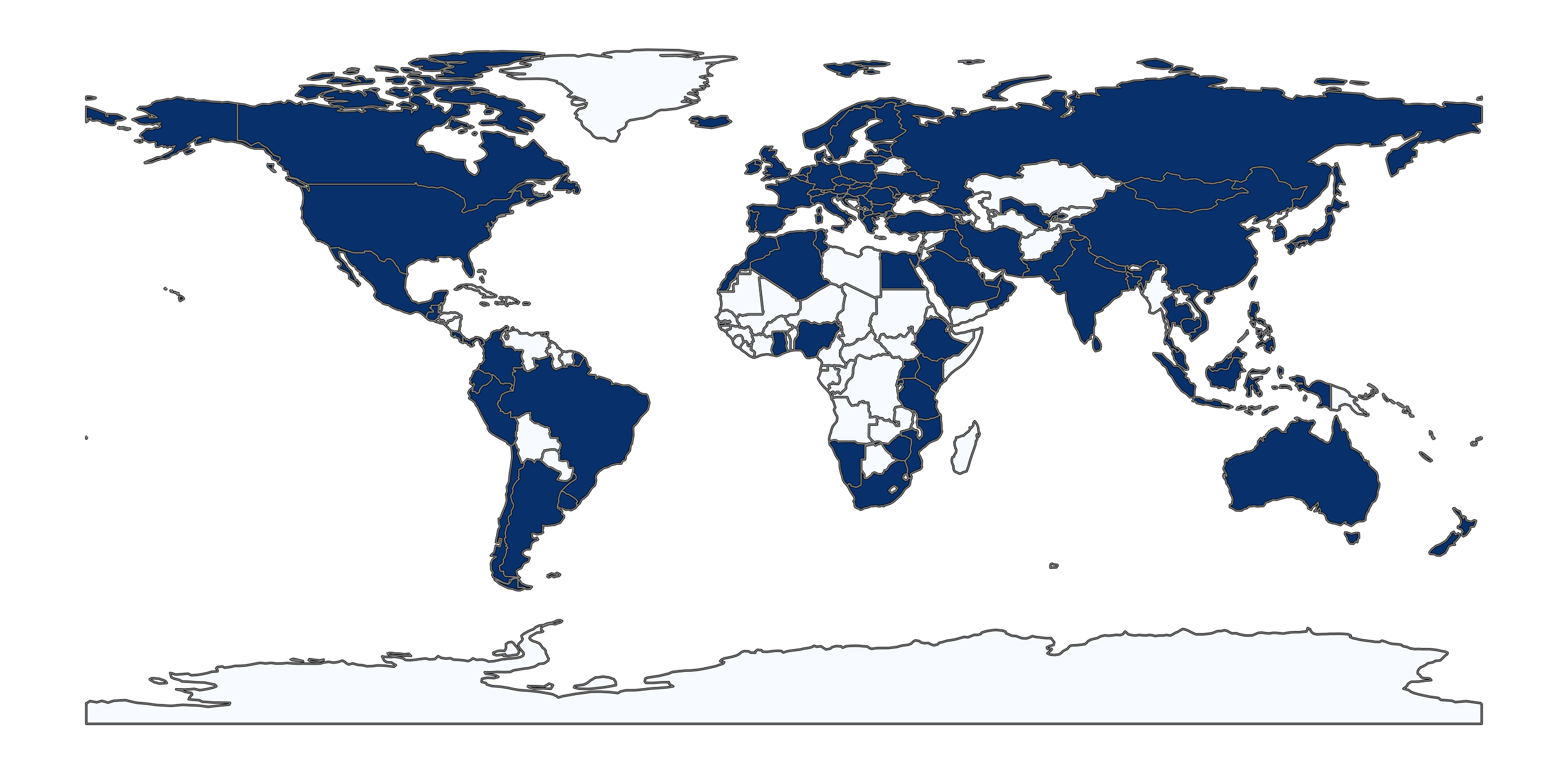

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: