Can the 50/30/20 Rule Help You Save Enough for Financial Independence?

In today’s post we clarify the 50/30/20 rule and whether it works for your path to Financial Independence and early retirement. Phra nang Cave Beach, Thailand. Thailand ranked as one of the top locations for early retirement in Asia. Photo by Farsai Chaikulngamdee on Unsplash.

Reading time: 9 minutes

Can the 50/30/20 Rule Work on the Road to Financial Independence?

The 50/30/20 rule, popularized by Elizabeth Warren, is a simple budgeting framework that allows you to allocate your income into needs, wants, and savings. But can it be effective to pursue Financial Independence (FI) or early retirement? In today’s post, we’ll unpack the logic behind this popular rule and compare it with other promising budgeting strategies in the FI space.

Whether you’re just starting out on your investing journey, pursuing Financial Independence with a family, or joined the FI journey a bit later in life, this post will give you clarity on how (and whether) to use this rule to reach your financial goals faster.

What Is the 50/30/20 Budget Rule (Elizabeth Warren's Rule)?

While the core idea of dividing your net income into needs, wants, and savings has been around for a long time, the 50/30/20 framework as we know it today was popularized by US Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their 2005 book, All Your Worth—a guide that introduced what is now called ‘the Elizabeth Warren spending rule’.

It’s a simple system for managing your after-tax income by dividing it into three distinct buckets—50% for needs, 30% for wants, and 20% for savings. The goal is to help individuals and families avoid financial stress by building a balanced spending plan that still prioritizes their future.

Simple frameworks like the 50/30/20 rule can matter more than we think. We live in a time when—despite having some of the highest salaries and living standards in the world—most US households report living paycheck to paycheck. Indeed, personal savings rates are dangerously low in the US compared to other countries.

In this context, any tool that helps people save more consistently deserves our attention. We also live in a world full of noise—think of the crypto hype, stock market speculation, or the daily bombardment of consumption propositions we face. In this context, the ability to build a stable spending plan can be seen almost as a superpower.

If a rule of thumb can nudge more people towards increasing their savings for retirement—gaining financial peace of mind in the process—then I’m all for it.

This rule was developed with average earners in mind—those with steady but moderate incomes who often feel overwhelmed financially. It doesn’t require any special financial tools to implement, nor does it ask you to categorize every single transaction manually. Perhaps its simplicity was a key reason why it caught on so quickly—most people often feel intimidated by detailed budgets or simply refuse to track every single coffee or subscription purchase.

Although this approach does not promise early retirement, implementing it from a young age could—as we’ll illustrate later on with examples. However, the main focus of the 50/30/20 rule is to slowly reach retirement with a suitable nest egg.

San Sebastian, Spain. Looking to retire early abroad? Check out or ranking of best destinations to retire early in Europe. Photo by Quick PS on Unsplash.

Breakdown of the 50/30/20 Rule: What Goes Where

Let’s break down the 50/30/20 budget rule with examples and see what goes into each category—so you know exactly how much you should save if you make $3,000, $5,000, or more per month.

Let’s say you’re earning $5,000 per month after tax. According to the 50/30/20 rule, $2,500 (50%) should be allocated to cover your needs—essential expenses like rent, mortgage payments, groceries, basic transportation, insurance, and utility bills. Needs refer in this context as the basic costs you must pay to function and remain financially stable.

Next, we’d allocate $1,500 to wants, which includes discretionary expenses like eating out, entertainment, travel, gym memberships, subscriptions, etc. Wants typically contribute to a higher quality of life—especially when the spending brings you value and joy. and is aligned with your values. The key here is to carefully select which expenses do, so we can cut back mercilessly on those that don’t.

The remaining 20% of the budget—$1,000 in this example—would go to savings and investments. This category includes several spending categories, including contributing to your emergency fund, paying down high-interest debt like credit cards, or investing in your retirement accounts. Many people wonder if saving 20% of your income is enough—further on, we’ll explore when it is and when it’s not.

For someone on the path to Financial Independence, this last category is where the progress happens. Once you have your emergency fund in place and debts paid off, saving and investing 20% of your net income over time will provide you in most cases with a comfortable retirement—assuming, of course, you followed this approach throughout your whole career and didn’t start implementing this framework too late.

The percentages of the framework make its implementation straightforward. However, many find it challenging to distinguish between needs and wants. Is a second car a need or a want? What about organic groceries or a nicer apartment in a better neighborhood?

Clearly, the answer to these questions is not always obvious. The good news is that it doesn’t matter too much either. From the perspective of pursuing Financial Independence and retiring comfortably, what really matters is that you remain disciplined with the 20% of the formula.

Is your gym membership a “need” or a “want”? Applying the 50/30/20 rule categories can be tricky. Photo by Gold's Gym Nepal on Unsplash.

Is Saving 20% Enough for Early Retirement? implementing the 50/30/20 rule for Financial Independence

While the 50/30/20 rule does encourage savings and is suitable for households living paycheck to paycheck or for those who are financially off-track, saving and investing 20% of your net salary may fall short for those aggressively pursuing FIRE (Financial Independence, Retire Early).

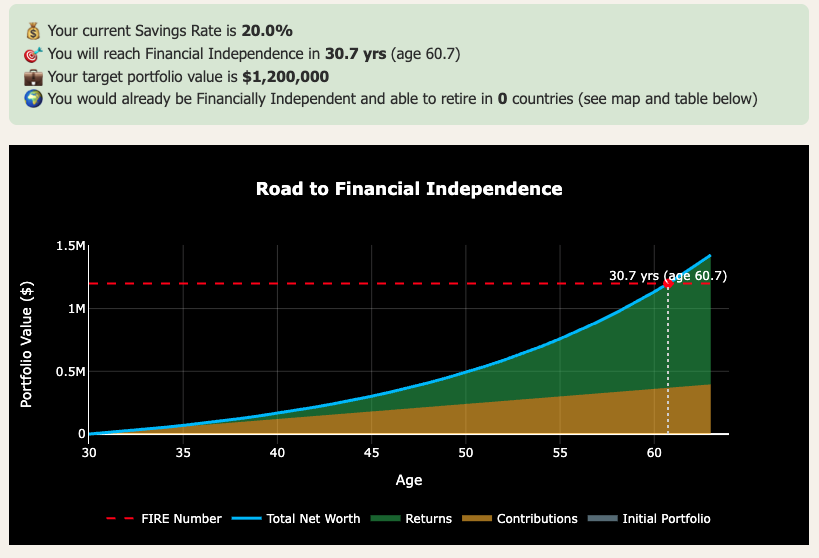

Let’s say you are 30 and would like to retire in 15-20 years rather than in 30-35. Would it be possible to achieve this following the 50/30/20 rule? According to our Financial Independence Calculator below (Figure 1), implementing a 20% savings rate on a monthly $5,000 net salary would require approximately 30 years of saving and investing before stepping away from our career. If compared with age 65, it would be possible to retire somewhat early, but not significantly early.

For many, this is not a bad outcome—in this example, you could retire at age 61 with a $1.2M portfolio, assuming a 7% real return on investments and a 4% Safe Withdrawal Rate. This nest egg—supplemented with social security—would likely make for a comfortable retirement for the household in this example.

Figure 1: Screenshot of our Financial Independence Calculator—free if you subscribe to our email newsletter. Under the assumptions of this case study, this household would reach Financial Independence at age 61 with a $1.2M portfolio.

* Further Reading – Article continues below *

If we start our financial journey with zero savings, implementing a 20% savings rate will get you to Financial Independence in about 31 years. It’s important to understand that this path to FI does not depend on age or net household income. If you change the age in the example above to 35 then you’d reach the same portfolio at 66—after 31 years.

But if we wanted to retire substantially earlier than the norm—say, at age 45 or 50—then a 20% savings rate simply does not deliver. In our example, to retire at age 45 or 50 would require increasing our savings rate to at least 50% and 38%, respectively.

As we’ve covered in the past, the savings rate is the single most important lever on your path to early retirement. The math of FI is very sensitive to the savings rate because it affects both how much you save and how much income you need to replace in retirement. In other words, saving more each month not only builds your portfolio faster, it also lowers your portfolio target because you’re able to sustain your lifestyle on less.

It still doesn’t mean the 50/30/20 rule is useless for FI. It provides structure in the early stages, especially for those who’ve never saved intentionally before or who stumbled across the concept of Financial Independence late in life.

For those individuals, implementing a 50/30/20 approach can be a fantastic idea, which can be further tightened over time, e.g., to a 50/20/30 or 40/20/40 framework. You can also decide to shift your lifestyle gradually—it doesn’t need to happen overnight.

Focus on optimizing your savings rate, not on the investment returns of your portfolio. Photo by Austin Distel on Unsplash.

Why Savings Rate Matters More Than Investment Returns

One of the most persistent myths in personal finance is that chasing higher investment returns is the ultimate driver of wealth. While returns certainly matter, for the vast majority of society they’re simply not the primary lever you can act on. Your savings rate is.

As we learned through Jack Bogle—creator of index funds—chasing a 1% higher return is in most cases a fool’s errand. The data shows that by trying to be clever—by trying to select your own stock portfolio, time the market, or engage in expensive actively-managed funds—the odds are simply stacked up against you: after fees, the vast majority of investors will underperform those content with obtaining the average stock market via index funds.

But let’s say you are an investing guru (or were just lucky with your stock picking) and somehow manage to consistently get 1% higher return over the course of your entire 40-year career. In the figure below we compare the effect of a higher return (8% instead of 7%) on your portfolio versus increasing your savings rate from 20% as per the 50/30/20 rule to 30%.

As observed, you reach Financial Independence 4 years earlier by focusing on the savings rate instead than focusing on the percentage returns.

Figure 2: Testing the impact of higher investment returns (8% instead of 7%, Top Pannel) vs increasing savings rate (30% instead of 20%). For the vast majority of investors, increasing your savings rate is much easier than trying to obtain higher than average returns from your investments. It also gets you to early retirement quicker.

The takeaway is that focusing on your savings rate is not only much easier, but it will also likely get you to faster to Financial independence. Wherever you are in your personal finance journey, if you feel like you are not on track to retire by a certain age, don’t try to chase risky investments—focus instead on adjusting your lifestyle and savings rate.

So when should you lean on the 50/30/20 rule—and when is it time to go beyond it? Your stage in life makes a big difference.

When Should You Use the 50/30/20 Rule? Age and Timing Matter

At this point, it should become clear that your ability to implement the 50/30/20 rule depends also on your age. Given that it takes about 31 years to reach Financial Independence—irrespective of income—your age largely determines whether this is a viable strategy for you.

When you’re fresh out of college/university, say age 24, implementing the 50/30/20 rule can work quite well. It allows you to reach early retirement around age 55, while still enjoying 80% of your income along the way. As we showed earlier, even starting at age 30 will get there at a reasonable age of 61. Remember, this means sticking consistently to this strategy for 31 years.

Yet, I’d argue that if you’re fresh out of college you’re likely used to being happy on a very low income. Chances are that by implementing the 50/30/20 rule, you actually increase your annual spending tremendously in the first year out of college. This would be a great missed opportunity for locking in a high savings rate early on.

If you were living on $12,000–15,000 and suddenly land a $60,000 salary, it’s tempting to loosen the reins and follow the 50/30/20 rule. But this is actually the perfect moment to be intentional—why not lock in a high savings rate before lifestyle inflation sets in. Yes, you may want to live more comfortably—no need to continue living like a student—but chances are this is the best opportunity to start building your savings and investing muscle.

I think this something we did well during our journey to Financial Independence. We didn’t feel in a hurry to increase our lifestyle overnight—we continued to live in the same place we were renting for quite some time. This allowed us to lock in 50-60% savings rate for a few years. Only when our first born came into the picture did we decide to move to a bigger place.

Now contrast that with someone in their late 30s or early 40s, juggling a mortgage, kids, and rising costs. For them, flexibility is now more limited, and saving that extra 10% requires more effort. For these cases, I think pursuing the 1% Savings Method for Financial Independence is a smarter approach than implementing immediately the 50/30/20 rule.

Enjoy the ride, not the destination. It’s completely possible to pursue Financial Independence while growing a family. Photo by Jessica Rockowitz on Unsplash.

The 1% Savings Method is a flexible strategy that encourages you to increase your savings rate little by little—increasing your savings rate by 1 percentage point each month. Say you currently have a 5% savings rate, but you fear that implementing too many changes abruptly may disrupt your quality of life, or perhaps it will be hard to bring your special other on board. Fine—just focus then on hitting a 6% savings rate next month, then 7%, and so on.

The beauty of this approach is that it allows you to reach a high savings rate after a couple of years—without feeling the “pain”. If you are aware of the concept of hedonic adaptation, you’ll realize that we adapt very quickly to small changes in our life—and implementing these 1% changes in your budget will feel very easy to accomplish.

Ideally, as we’ve seen, the key is to take advantage of timing. Save more when you can, early and aggressively. Then, when life gets more complicated, you’ll already have built the momentum. And if you're starting late? That’s fine too. Just choose the approach that matches your current situation—not someone else’s ideal scenario. The 1% Savings Method can be a real game-changer in some cases.

Age affects what’s possible—but so does personality. What budgeting style will actually stick for you? Let’s take a look.

Which Budgeting Style Fits You Best? Structure vs Flexibility

Some people love the clarity of having categories—they want to know exactly where each dollar goes. For this type of personality, the 50/30/20 rule can offer a comforting structure. It enables them to show discipline, but also a degree of permission—you’re free to enjoy life today, while also building a portfolio for the future.

At the other end of the spectrum, some personality types may dislike categorizing every single expense. They’d rather have an automated savings target and forget the rest. For these cases, setting a “pay yourself first” rule may be preferable—e.g., saving and investing 25-30% of your net salary as your first expense. Once the savings rate is locked in, they may feel it’s unnecessary to label all the rest of the spending as “needs” or “wants”

It likely depends a bit on your personality. While I understand the benefits the 50/30/20 rule can have for many, and specially when starting out on your savings and investment journey, I lean more toward the second camp. I personally spend only 30 minutes at the end of the month tracking in an Excel sheet our expenses, but don’t bother to categorize them. We’ve implemented a “pay yourself first” budget, where our monthly investment contributions are already automatized, so I feel very little can go wrong.

Santa Teresa Beach, Puntarenas Province, Costa Rica. Looking to retire early abroad? Check out or ranking of best destinations to retire early in Latin America. Photo by Nathan Farrish on Unsplash.

Pros of the 50/30/20 Rule

A key strength of the 50/30/20 rule is its simplicity. It’s easy to understand, remember, and implement, even if you’ve never budgeted or tracked your expenses before. For anyone starting out, it removes the guesswork and provides an intuitive structure that avoids lifestyle inflation.

It also allows balance—this approach clearly signals you are allowed to spend freely and enjoy life now while your still young and healthy, but still saving meaningfully for the future. Some people in the FIRE community take the delayed gratification too far—Bill Perkens argues many of them are actually deleting gratification, since most then die with huge portfolios they did not get to spend in old age—in practice they could have retired substantially sooner.

Another advantage is that it works fairly well with irregular income—you can convert the fixed percentages to actual amounts each month. It doesn’t require to track every line item—just the broad categories.

Also, for couples sharing finances, it may provide a common language and framework that makes it easier to communicate with. Early on, it’s probably easier to nudge the more spendier person in the partnership into following a very established 50/30/20 framework rather than to some extreme version of FIRE savings rate.

Cons and Common Pitfalls

One disadvantage of the 50/30/20 rule is the blurred line between needs and wants, making it harder to follow strictly—especially for lower-income households. Is your gym membership needed for your physical and mental health? Is organic food a want or a priority? Many of these grey areas can lead to “justified overspending” and could potentially undermine the savings portion.

As we saw above, unless you start implementing it in your 20s, the 50/30/20 is not aligned with early retirement. Still, it can be a good starting point for those wanting to get back on track. The savings rate can always be ratchet up over time.

If you live in a high cost of living location, the 50/30/20 rule may be difficult to implement. You may find that needs alone consume more than 60% of your budget. Still, in most cases you can tweak the framework or use a different approach entirely.

Finally, the 50/30/20 rule doesn’t prioritize debt repayment aggressively. While minimum debt payments would fall into the “needs” category, the framework may not encourage aggressively paying down high-interest debt. For someone with large credit card balances or student loans, allocating only 20% to savings (and extra debt payoff) may be insufficient.

Ultimately, the 50/30/20 Rule is a tool. You need to make sure it’s aligned with your personal financial goals and retirement dreams. Photo by Vandan Patel on Unsplash.

Conclusion: When the 50/30/20 Rule Works—and When It Doesn’t

I the end, the 50/30/20 rule isn’t a magic formula—it’s a tool. And like any tool, it’s value depends on how and when you use it. If you’re early in your financial journey, this simple framework can provide structure, discipline, and permission to enjoy life today while still not forgetting to prepare for the future.

For those who are overwhelmed, inconsistent, or just getting back on track, it offers clarity without making things too complicated. And for couples or families, it can be a helpful shared system to talk openly about money.

That said, if you’re aiming to retire years or even decades earlier than age 65, this rule will fall short—unless you start implementing it in your early twenties or adjust it towards a higher savings rate over time. That’s where other strategies, like the 1% Savings Method or pay-yourself-first systems, can realign you with your desired early retirement.

In the end, what matters most is not whether the method is perfect, but whether you’re making intentional and consistent progress towards your financial goals. The best budget is one you will actually stick to, so if the 50/30/20 rule gets you going, then it’s doing the job. If you're wondering what’s a realistic amount to save per month, start with 20% and adjust based on your goals, income, and timeline for retirement. You can always ramp up your savings rate over time.

💬 I'd love to hear your thoughts—have you tried the 50/30/20 rule or follow a different approach? Did it help or hold you back? Drop a comment below and share your budgeting experience.

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey. Subscribe below to follow our journey.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

Don’t miss our insights on the “Crossover Point” of financial independence or on how to invest your hard-won savings. Didn’t find what you were looking for? Check out our latest articles below.

Disclaimer: I am not a financial adviser, and the content in this website is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

The 50/30/20 rule is a budgeting method that divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. It was popularized by Elizabeth Warren to help people manage money with less stress and more balance.

-

A general recommendation is to save at least 20% of your net income. For a €3,000 salary, that’s €600. If your goal is early retirement, saving 30–50% may be more appropriate depending on your timeline and lifestyle.

-

Not usually, unless you start saving in your early 20s. Saving 20% is great for long-term retirement at 65, but if you want to retire earlier—say at 45 or 50—you’ll likely need to save 35–50% of your income or more, depending on your investment returns and expenses.

-

It’s simple, beginner-friendly, and helps you build a balanced spending plan without micromanaging every transaction. It encourages consistent saving and works well even for those with irregular income.

-

It can be hard to define “needs” vs. “wants,” and 20% savings may not be aggressive enough for big goals. It also doesn’t prioritize debt payoff or early retirement unless the percentages are adjusted.

-

This rule may not work well if you have high fixed costs, live in an expensive city, or need to pay off debt quickly. In some cases, other strategies like the 1% Savings Method or zero-based budgeting may be more effective.

-

Both methods work well when starting out, but serve different goals. The 50/30/20 rule is great if you’re already able to save 20% and want a clear, structured plan. The 1% Method is better if 20% feels too high right now, or if you’re aiming for early retirement and need to increase your savings rate gradually without burning out.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: