50 Clever Money-Saving Tips for 2026 (Budget Smarter)

Implement smart saving habits to invest early, build wealth, and gain the freedom to design life on your own terms. Photo by Becca Tapert on Unsplash.

Reading time: 9 minutes

Your 2026 Roadmap to Saving Money and Building Wealth

Looking to save money in 2026 without sacrificing your lifestyle? This post shares 50 proven money-saving tips—from clever budgeting hacks to financial strategies that support your journey to financial independence. Whether you’re saving $1,000 fast or building long-term wealth, you’ll find practical advice to cut unnecessary costs, raise your savings rate, and invest wisely—especially if you’re aiming for LeanFIRE and want to reach financial independence on a lower cost of living.

Did you know saving just $100 per month could grow into $250,000 in 40 years? Implementing even a few of these ideas can put you on the fast track to financial freedom.

The truth is, the earlier you start being mindful with your spending, the sooner you can get your investments rolling. Reaching your first $100K invested is often the hardest part—after that, compounding begins to work its magic. If you're early in your financial journey, these saving strategies are especially important.

By implementing several of the ideas below, I am confident you can save much more than $100 on a monthly basis. Don’t waste your hard-earned money—honor the effort it took to earn it by applying clever ways to save money even on a low income.

Simple strategies to save money!

A) General Money-Saving Tips and Daily Budget Hacks

Want to start saving money without changing your entire lifestyle? These general budgeting tips are easy to apply and ideal for building better daily habits.

1) Cancel unused subscriptions.

We are completely flooded in subscriptions. Music streaming, video games, magazines and newspapers, fitness and wellness, software and productivity tools, streaming services, you name it. Be honest with yourself: how much free time do you really have? Take a hard look at all your subscriptions and decide which ones you are truly getting your money’s worth and cancel the rest.

2) Pretend to cancel subscriptions to get better deals.

I recently got a 50% reduction to renew my annual Headspace subscription and it literally “cost” three clicks of my time. Similarly, I also got 33% off a magazine subscription after 10 minutes in a chat box. Generally, when beginning a subscription, set yourself a calendar reminder a few days before it's due to expire. This allows you to consider whether you'd like to cancel or employ the "pretend to cancel" tactic.

3) Regularly shop around for better service providers.

Once per year, at a pre-defined date, sit down with the information of your insurance, utilities, internet, phone, etc. providers. There are always new competitors offering better deals for the same service—don’t leave any money on the table.

4) Shop at thrift stores.

Shop at thrift stores (or their online equivalents) for clothing and household items, including furniture. The depreciation cost of most products is staggering, it is not uncommon to see 50% off or more on second hand products that are as good as new. Pride yourself on being more environmentally-friendly and appreciate that the product has a history and enjoyed multiple uses.

In my area, eBay and Vinted are popular choices, while local flea markets provide unexpectedly enjoyable experiences with live music and a great atmosphere. Frankly, it is normally a much better experience overall than just going to an indoor mall.

By “previously loved” items, including clothes. Learn about the depreciation cost of new items. Photo by Prudence Earl on Unsplash.

5) Use discount apps, coupons, and price compare.

Price compare before making purchases, especially for food and household supply items.

B) Banking & Finance Hacks to Boost Your Savings Rate

Your banking habits have a huge impact on your financial success. Here are smart ways to lower fees, automate savings, and increase your long-term wealth.

6) Implement automatic savings through a “pay yourself first budget”.

Implementing a pay yourself first budget ensures prioritizing savings and investments before spending at the very beginning of the month. It fosters good savings habits and helps to keep a consistent savings rate, the single most important factor for working towards financial independence.This strategy is especially powerful if you’re wondering how to save money from your salary and increase your savings rate consistently over time.

7) Avoid investing in actively-managed funds.

Acknowledge that for most retail investors, the odds are stacked up against you—it is statistically very unlikely that you will beat the market after fees. Passive investing is the best strategy for the vast majority of retail investors; invest regularly by dollar-cost averaging into internationally-diversified, low-cost index funds or ETFs that track them. This decision is likely one of the ones that will make the largest difference for your retirement portfolio over the long run.

8) Avoid high expense ratios.

Be very careful with the fees that investment funds charge. You should be very skeptical of anything advertizing annual fees over 0.1% (more common is 0.04% or 0.07%).

9) File your tax returns.

Although this depends obviously on where you live, in many countries you can get a lot of money back by filing a tax return.

10) Consult a tax advisor.

For big ticket items, it is always a good idea to hire a tax advisor. Don’t try to save money on this. In the end a good tax advisor will save money for you. Remember: penny wise, pound foolish.

Consult with tax advisors on big-ticket items. Photo by Antoni Shkraba Studio on Pexels.

11) Track your spending.

You can’t manage what you can’t measure. Track your expenses at the end of the month—it only takes 30 minutes and can make a huge difference in your finance journey. Tracking your spending allows you to be more mindful of your finances and to distinguish wants versus needs.

12) Avoid unnecessary insurance.

This deserves a separate post, but generally avoid insurances for small items like your phone and other gadgets. However, you absolutely do need health insurance, life insurance (if you have a family), occupational disability insurance (very often overlooked!), and liability insurance.

13) Watch our for bank account fees and interest rates.

Compare what different banks offer; don’t throw away money by paying monthly account or credit card fees if other banks are offering a comparable service for free. If you are sitting on a sizeable amount of cash that you intend to use in the short term, compare what the bank’s interest rates are for their money market accounts. As I write this, the interest rates offered by banks vary wildly: don’t leave money on the table.

14) Avoid late fees.

Paying late fees of bills we forget about is not so uncommon. Have a system in place instead: either pay the bill on the same day or file it in a special location and immediately set up a calendar reminder for when you should pay it.

15) Avoid ATM fees.

It is 2026; if your bank is still charging you unreasonable fees at ATMs, particularly when traveling abroad, it might be a good time to consider changing to another bank.

C) Smart Transportation Tips to Cut Costs in 2026

Transport is one of the largest expenses in many households. Cut your costs with these practical car, bike, and ride-sharing hacks.

Photo by Vidar Nordli-Mathisen on Unsplash.

16) Use the bike.

We recently wrote a blog post on the real cost of car ownership and on the opportunity cost of owning a car throughout your entire working career. It is much more than you think. If you live in a big city or in a country with good public transport, owning a car is a big thing to reconsider. Drop your car, lead a less stressful and healthier life, and reap the financial benefits.

17) Use car sharing instead.

Once the previous point is in place, in most cities you have excellent car-sharing opportunities. I rent cars and vans nearly every month (in many cases weekly) and still pay a small fraction of what I would by owning a car.

18) Plan you errands smartly.

It drives me mad when I see my parents run errands erratically each day, with no attempt to consider organizing things on a weekly basis. If you own a car, it doesn’t mean you need to do two small trips every single day. Bundle the trips together instead and save yourself time and money.

D) Energy-Saving Tips for Lower Utility Bills

Looking for clever ways to save money at home? These energy-saving tips reduce your monthly bills while helping the planet. These are clever ways to save money at home that many people overlook—but the savings add up fast.

19) Bundle up in winter.

Unless you enjoy wasting hard-earned money, there is no reason for wearing t-shirts around the house in winter. Bundling up in winter is cozy.

20) Turn off/down the heat.

Get in the habit of turning off/down the heat and of closing the doors of the rooms you are not using.

21) Ventilate rooms regularly.

In winter, the humidity collects in the room, reducing substantially your energy efficiency. Air the rooms at least once per day for 5 to 10 minutes (better twice per day).

Ventilate your rooms well in winter to improve energy efficiency. Photo by Luke Webb on Pexels.

22) Turn off the lights.

Get into the habit of turning off the lights of the rooms as you exit them.

23) Change your lightbulbs.

Be sure to change your lightbulbs to the most energy efficient ones you can find.

24) Take cold showers / ice baths.

Cold plunging has gotten very trendy—I know. But for good reason. Besides saving substantially on water and energy you can experience some of the following health benefits: enhanced immunity, reduced inflammation, better metabolism, improved mental health, improved circulation, increased energy and alertness, better sleep, reduced stress, increased testosterone levels, enhanced mental resilience, longevity benefits…

Start out slowly by aiming to use cold water in the last 2-3 minutes of your shower. Can you think of any other activity in life where you get so many benefits for three minutes of your time? For motivation and to learn more about the benefits, you can follow Andrew Huberman for the latest science on cold exposure.

E) Frugal Food Hacks to Save on Groceries

Food costs add up fast, but so do savings. Here are the best grocery and kitchen hacks to reduce your food budget without sacrificing health. Check out our top 20 money-saving food hacks in detail here.

If you’re trying to figure out how to save $1,000 ASAP or how to save $10,000 in a year, food is one of the best places to start. These food hacks can help you cut hundreds of dollars a month without giving up enjoyment.

25) Avoid coffee to go.

Here it helps to ask ourselves—is it a habit or a pleasure? Do you really enjoy walking fast with a coffee mug in your hand or is it some habit you picked from someone else? You are paying the price for sitting down and enjoying the nice atmosphere of the coffee shop, so why not do just that? If you enjoy walking fast with coffee, at least bring your coffee from home!

Pleasure or habit? Photo by Ceyda Çiftci on Unsplash.

26) Watch out with takeaways and eating out too much.

If you are a foodie and this is a hobby for you, by all means go ahead. But, for many others, ask yourself again—pleasure or habit? Indulging in occasional outings can be delightful, but if done too frequently, it's likely that you're succumbing to the trap of hedonic adaptation. If you want to save some money, hosting potluck dinners can be a great alternative.

27) Engage in meal planning and batch cooking.

Organizing yourself on a weekly basis will help you avoid buying and wasting too much food. It will also reduce impulse buying at the grocery store.

28) Freeze meals for a later use.

This may seem obvious, but never let a good meal go to waste.

29) Choose your grocery store wisely.

Remember what we laid out at the beginning of the post: every $100 you save per month is over $100K after 30 years. Is the fancier store really worth it? Is it not possible to get good, healthy ingredients too at the cheaper store? In some cases, we may be talking about several hundred dollars of difference here over time.

30) Shop for food only once per week.

Force yourself to plan and save money in transport and by reducing food waste and impulse buying.

31) Buy generic brands instead of name brands.

For a lot of food types the difference is minimal.

32) Buy seasonal.

Avoid strawberries in January. Familiarize yourself with a seasonal calendar to have a good overview of what is in season in your country.

33) Lean towards plant-based meals and cooking from scratch.

Triple win—good for your health, good for the environment, good for your wallet.

Plant-based food for your health, planet, and… wallet. Photo by Frames For Your Heart on Unsplash.

34) Try out our food waste inventory challenge.

You can’t manage what you can’t measure. This simple exercise may be painful at first, but trust me, it is worth it! Place a blank sheet of paper on the front of your fridge at the beginning of the month. Each time you throw away a food item note it down along with its estimated price, e.g., one yogurt, 25 cents.

Add up all the items at the end of the month and multiply times 12. Voila! There is your estimated annual food waste bill. The initial shock may be good news as it will stir you permanently into avoiding food waste.

35) Avoid sugary drinks.

Give your body the very best it deserves: water. Aim for 8-10 glasses per day.

36) Bring food with you.

Get in the habit of carrying some food around with you—water, fruit, a small healthy snack. You never know when you will be hungry.

F) Health-Related Money Tips That Save Thousands

Your health is priceless—but it doesn’t have to be expensive. These simple changes can save you thousands over time.

37) Consider your gym membership.

Analogous to the advice on eating out, if the gym is your passion go ahead and skip to the next money-saving tip. But if you struggle to go to the gym regularly, maybe you can find cheaper ways to staying in shape.

38) Quit and/or reduce smoking and alcohol.

I think this one is pretty obvious, but let’s do some quick math on the smoking example. A pack a day will set you back roughly $250 per month or $3,000 per year in the US. Investing this money instead over the course of a 40-year career would render you a portfolio in the ballpark of $600,000. That is quite an opportunity cost for you and your loved ones for ruining your health.

G) Travel Hacks to Save Big on Your Next Trip

Travel smarter in 2026 with these budget-friendly vacation tips to enjoy more while spending less.

39) Travel during off-peak seasons.

Travel during off-peak seasons—one of the smartest ways to save money fast while traveling.

What could beat having the beach to yourself? Photo by Darren Lawrence on Unsplash.

40) Use travel comparison websites.

Find the best deals on flights and accommodations.

41) Travel with friends or family.

If possible, try to split costs.

42) Stay with friends or family

If possible, try to avoid booking hotels.

H) Miscellaneous Tips: Mindful Spending, Gifts & More

These final money-saving hacks don’t fit into neat categories, but they can make a big difference in your budget.

43) Plan presents in advance.

Acquire presents throughout the year when you see good deals. Avoid last minute, compulsive shopping, which comes out more expensive.

44) Find inexpensive presents that add value.

Have you ever heard of someone complain after receiving a good book? Normally, more thought goes into choosing the right book for someone than just randomly picking up a scarf or a purse at the mall.

45) Use the library.

I personally like to own the book to make notes and be able to revisit its best parts. More importantly, I like how it looks in the background—it gives our home a more cozy feeling. But for those that don’t care, remember to use the library.

You can take much more than books from the library these days. Photo by Alex Block on Unsplash.

46) Avoid lottery tickets.

Americans spend about $1,000 per year on lottery tickets. The opportunity cost of investing this money over a 40-year period is around $200,000.

47) Rent out tools and equipment.

Try to avoid single-use items.

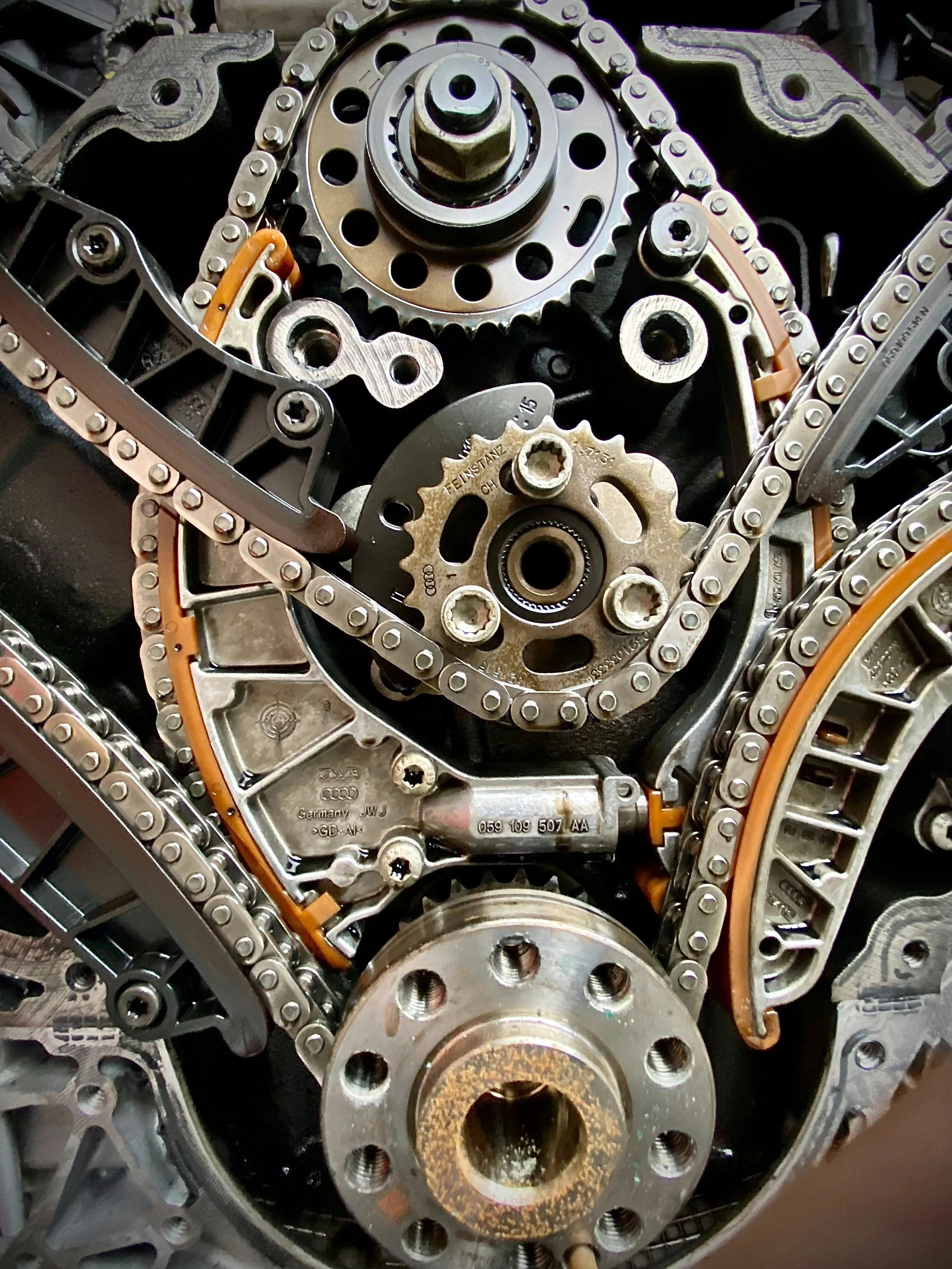

48) Adopt mentality of learning to fix things yourself.

This one is a big money saver. It also feels good to learn new skills and take care of your belongings.

49) Sell unused or unwanted items online or at garage sales.

It keeps the clutter out of the house and makes you question yourself next time you buy something you don’t really need.

50) Practice mindful spending.

Before making a purchase, especially on non-essential items, pause and ask yourself whether you truly need it or if it's just a want. Consider even waiting 24 hours before making impulse purchases to see if you still want or need the item.

Conclusion

Saving money doesn’t have to be painful or complex. By consistently applying a few of these 50 smart tips, you can save thousands each year and grow your wealth steadily. Whether you’re trying to save $1,000 this month or reach financial independence in the next decade, the key is to take consistent, intentional action.

Want to learn how to save $10,000 in a year? Start small. Combine food, energy, and subscription hacks to free up hundreds of dollars monthly. The cumulative impact over time is massive.

Whether you're saving for a rainy day or pursuing financial independence, these money-saving hacks can help you build long-term wealth—starting today, and are especially effective for those on the LeanFIRE path.

Remember, financial success isn’t about deprivation—it’s about smart choices that align with your goals.

Enjoyed this post? Don’t miss our insights on frugality from Vicky Robin’s classic ‘Your Money or Your Life’ or our post on 20 simple food hacks to cut the grocery bill in 2026. Didn’t find what you were looking for? Check out our most recent articles further below.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey.

Disclaimer: I am not a financial adviser, and this content is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

Start by cutting unused subscriptions, reducing takeout meals, shopping with a list, and tracking your spending habits. These quick wins help you take control of your budget.

-

Focus on your biggest spending categories—cut restaurant visits, avoid impulse shopping, and automate transfers to savings. Pair these with smart grocery planning and car-free commuting.

-

Begin by tracking expenses, setting a budget, and prioritizing essential costs. Automate savings at the start of the month and look for recurring expenses you can cut or downgrade.

-

Bundle errands, meal prep, use public transport, and plan purchases in advance. These tactics help reduce everyday waste and maximize your money’s value.

-

Yes—use your local library, cook at home, track expenses with free apps, avoid interest charges, and reduce utility use to build savings without spending anything upfront.

-

Break it down: aim to save ~$835/month through small wins like switching grocery stores, canceling unused services, and reducing non-essential purchases like takeout and online shopping.

-

Turn off unused appliances, lower your thermostat, cook from scratch, and adopt energy-efficient habits. These daily behaviors compound to reduce utility bills significantly.

-

Follow a “pay yourself first” method by setting automatic transfers to savings right after payday. Avoid lifestyle inflation and stick to a simple budget aligned with your goals.

-

Start with small recurring wins—cut fast food, cancel subscriptions, and shop second-hand. Look for side gigs and government incentives to boost income without big lifestyle changes.

-

Aiming to save $100–$500 in one month is doable for most. Focus on food, transportation, and subscription spending, where most people waste the most money without realizing it.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: