10 Wealth Lessons from The Almanack of Naval Ravikant

Photo by Kate Darmody on Unsplash.

Reading time: 7 minutes

Disclaimer: I am not a financial adviser, and this content is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

Check out and subscribe to our YouTube channel here.

Introduction

In today’s post, we break down Eric Jorgenson’s bestselling book “The Almanack of Naval Ravikant”, a must-read for anyone aspiring to achieve financial independence. Naval Ravikant, the renowned founder of AngelList, is a Silicon Valley and startup culture icon. The first part of the book is dedicated entirely to proven strategies for building wealth, while the second half discusses happiness and Naval’s philosophy of life. Naval enjoys discussing the interplay between wealth and happiness, advocating for a life designed around personal fulfilment and continuous learning rather than material accumulation alone. As you can see, the two topics fit like a glove to our mission at The Good Life Journey. Today’s post will focus on the takeaways for building wealth.

The overarching message of Naval lies on focusing on the importance of leveraging specific knowledge, embracing long-term thinking, and prioritizing ownership in businesses or assets that can grow exponentially. Naval advocates for building lasting wealth through smart, intentional efforts rather than relying on luck or fleeting opportunities, or on renting your time for money (i.e., most 9-to-5 jobs). To do so, he highlights the importance of creating high-value opportunities, continuous learning, and establishing a mindset oriented towards achieving financial freedom.

*Affiliate link: If you enjoy our content, consider purchasing your book through our link. We earn a small commission, which helps support the blog. In addition, 10% of all revenue generated is donated to charitable causes.

10 lessons from The Almanack of Naval Ravikant

1. You’re not going to get rich renting out your time.

If you are paid for renting out your time, it will be very difficult to acquire the money you need to buy your freedom. The reason is that, without asset ownership, your inputs are too closely tied to your outputs. You are not earning while you sleep, when you are on vacation, or when you are retired—you can’t earn non-linearly. Instead, invest in equity to grow your wealth. You can do this by either owning equity as a stock shareholder or through stock options if it is possible in your sector. But normally, the real wealth is created by starting your own company.

Quote: “If you don’t own a piece of business, you don’t have a path towards financial freedom”.

2. Escape competition through authenticity and arm yourself with specific knowledge.

Specific knowledge is something you cannot be trained for. If society could train you to do it, it could also train someone else. You find it by swimming against the tide, by being your unique self, by tapping into your innate talents, and, most importantly, by following your true passion to build wealth, rather than the latest trend. Specific knowledge is often highly technical or creative, it is something that cannot be outsourced or automated. According to Naval, acquiring specific knowledge is the key ingredient for building wealth and it can take many years to develop.

Quote: “Figure out what you can uniquely provide”.

3. Be accountable.

Take full responsibility for your actions and their outcomes, be transparent about your contributions, and ensure that your reputation is tied to the results you deliver. Society will then reward you with responsibility, equity, and leverage. We are socially hardwired to not fail in public under our own names, but Naval argues that the ability to fail in public will actually gain you a lot of power.

Quote: “Embrace accountability and take business risks under your name”

4. Use leverage.

Building wealth requires giving society what it wants but does not yet know how to get. Leverage to provide this at scale can come from capital, people, and products with no marginal costs of replication. To raise money, you need to apply your specific knowledge with accountability and show good judgment. Labor is the oldest and most fought-over form of leverage, but Naval recommends that it shouldn’t be our primary focus: this form of leverage will impress out parents, but it is very messy, requiring huge leadership skills. Capital and labor are “permissioned” leverage, meaning someone has to give it to you, whereas code and media are examples of products with no marginal costs of replication that use “permissionless” leverage. You can develop scalable products—books, media, movies, code— that literally work for you while you sleep.

Quote: “Forget rich versus poor, white-collar vs blue-collar. It’s now leveraged versus un-leveraged”.

5. Focus on long-term wealth-building over status.

Status is a very old, zero-sum game. It’s hierarchical, if you go up, then I go down. To win a status game, you have to put somebody else down. Avoid playing this game, as they can turn you into an angry, bitter, envious, and combative person. There is nothing inherently wrong with money, it’s just that the lust for money is bad for you. Unfortunately, there is not a magical number where the desire for more money turns off—if you are not careful, it is a bottomless pit that will always occupy your mind. Naval encourages us to seek wealth instead. By focusing on building wealth we can achieve financial independence, personal freedom, and a design fulfilling life. Building wealth is the best way to free ourselves from the endless comparisons inherent in seeking status. Avoiding lifestyle inflation as you make more money is the best way to stay away from a constant love for more money.

Quote: “Those attacking wealth creation are often just seeking status”.

Photo by Ante Hamersmit on Unsplash.

6. Become the best in the world at what you do. Keep redefining what you do until this is true.

An important trait needed to arrive there is to adopt the mentality of a perpetual learner. According to Naval, it is more relevant to be able to become an expert in a new field within a year that to have studied the “right” thing in college. He suggests that this approach involves both honing one's unique talents and persistently shifting one's professional niche to align with their evolving strengths and passions. This will allow you to distinguish yourself in a competitive market, create significant value, and achieve both personal satisfaction and financial success.

Quote: “Each person is uniquely qualified at something”

7. Change your definition of retirement.

For Naval, retirement is when you stop sacrificing today for an imaginary tomorrow. Three different strategies can get you there. Firstly, you can have sufficient assets in your investment portfolio that allows your passive income to cover your monthly expenses. This path is elaborated in several posts in this blog. Secondly, you can just drive down your expenses pretty much to zero—you can become a “monk”. And finally, you can get there by doing something you love—you enjoy it so much, it is no longer about the money and you are not sacrificing today.

Quote: “When today is complete, in and of itself, then you are retired”.

8. Earn money and build wealth, but realize this is not the ultimate destination.

Money buys you freedom in the material world, but it won’t solve your health and family problems, nor will it give you peace of mind. Nevertheless, Naval says it’s a reasonable place to start. Focus first on buying back your freedom. Then, you will have the time and energy to pursue your own internal peace and happiness, which is the ultimate destination.

Quote: “Let’s get them rich, let’s get them fit and healthy. Then, let’s get them happy”.

9. Shed your identity to see reality.

If all your beliefs line up neatly into bundles, you should be very suspicious. Creating identities and labels locks you in and keeps you from seeing the truth. To be able to see it, you not only have to shed your identity, but also your ego—the less desires you can have about an outcome you want, the easier it will be to see reality with objectivity.

Quote: “You can only make progress when you’re starting with the truth”

10. If you can’t decide, the answer is no.

Should I marry this person? Should I take this job? Should I buy this house? Should I go into business with them? Modern society is just too full of options, we are not biologically built to realize how many choices we have. Naval recommends that if you can’t decide, then the answer is no.

Quote: “When you chose something, you get locked in for a long time”.

Enjoyed this post? Don’t miss Naval Ravikant’s 12 insights for unlocking happiness or Morgan Housel’s 18 money lessons based on his bestseller ‘The Psychology of Money’.

*Affiliate link: If you enjoy our content, consider purchasing your book through our link. We earn a small commission, which helps support the blog. In addition, 10% of all revenue generated is donated to charitable causes.

Check out and subscribe to our YouTube channel here.

Check out our Financial Independence Tools (Works for PC only)

Tool: Best Countries for Retirement: Where to Retire Abroad?

Tool: Identify Countries Where Relocating Can Help You Achieve Financial Independence Faster

Tool: Identify Cities Where Relocating Can Help You Achieve Financial Independence Faster

What to read next?

“Best Countries to Retire in Europe in 2025: Top 5 Affordable and Expat-Friendly Destinations”

“Find Your Perfect Retirement Destination: A Data-Driven Relocation Tool for 2025”

“Relocation Tool for FI: Compare Salaries & Cost of Living Globally”

“Best and Worst Cities in the US and Canada for Financial Independence in 2025”

“Top 11 Countries Globally to Accelerate Financial Independence (and Retire Early)”

“Best Countries in Europe to Achieve Financial Independence (FI)”

“How to Retire Early in Germany: Key Insights into Financial Independence (FIRE)”

“Variable Percentage Withdrawal (VPW): A Flexible Retirement Strategy to Maximize Your Portfolio”

“FIRE with Kids: How to Achieve Financial Independence While Raising a Family”

“Green Living, Wealth Building: The Financial Rewards of a Sustainable Lifestyle”

“How Wars Affect Stock Market Returns: Lessons from History and Current Conflicts”

“Cut Years to Financial Independence with Geographic Arbitrage”

“Capital Gains Taxes and Financial Independence in Retirement Locations”

“Top Countries for Geographic Arbitrage and Early Retirement in 2025”

“Flexible Early Retirement: A Smarter Alternative to the 4% Rule”

“Renting vs Buying a Home: Impact on Financial Independence”

“The Crossover Point: Key to Financial Independence Explained”

“Common Sense Investing: 14 Tips from Jack Bogle for Financial Success”

“18 Key Money Lessons from The Psychology of Money by Morgan Housel”

“The 4% Rule for Retirement: Guide to Safe Withdrawal Strategies”

“Reaching Your First $100K: The Key to Financial Success and Growth”

“10 Financial Habits You Need to Master by Age 30 for Financial Success”

“7 Effective Budgeting Strategies to Reach Financial Freedom”

“How Living Car-Free Can Help You Retire Early and Save Millions”

“Global Savings Rates: What OECD Data Reveals About Financial Independence”

“How to Achieve Financial Independence: Beginner's Guide to Early Retirement”

Check out as well some of our life philosophy posts.

“From Burnout to Freedom: Why I Quit My Job Before Financial Independence”

“The ‘Second Mountain’ : How Relational Living Leads to a Fulfilling Life”

“Green Living, Wealth Building: Financial Rewards of a Sustainable Lifestyle”

“9 Key Work and Money Lessons from ‘Your Money or Your Life’”

“Seneca’s Timeless Wisdom: 9 Life Lessons for Purposeful Living”

“Unlock Happiness: 12 Life Lessons from Naval Ravikant's Almanack”

“8 Longevity Lessons from Netflix’s Blue Zones for a Longer Life”

“30 Powerful Life Lessons from My 30s for Success, Health, and Happiness”

“10 Powerful Lessons from Stoicism and Buddhism to Achieve Inner Peace”

“Dalai Lama’s 50 Lessons for Happiness and Living a Joyful Life”

“20 Rewilding Lessons from Isabella Tree: Insights to Restore Our Planet”

“8 Surprising Lessons on Work and Time from Dr. James Suzman’s Research”

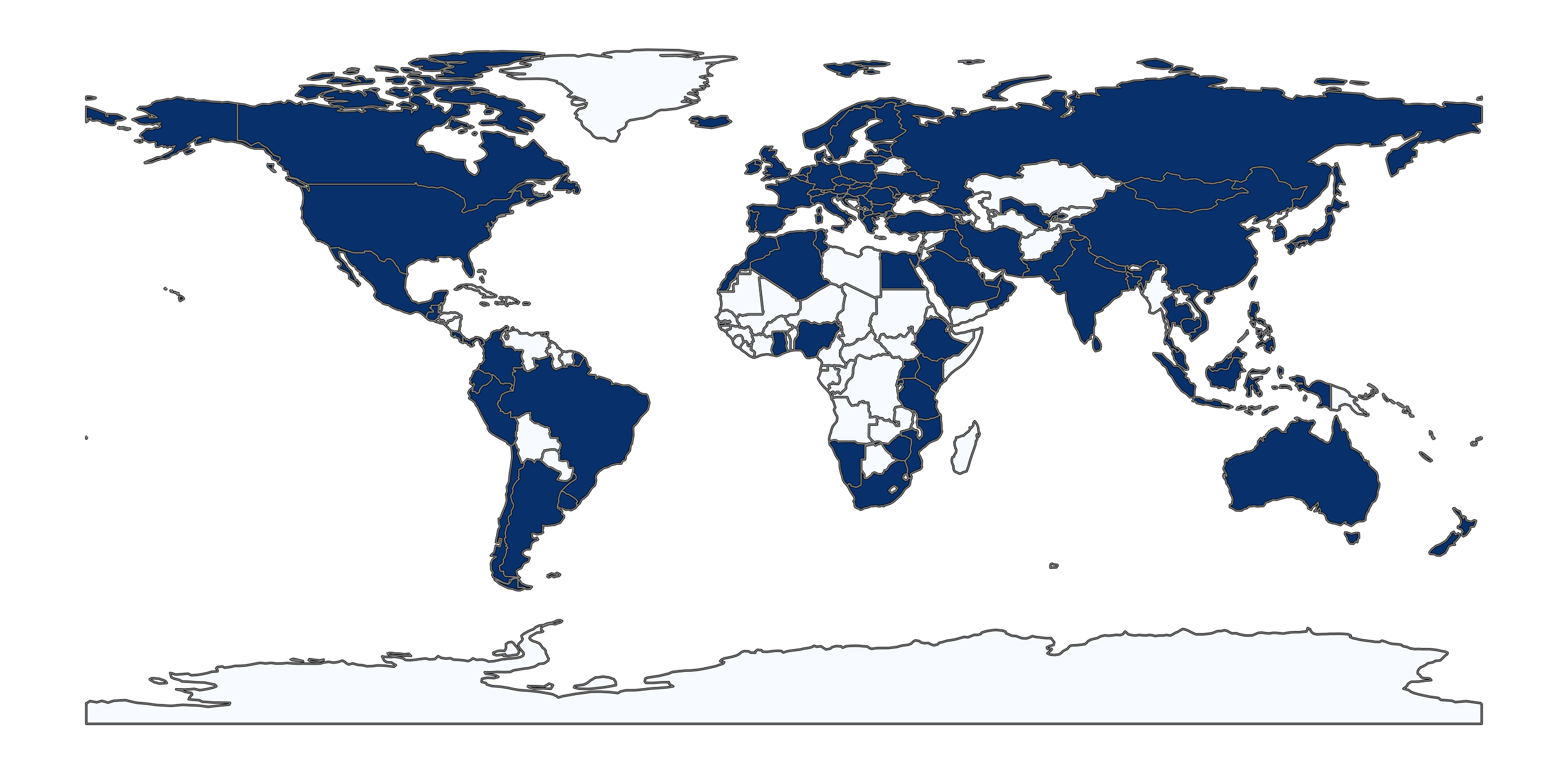

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: