Reaching Your First $100K: The Key to Financial Success and Growth

Photo by Nghia Le on Unsplash.

Check out and subscribe to our YouTube channel here.

Reading time: 4 minutes

Disclaimer: I am not a financial adviser, and this content is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

Why is it crucial to reach your first $100K in investments, and why do so many people struggle to get there?

Why Reaching Your First $100K in Investments Is Crucial for Building Wealth

As renowned investor Charlie Munger famously explained, achieving your first $100K in savings and investments is one of the toughest, yet most rewarding financial goals: "The first $100,000 is a bitch, but you gotta do it. I don't care what you have to do—if it means walking everywhere and not eating anything that wasn't purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit."

The quote highlights the difficult challenge of accumulating significant savings and investments and the importance of crossing this milestone, after which the benefits of compounding and wealth accumulation should become clearer In this post, we reveal and discuss why this is the case and provide some examples of what this timeline could look like based on different scenarios. We hope this will provide some extra motivation on your quest to reaching this important step on your financial journey.

Shockingly, despite living in one of the wealthiest countries, only 14% of Americans have saved over $100,000 in their retirement accounts, highlighting a nationwide struggle with financial discipline. While it's undeniable that for numerous individuals, their income doesn't afford substantial savings, this staggering statistic also sheds light on behavioral factors. For many, a lack of discipline, dedication to a financial strategy, financial literacy, and/or a leading a lifestyle beyond their means could explain for this shortfall.

The Power of Compound Interest: How $100K Makes Wealth Accumulation Easier

First and foremost, understanding compound interest is key to building long-term wealth. Compounding can turn small savings into significant investments over time. Compounding refers to a process where the earnings generated from our investments are reinvested to produce further earnings, leading over time to exponential growth. In simple terms, you are not only earning interest on your original savings but also on the interest that has already been earned. Most people struggle to comprehend non-linear relationships effectively, hence it's beneficial to clarify using some examples.

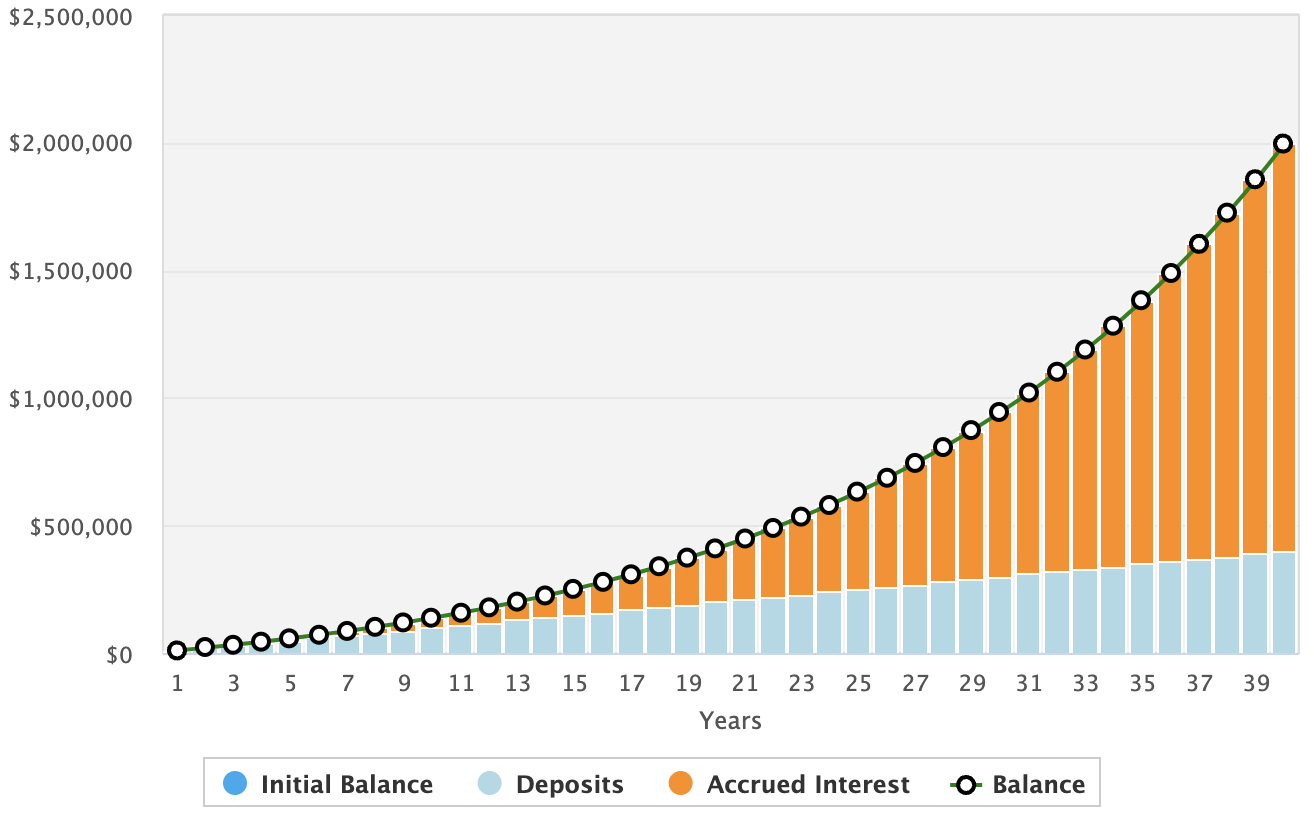

As observed in the figure below, investing steadily $10,000 per year (depicted in blue) produces total returns that are represented by an exponential-shaped curve (orange) that reaches approximately $2 million after 40 years (assuming a 7% real return on investment). Unfortunately, the exponential nature of this curve only begins to be clear after some years have passed. Notice that the initial years of saving and investing seem pretty linear, and are a reason why some may be discouraged by the results at first.

Figure 1. Scenario 1: Portfolio outcome after 40 years assuming a yearly $10,000 investment and a 7% return.

In this example, you could reach your first $100,000 in just 7.8 years by investing $10,000 annually—demonstrating the power of steady contributions. The good news is that the second $100,000 would take only 5.1 years, the third 3.8, the fourth 3 years, and the fifth 2.5 years. You get the idea. Wealth accumulation becomes more straightforward as your portfolio grows, thanks to the exponential power of compound interest and smart investing strategies; as observed in the figure, the share of your total portfolio coming from accrued interests (Figure 1, orange) keeps getting larger over time.

After reaching your first $100,000, you could potentially decide to moderate your savings rate and the amount that you periodically invest, assuming that you have had to make large sacrifices to get there in the first place. In another scenario, after achieving your first $100,000 in savings, reducing your annual investment to $5,000 can still make you a millionaire in 36 years, instead of the 31 years it would take in the first scenario. That is not a big difference, considering the effort invested in the second scenario is likely more achievable for most.

Figure 2. Scenario 2: Initial portfolio of $100,000. Portfolio outcome after 40 years assuming a yearly $5,000 investment and a 7% return. Figure is depicting the 30 years after reaching the first $100,000 invested.

Key Takeaways: Why $100K Is the Game-Changer for Financial Success

The key takeaway is to invest aggressively while you’re young to maximize the benefits of compounding, positioning yourself for financial freedom later in life. Do everything you possibly can now to reach that first $100,000 invested and you are likely setting yourself up for a comfortable life later on. Consider adopting a "pay yourself first" budget, boost your savings by cutting unnecessary expenses, and explore side hustles to accelerate your journey to $100K and beyond. If this is not enough to reach your goal fast enough, consider the possibility of a side hustle that may speed things up in those initial years.

Reaching financial success requires discipline and planing. We are living to a large extent in a status economy where everyone is out there doing things to impress others. It is also an instant gratification world, where spending the fruits of your labor is unprecedentedly easy–available at the point of our fingertips. This blurs the line between our needs and our wants, leading us to pursue desires for often frivolous reasons. The good news is that if you do manage to reach that first $100,000 invested early in life, chances are you will have developed a set of habits, skills, and character traits that will allow you to reach financial success and lead a very comfortable life.

Remember, financial success does not have to be a solitary journey. There is a thriving community of like-minded individuals who share resources, tips, and motivation to help you on your financial path. From groups on Reddit to different blogs and podcasts, the financial independence community is full of valuable insights. To stay up to date with the latest ideas and discussions, I highly recommend using FIRE Aggregator. It’s an excellent resource that consolidates the best content in the FI space into one place, saving you time while keeping you informed and inspired.

Enjoyed this post? Don’t miss our insights on flexible withdrawal strategies for early retirement and our post on the benefits of geographic arbitrage for financial independence.

Check out and subscribe to our YouTube channel here.

Check out our Financial Independence Tools (Works for PC only)

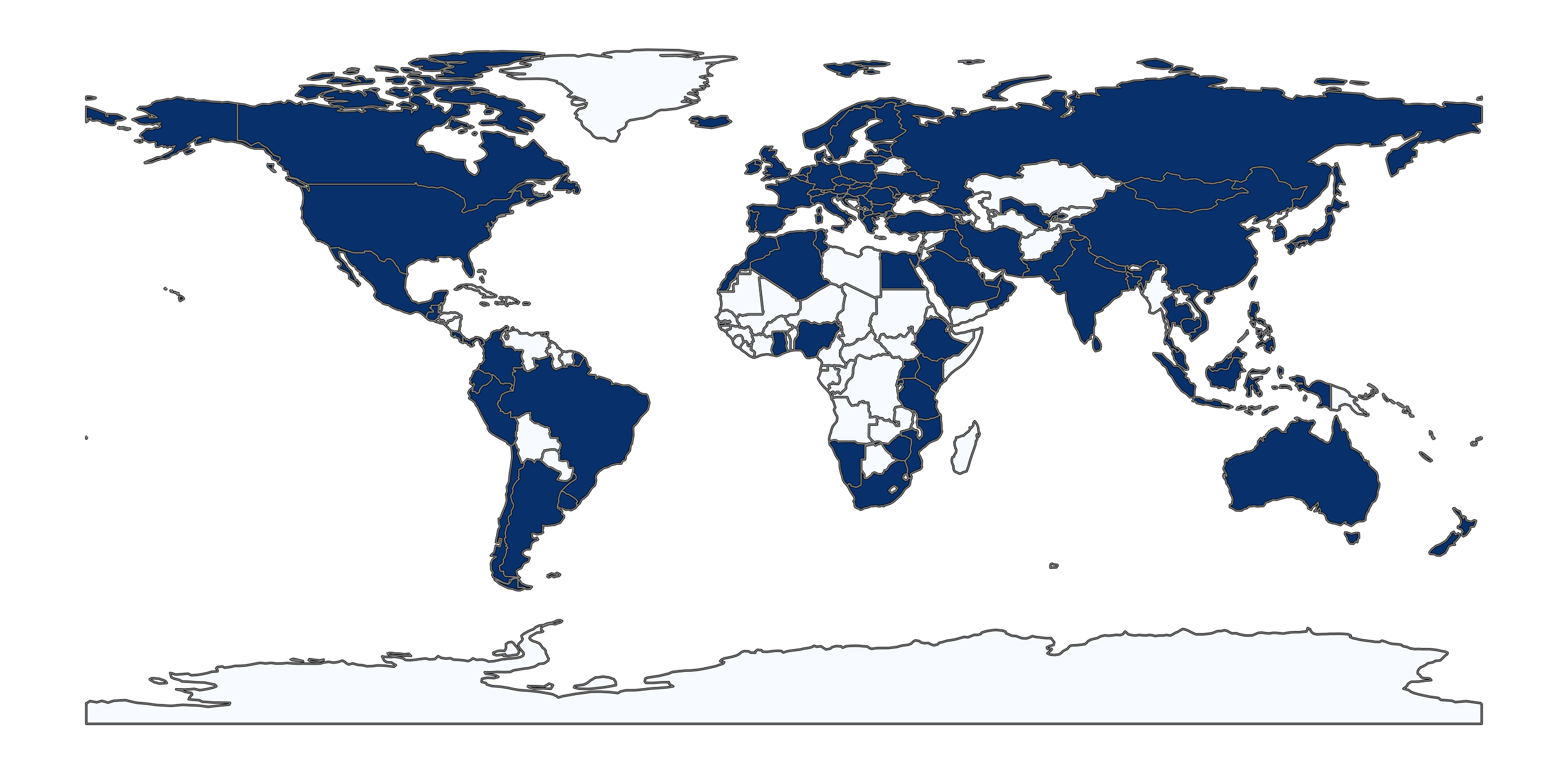

Tool: Identify Countries Where Relocating Can Help You Achieve Financial Independence Faster

Tool: Identify Cities Where Relocating Can Help You Achieve Financial Independence Faster

Tool: Best Countries for Retirement: Where to Retire Abroad?

What to read next?

“Best Countries to Retire in Europe in 2025: Top 5 Affordable and Expat-Friendly Destinations”

“Find Your Perfect Retirement Destination: A Data-Driven Relocation Tool for 2025”

“Relocation Tool for FI: Compare Salaries & Cost of Living Globally”

“Best and Worst Cities in the US and Canada for Financial Independence in 2025”

“Top 11 Countries Globally to Accelerate Financial Independence (and Retire Early)”

“Best Countries in Europe to Achieve Financial Independence (FI)”

“How to Retire Early in Germany: Key Insights into Financial Independence (FIRE)”

“Variable Percentage Withdrawal (VPW): A Flexible Retirement Strategy to Maximize Your Portfolio”

“FIRE with Kids: How to Achieve Financial Independence While Raising a Family”

“Green Living, Wealth Building: The Financial Rewards of a Sustainable Lifestyle”

“How Wars Affect Stock Market Returns: Lessons from History and Current Conflicts”

“Cut Years to Financial Independence with Geographic Arbitrage”

“Capital Gains Taxes and Financial Independence in Retirement Locations”

“Top Countries for Geographic Arbitrage and Early Retirement in 2025”

“Flexible Early Retirement: A Smarter Alternative to the 4% Rule”

“Renting vs Buying a Home: Impact on Financial Independence”

“The Crossover Point: Key to Financial Independence Explained”

“Common Sense Investing: 14 Tips from Jack Bogle for Financial Success”

“18 Key Money Lessons from The Psychology of Money by Morgan Housel”

“The 4% Rule for Retirement: Guide to Safe Withdrawal Strategies”

“Reaching Your First $100K: The Key to Financial Success and Growth”

“10 Financial Habits You Need to Master by Age 30 for Financial Success”

“7 Effective Budgeting Strategies to Reach Financial Freedom”

“How Living Car-Free Can Help You Retire Early and Save Millions”

“Global Savings Rates: What OECD Data Reveals About Financial Independence”

“How to Achieve Financial Independence: Beginner's Guide to Early Retirement”

Check out as well some of our life philosophy posts.

“From Burnout to Freedom: Why I Quit My Job Before Financial Independence”

“The ‘Second Mountain’ : How Relational Living Leads to a Fulfilling Life”

“Green Living, Wealth Building: Financial Rewards of a Sustainable Lifestyle”

“9 Key Work and Money Lessons from ‘Your Money or Your Life’”

“Seneca’s Timeless Wisdom: 9 Life Lessons for Purposeful Living”

“Unlock Happiness: 12 Life Lessons from Naval Ravikant's Almanack”

“8 Longevity Lessons from Netflix’s Blue Zones for a Longer Life”

“30 Powerful Life Lessons from My 30s for Success, Health, and Happiness”

“10 Powerful Lessons from Stoicism and Buddhism to Achieve Inner Peace”

“Dalai Lama’s 50 Lessons for Happiness and Living a Joyful Life”

“20 Rewilding Lessons from Isabella Tree: Insights to Restore Our Planet”

“8 Surprising Lessons on Work and Time from Dr. James Suzman’s Research”

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: