Capital Gains Taxes and Financial Independence in Retirement Locations

Photo by Robin Noguier on Unsplash.

Reading time: 7 minutes

Disclaimer: I am not a financial adviser, and this content is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

Check out and subscribe to our YouTube channel here.

Learn How Capital Gains Taxes in Popular Retirement Destinations Impact Your Financial Independence Timeline

Our personal finance blog helps you build financial literacy and achieve early financial independence with smart planning strategies. Pursuing financial independence involves saving diligently and investing wisely so you can eventually reach the “crossover point”, where you can live off your investments and eliminate the need for paid employment. Most people achieve financial independence by retirement age, relying on pensions, savings, and investments to fund their lifestyle. However, with strategic planning, financial independence can be achieved much earlier in life.

This blog presents numerous insights and strategies to achieve this and to make the journey easier. We previously covered how geographic arbitrage can fast-track your financial independence by moving to low-cost retirement countries. In a nutshell, by deciding to retire in a lower cost of living country you can target a smaller retirement portfolio number, allowing you to exit the workforce sooner. Today, we seek to better understand whether the tax regime of the host country could further accelerate your timeline to early retirement, and to what extent it actually is a relevant factor. Minimizing taxes on your retirement portfolio withdrawals can significantly accelerate your path to financial independence by targeting a smaller portfolio number.

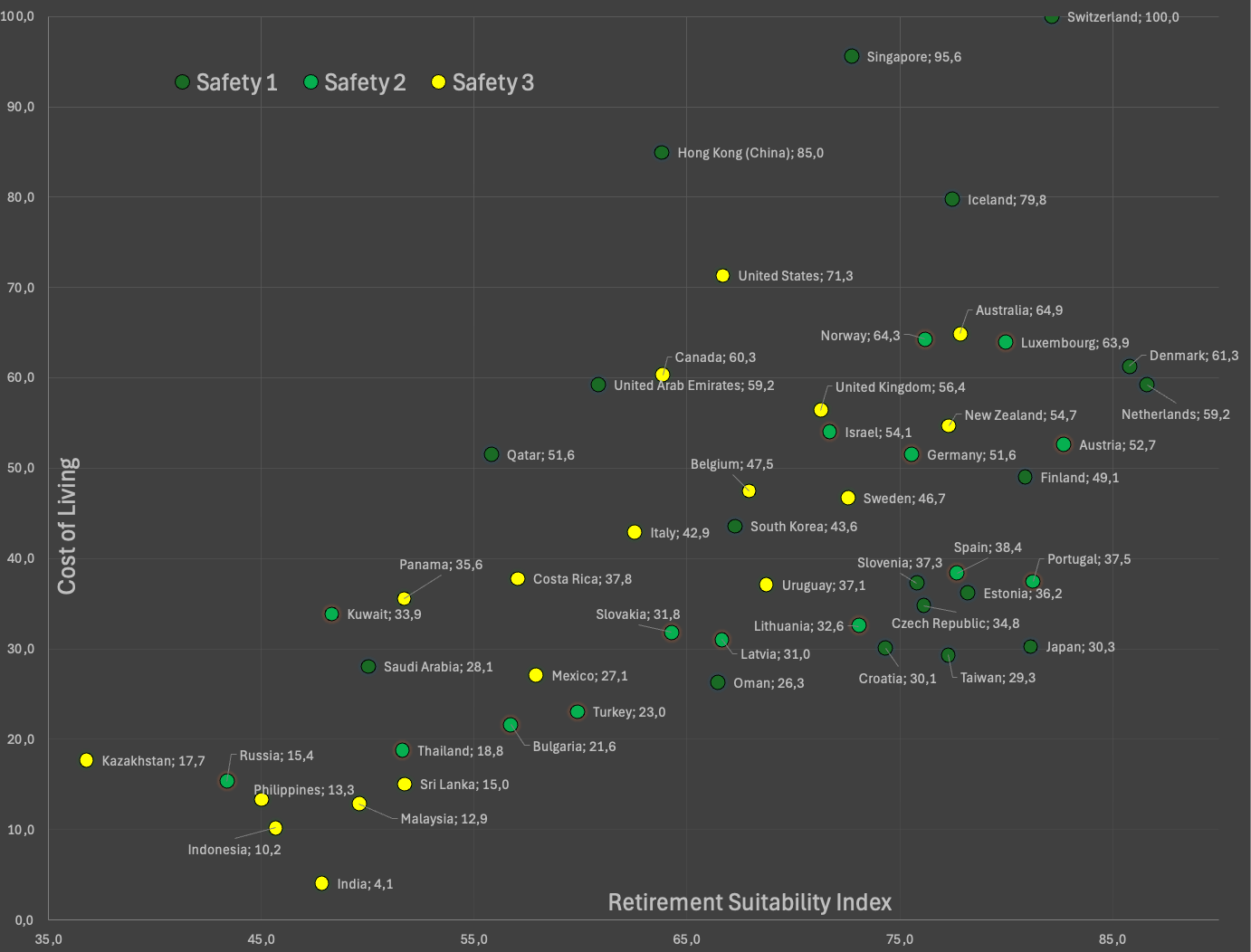

How to Choose the Best Countries for Early Retirement

Before looking into how the tax regime of our host countries affects our timeline for achieving financial independence, let’s consider some strong candidate countries for early retirement. In our last post, we proposed a methodology that allowed to identify a suitable country for geographic arbitrage. The methodology accounted for the general cost of living, which is of course a key consideration, but also took into account other numerous desirable characteristics we would like to have in the country we move to: a strong healthcare system, a general sense of safety, a stable political, legal, and financial environment, acceptable levels of pollution, and a pleasant climate. Figure 1 below summarizes the outcome of the excercise. Ideally, you would choose a country that has a lower cost of living (Y axis in the graph) and a high Retirement Suitability Index (X axis), which reflects the above-mentioned characteristics. To address the main question of this post (assess the effect of different tax regimes on the time it takes to reach financial independence), I will select a few different options across different geographies: Uruguay, Spain, Portugal, and Thailand.

Figure 1. Cost of Living versus Retirement Suitability Index for 51 countries. The Y axis represents the cost of living, while the X axis is a composite Retirement Suitability Index that considers health care system, safety, political, legal, and financial stability, pollution, and climate. The three color categories reflects one of the variables included in the index, namely the country's safety. Dark green depicts the safest set of countries, while yellow depicts the least safe set of countries. Countries falling in categories 4 and 5 were removed from the selection process. See our previous post for a detailed overview of the methodology if you are curious to understand how we arrived at these 51 countries from an initial set of 121.

Impact of Capital Gains Tax on Financial Independence

We explore how capital gains taxes in countries like Spain, Portugal, and Thailand impact your journey to early financial independence. Let’s assume you start your financial journey at age 30. With an after-tax household income of $80,000 and monthly expenses of $48,000, you would reach financial independence after 16.9 years at age 46, assuming a 7% return on investments and a 4% withdrawal rate in retirement. In this scenario you would target a retirement portfolio of $1.2M (25 times your expenses in retirement of $48,000). This scenario is depicted in Figure 1 below, which uses this popular financial independence calculator.

Figure 2. Baseline scenario. Timeline to reach financial independence: 16.9 years.

Now let’s account for capital gains taxes in different countries and see how this baseline scenario would change in the different countries selected.

Uruguay: Uruguay exempts foreign-sourced income from capital gains tax for tax residents. In other words, if you decide to retire in Uruguay with your $1.2M portfolio you wouldn’t pay any taxes on your yearly withdrawal rates of $48,000.

Spain: In Spain, capital gains taxes follow progressive brackets based on your income, starting at 19% (€0 – €6,000); 21% (€6,000 – €50,000); 23% o(€50,000 – €200,000); 27% (€200,000 – €300,000); 28% (> €300,000). Assuming a portfolio with 25% profit and 75% principal contributions, only $12,000 of the $48,000 annual portfolio withdrawal would be taxed according to those brackets. We’d pay close to $2,400 in taxes from the €48,000 withdrawal, an effective tax rate of 5%. As depicted in Figure 3, entering this tax rate in our original scenario would bring back our financial independence timeline to 17.3 years, postponing our early retirement by 0.4 years. To maintain $48,000 in retirement spending, you’d need to build a $1.26M portfolio in high-tax countries like Spain.

Figure 3. Timeline to financial independence considering a 5% effective tax rate (Spain).

Portugal: Portugal applies a flat 28% capital gains tax. For our example, the total amount of taxes paid on our $48,000 withdrawal would correspond to $3,360, an effective 7% tax rate. This would set back the timeline to reaching financial independence by 0.6 years.

Thailand: Analogous to the Spain example, our portfolio withdrawals in Thailand would be taxed according to multiple tax brackets. However, these are substantially lower: we would only pay around $600 in tax on our $48,000 withdrawal, corresponding to a 1.3% effective tax rate. It is clear that this has nearly no impact on our timeline to reaching financial independence (0.1 year).

Capital Gains Tax Holds Little Effect on the Timeline to Reaching Financial Independence

As shown in the examples, a country’s tax regime plays a small role in your overall timeline to early financial independence. Even for tax-heavy countries such as Portugal, it only delayed the timeline by 0.6 years, which is not much in the big scheme of things. The main takeaway is that capital gains taxes in countries like Portugal, Spain, or Uruguay shouldn’t be your primary factor when choosing a retirement destination on where to settle if you indeed decide to relocate upon early retirement. The actual cost of living in the country and other factors will play a much larger role. We will explore these in detail in a future blog post.

Enjoyed this post? Don’t miss our post on how to identify host countries for geographic arbitrage or our insights on reaching the crossover point for financial independence.

Check out and subscribe to our YouTube channel here.

Check out our Financial Independence Tools (Works for PC only)

Tool: Best Countries for Retirement: Where to Retire Abroad?

Tool: Identify Countries Where Relocating Can Help You Achieve Financial Independence Faster

Tool: Identify Cities Where Relocating Can Help You Achieve Financial Independence Faster

What to read next?

“From Burnout to Freedom: Why I Quit My Job Before Financial Independence”

“The ‘Second Mountain’ : How Relational Living Leads to a Fulfilling Life”

“Green Living, Wealth Building: Financial Rewards of a Sustainable Lifestyle”

“9 Key Work and Money Lessons from ‘Your Money or Your Life’”

“Seneca’s Timeless Wisdom: 9 Life Lessons for Purposeful Living”

“Unlock Happiness: 12 Life Lessons from Naval Ravikant's Almanack”

“8 Longevity Lessons from Netflix’s Blue Zones for a Longer Life”

“30 Powerful Life Lessons from My 30s for Success, Health, and Happiness”

“10 Powerful Lessons from Stoicism and Buddhism to Achieve Inner Peace”

“Dalai Lama’s 50 Lessons for Happiness and Living a Joyful Life”

“Job Fulfillment in Numbers: How Satisfying Are Our Careers?”

“20 Rewilding Lessons from Isabella Tree: Insights to Restore Our Planet”

“8 Surprising Lessons on Work and Time from Dr. James Suzman’s Research”

Check out as well some of our personal finance posts.

“Best Countries to Retire in Europe in 2025: Top 5 Affordable and Expat-Friendly Destinations”

“Find Your Perfect Retirement Destination: A Data-Driven Relocation Tool for 2025”

“Relocation Tool for FI: Compare Salaries & Cost of Living Globally”

“Best and Worst Cities in the US and Canada for Financial Independence in 2025”

“Top 11 Countries Globally to Accelerate Financial Independence (and Retire Early)”

“Best Countries in Europe to Achieve Financial Independence (FI)”

“How to Retire Early in Germany: Key Insights into Financial Independence (FIRE)”

“Variable Percentage Withdrawal (VPW): A Flexible Retirement Strategy to Maximize Your Portfolio”

“FIRE with Kids: How to Achieve Financial Independence While Raising a Family”

“Green Living, Wealth Building: The Financial Rewards of a Sustainable Lifestyle”

“How Wars Affect Stock Market Returns: Lessons from History and Current Conflicts”

“Cut Years to Financial Independence with Geographic Arbitrage”

“Capital Gains Taxes and Financial Independence in Retirement Locations”

“Top Countries for Geographic Arbitrage and Early Retirement in 2025”

“Flexible Early Retirement: A Smarter Alternative to the 4% Rule”

“Renting vs Buying a Home: Impact on Financial Independence”

“The Crossover Point: Key to Financial Independence Explained”

“Common Sense Investing: 14 Tips from Jack Bogle for Financial Success”

“18 Key Money Lessons from The Psychology of Money by Morgan Housel”

“The 4% Rule for Retirement: Guide to Safe Withdrawal Strategies”

“Reaching Your First $100K: The Key to Financial Success and Growth”

“10 Financial Habits You Need to Master by Age 30 for Financial Success”

“7 Effective Budgeting Strategies to Reach Financial Freedom”

“How Living Car-Free Can Help You Retire Early and Save Millions”

“Global Savings Rates: What OECD Data Reveals About Financial Independence”

“How to Achieve Financial Independence: Beginner's Guide to Early Retirement”

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: